GST Invoice Format in Excel, Word & PDF Download for Easy Billing

Download free invoice formats, bill templates, and professional invoice designs in Word, Excel, and PDF. Everything is ready to customise and share, whether you need a GST bill format, a simple invoice template, or a detailed bill format. Easy to edit, fully printable, and perfect for every business need.

Why Choose mazu Over Traditional Invoice Formats

Discover the more innovative way to create an invoice with mazu. Whether you prefer downloading ready-made formats or using customisable templates, mazu allows you to bill fast, free, and professionally.

Free Invoice Generation

Multi-Industry Use

Multiple Invoice Formats

Instant Customisable Invoice

Print & Share in Seconds

Smart Billing with Autofill GSTIN

Safe & Secure

Track Payments Easily

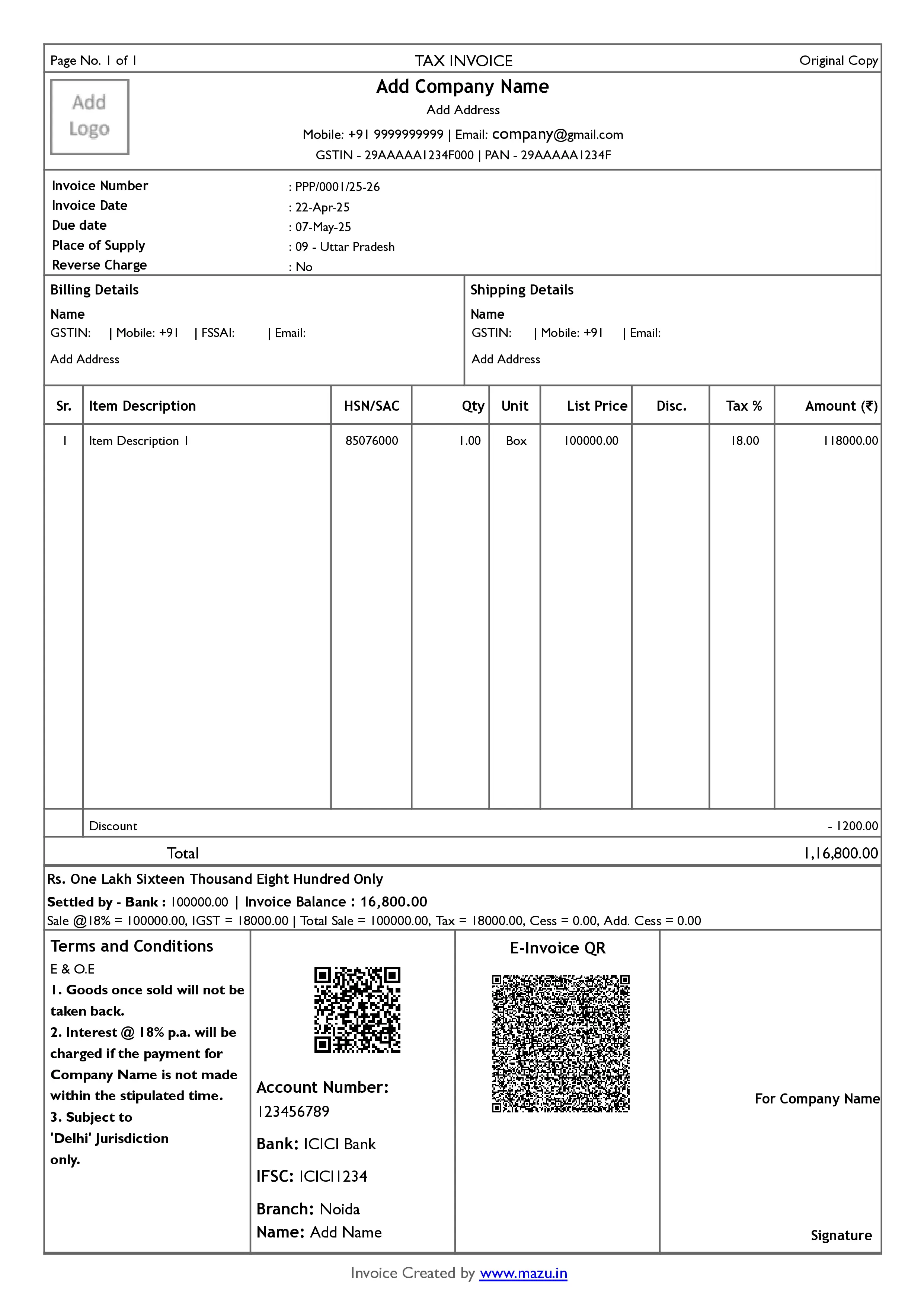

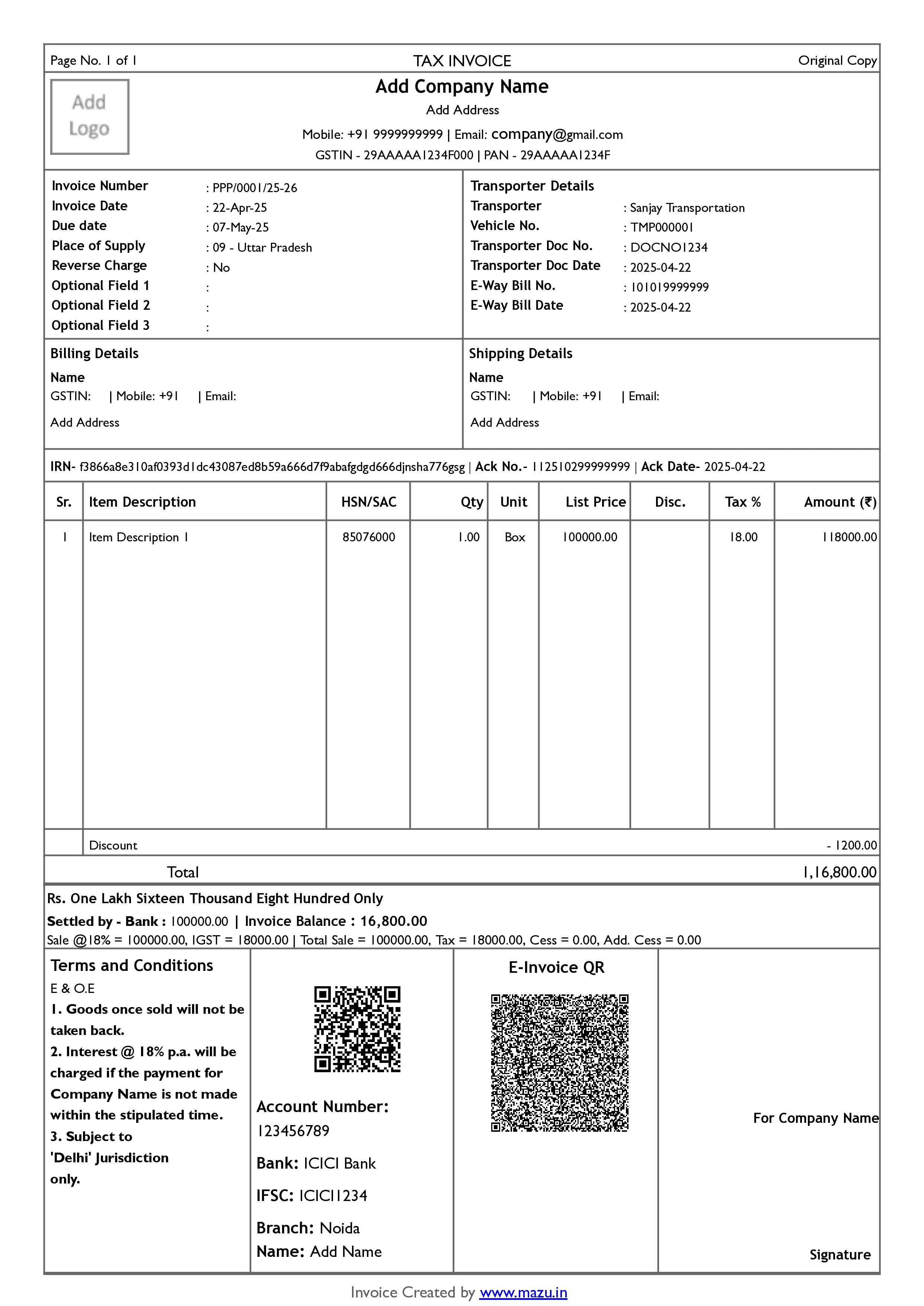

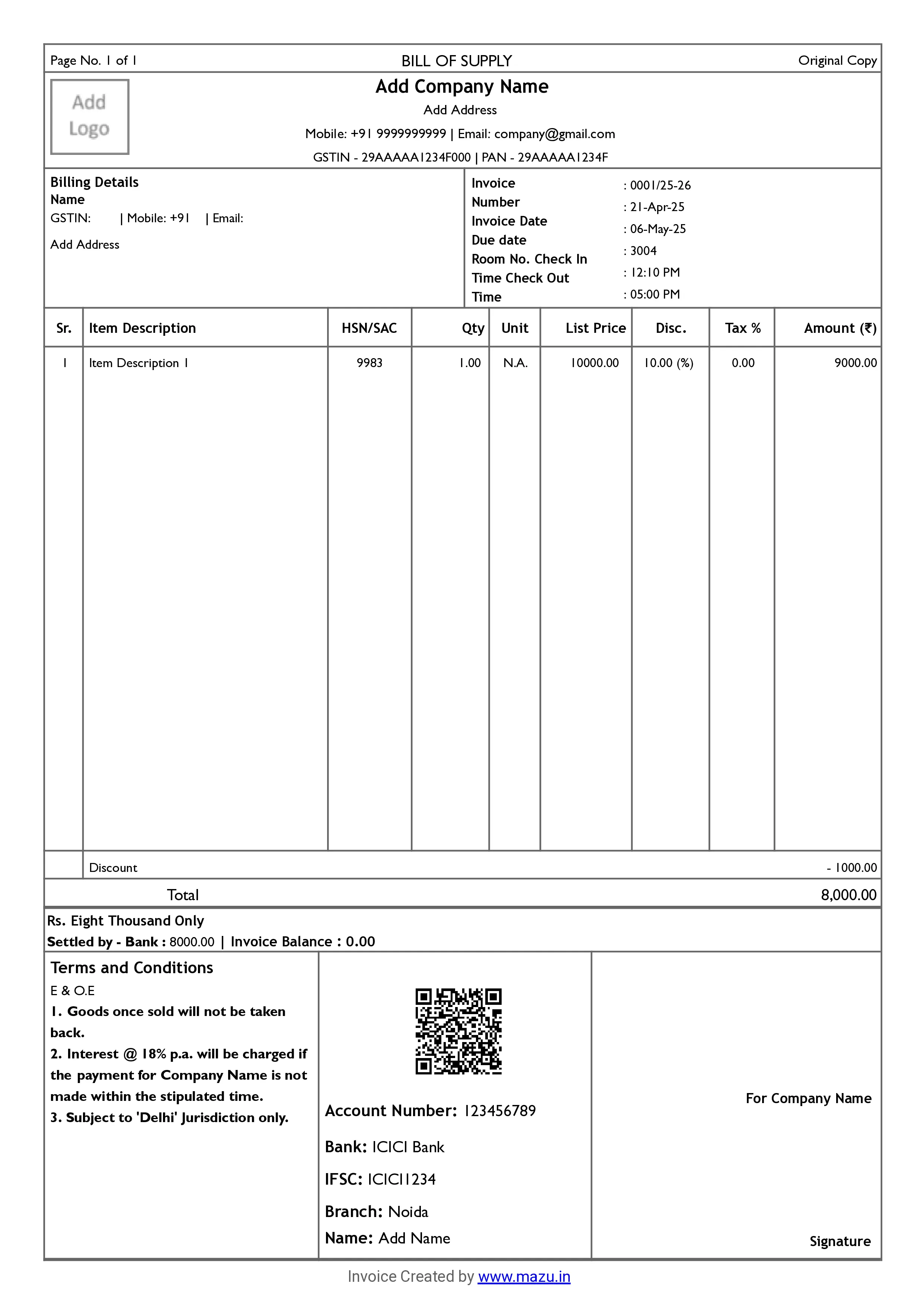

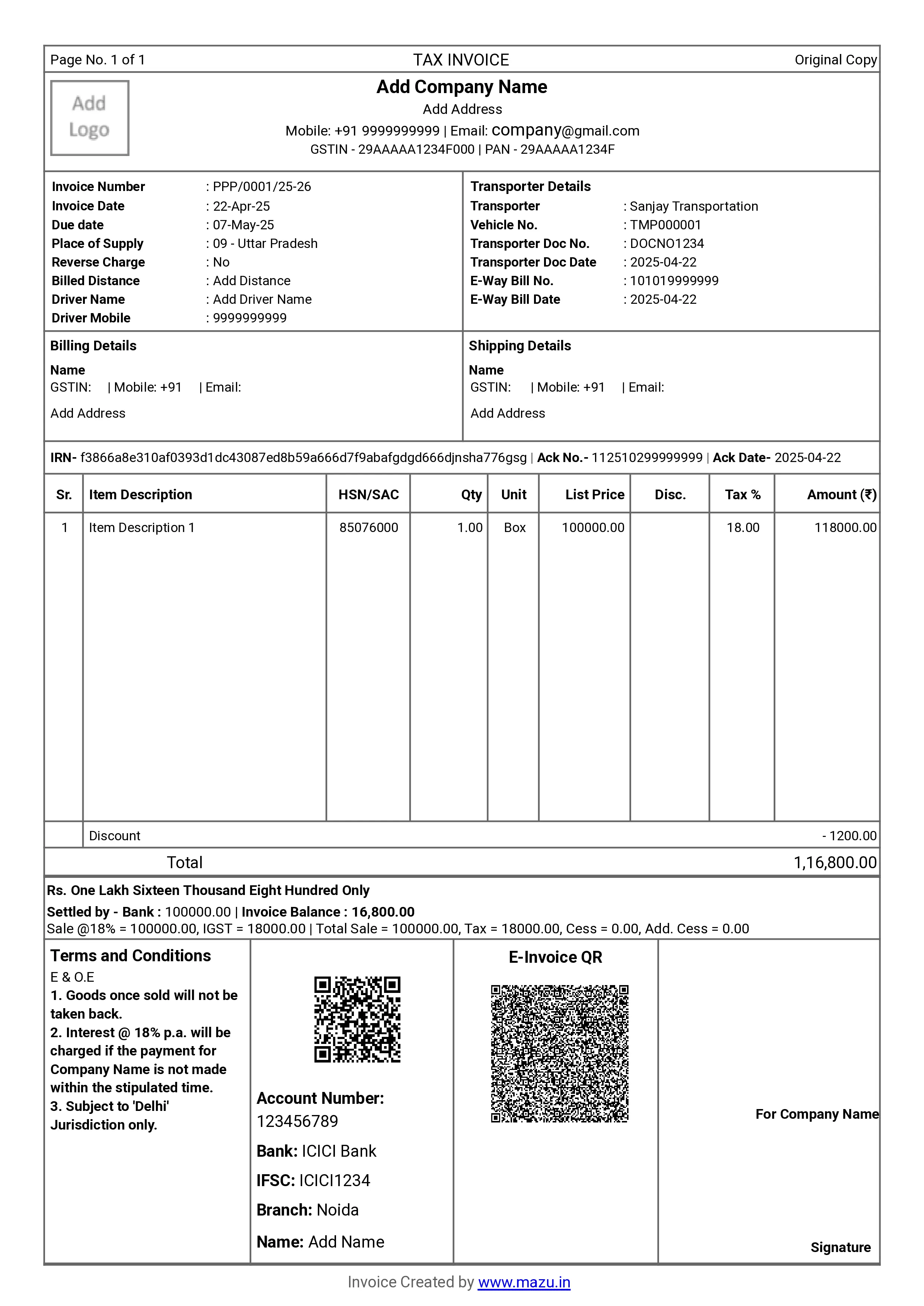

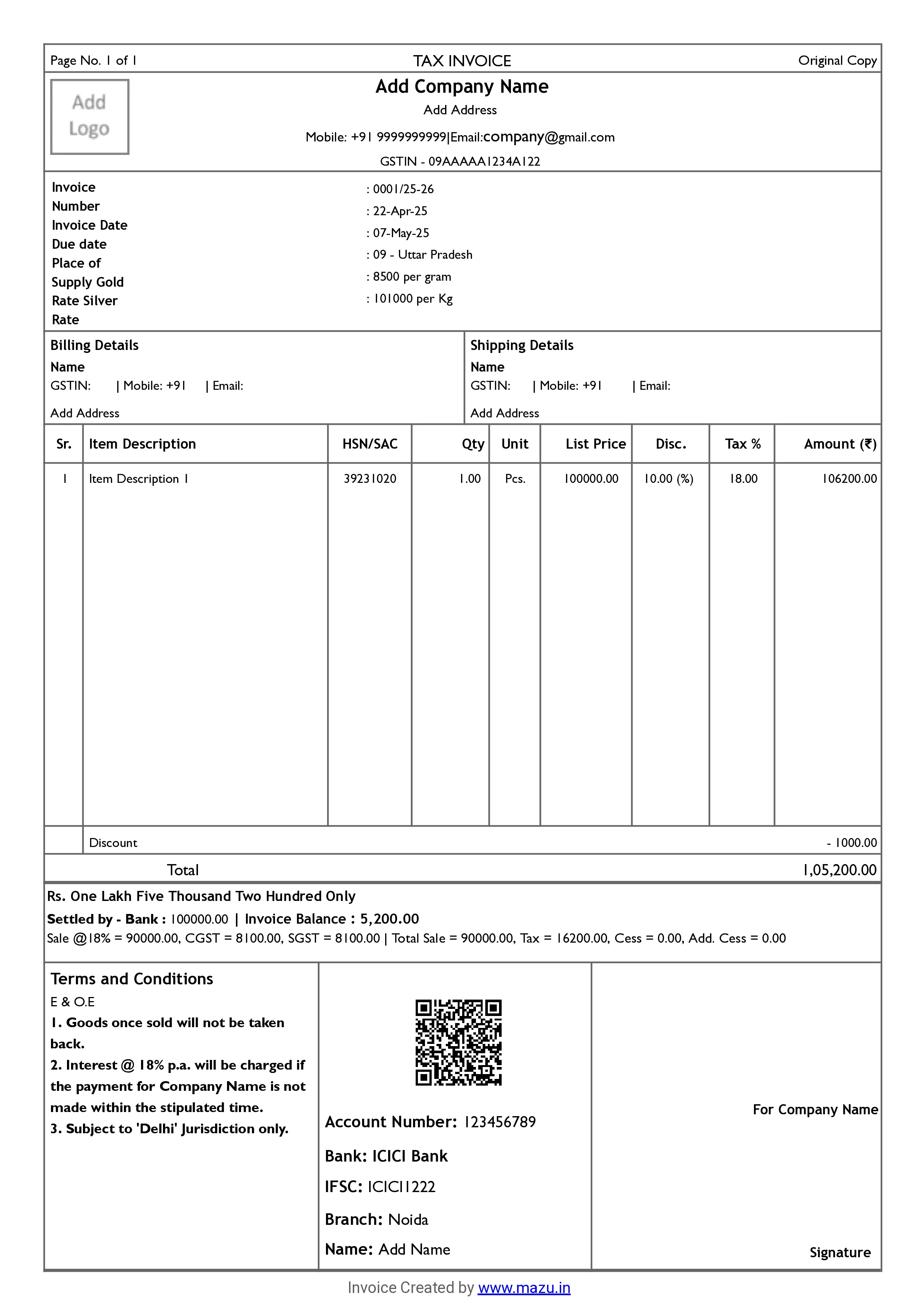

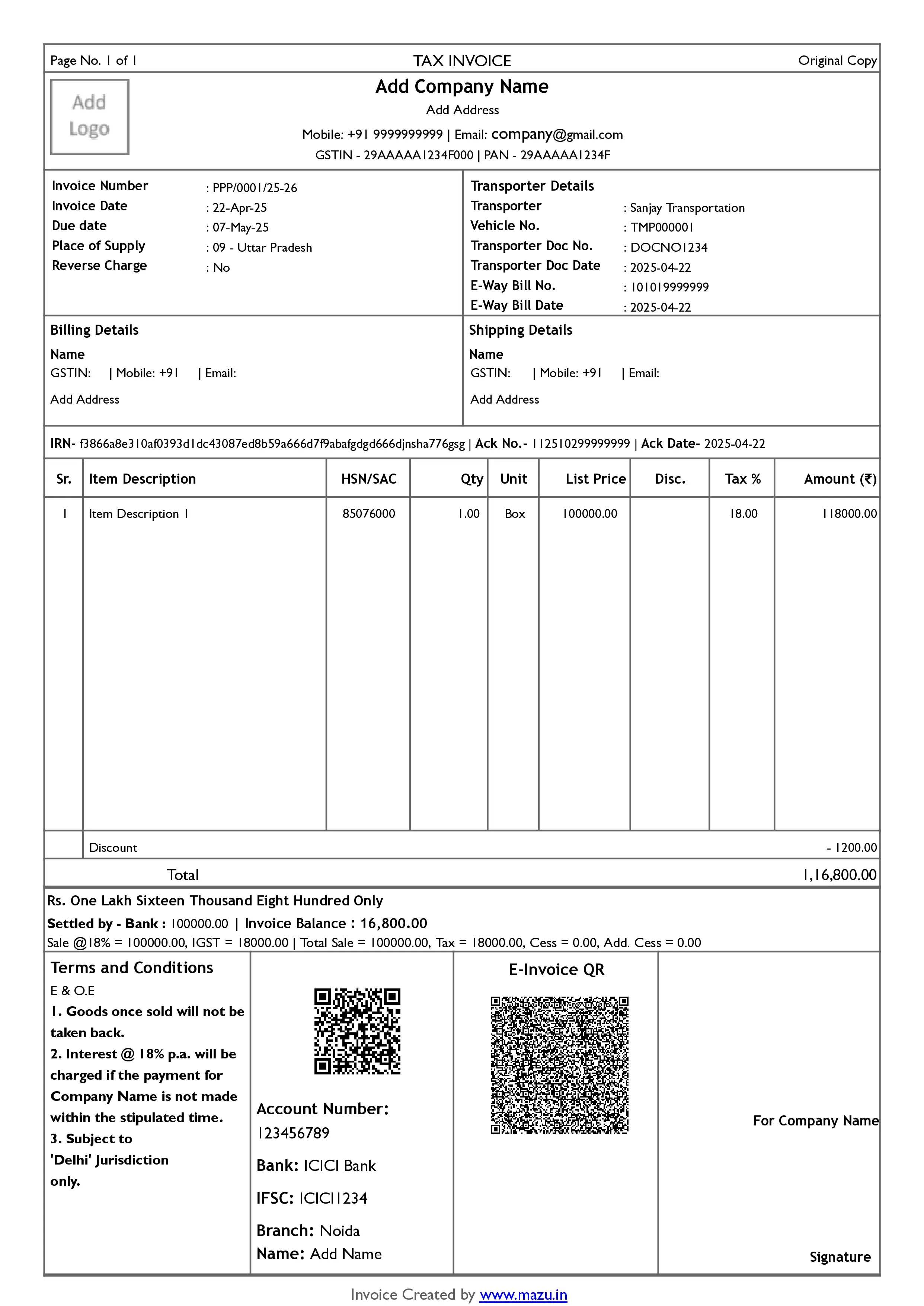

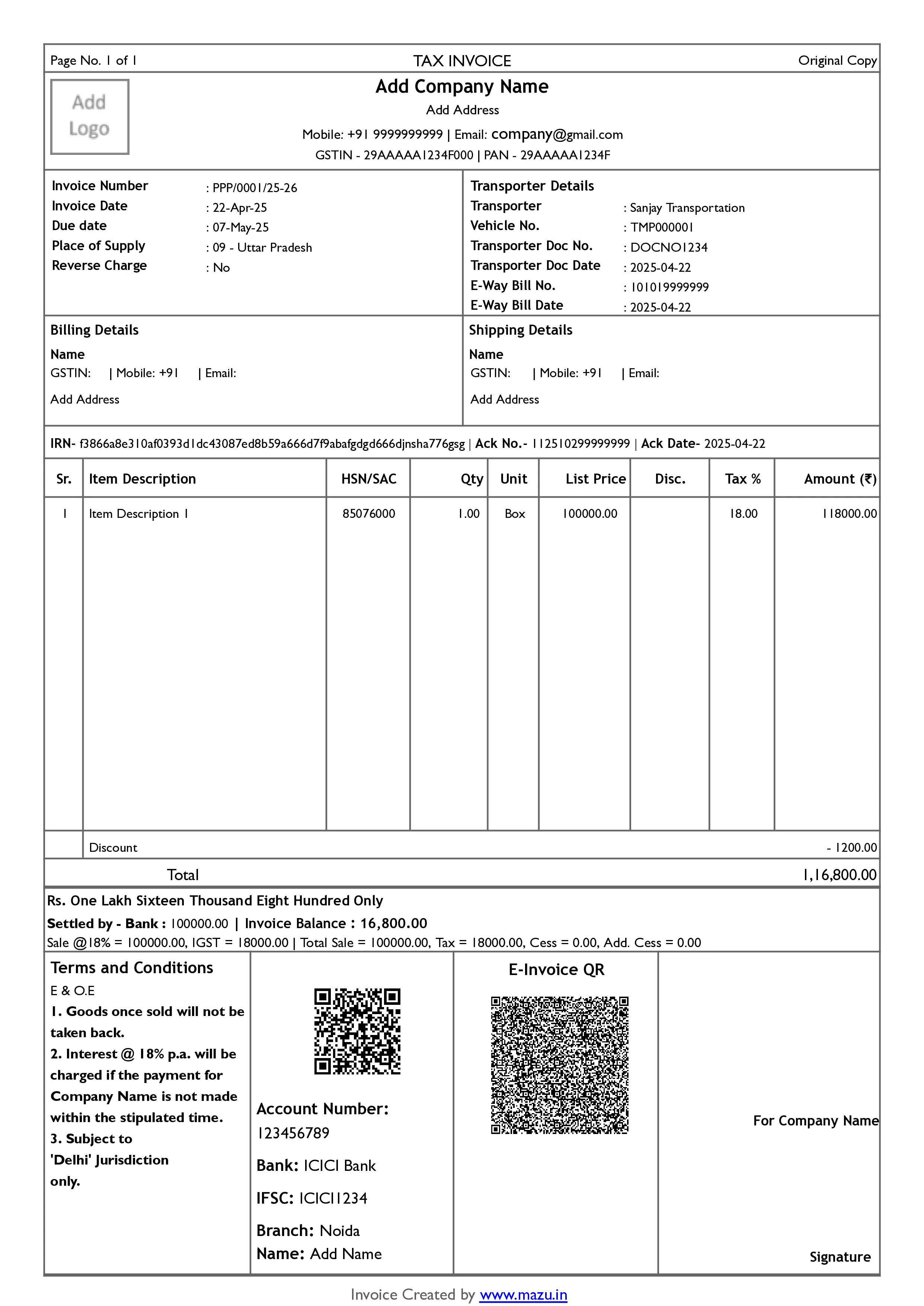

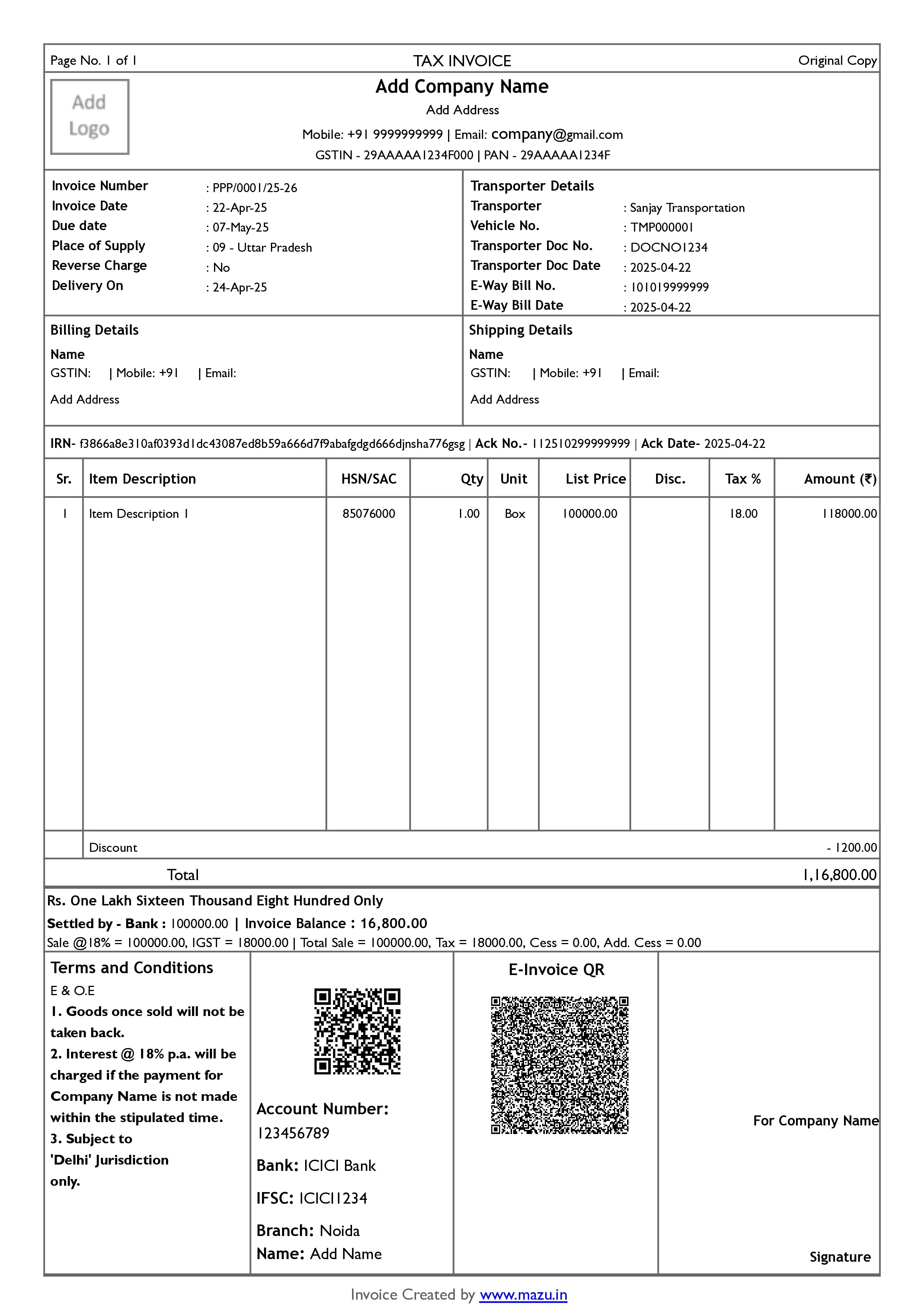

Simple GST Invoice Templates for Your Business

Download, Edit, and Share Invoices in Excel, Word, PDF - Absolutely Free!

discover

Some frequently asked questions

An invoice is a document issued by a seller to a buyer that lists the products or services provided, their prices, applicable taxes, and the total amount due. It serves as a payment request and a legal record of a transaction.

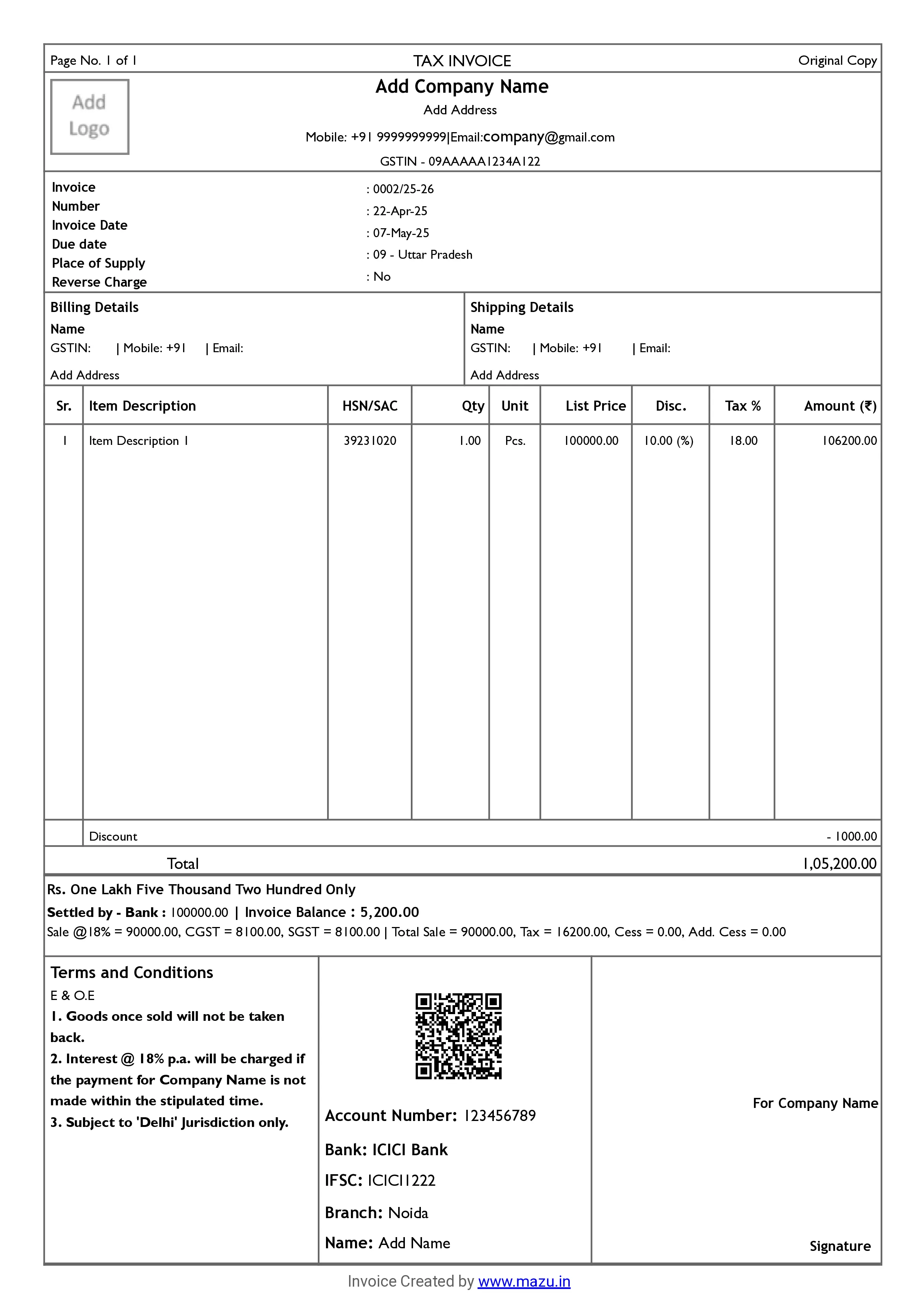

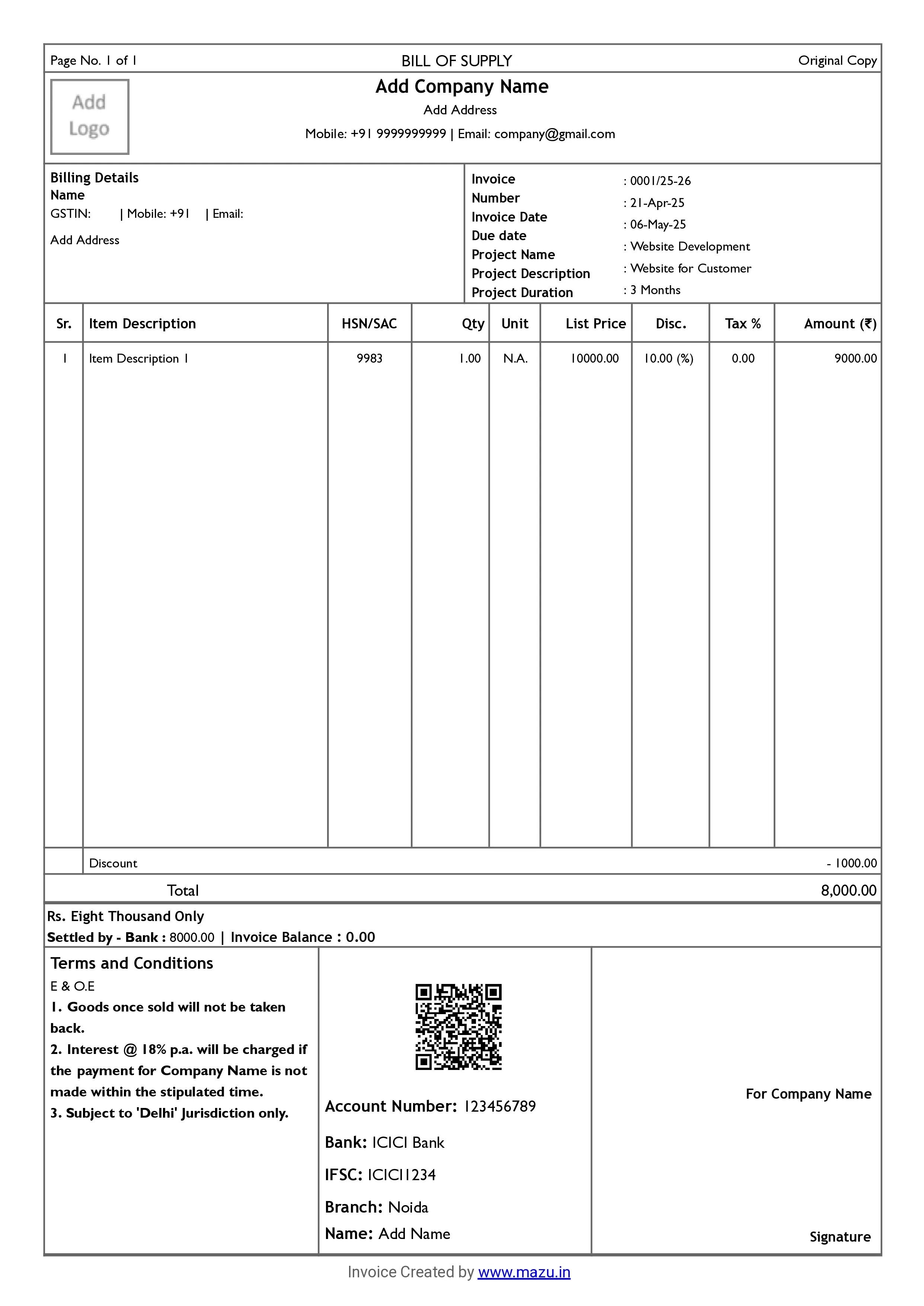

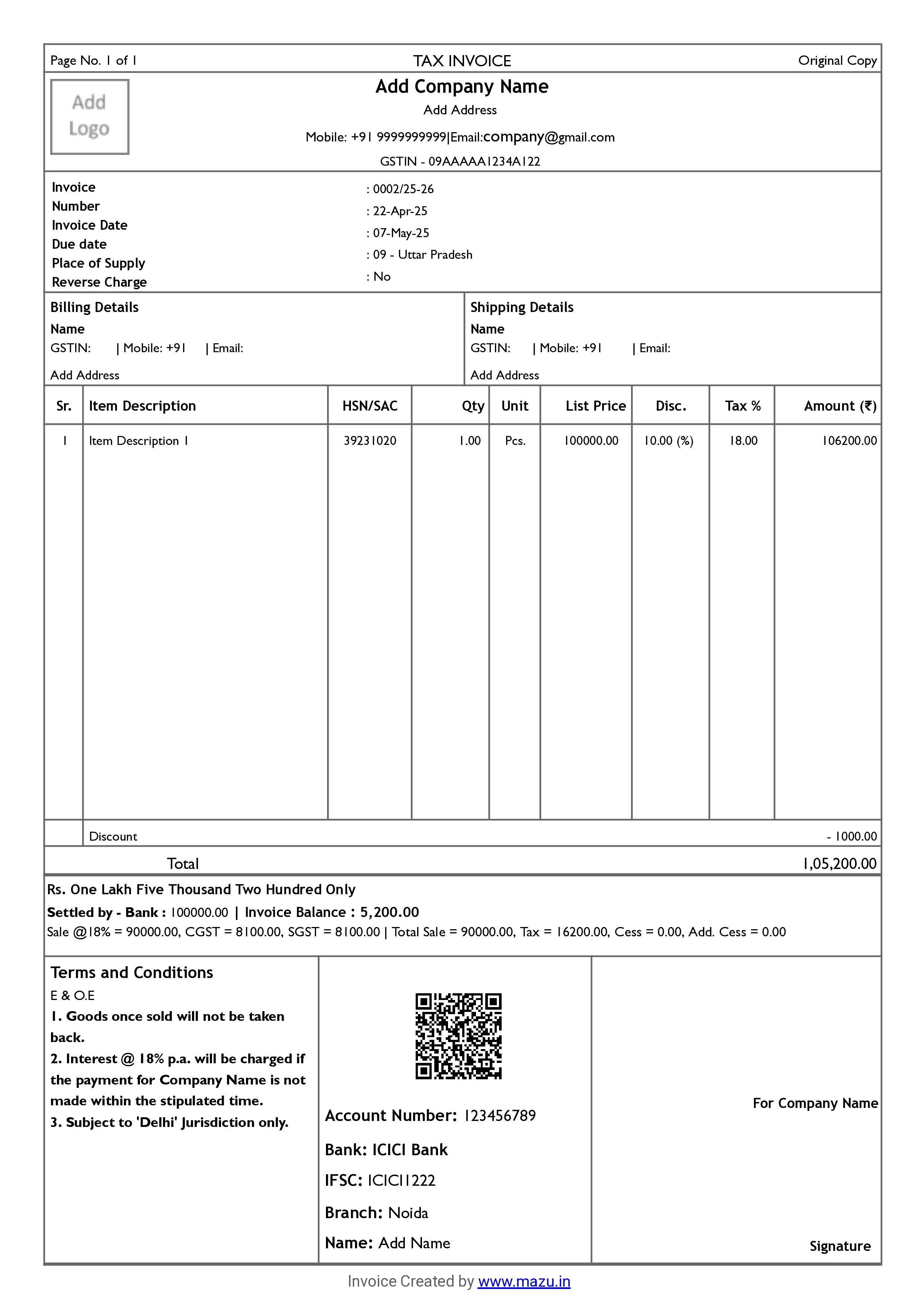

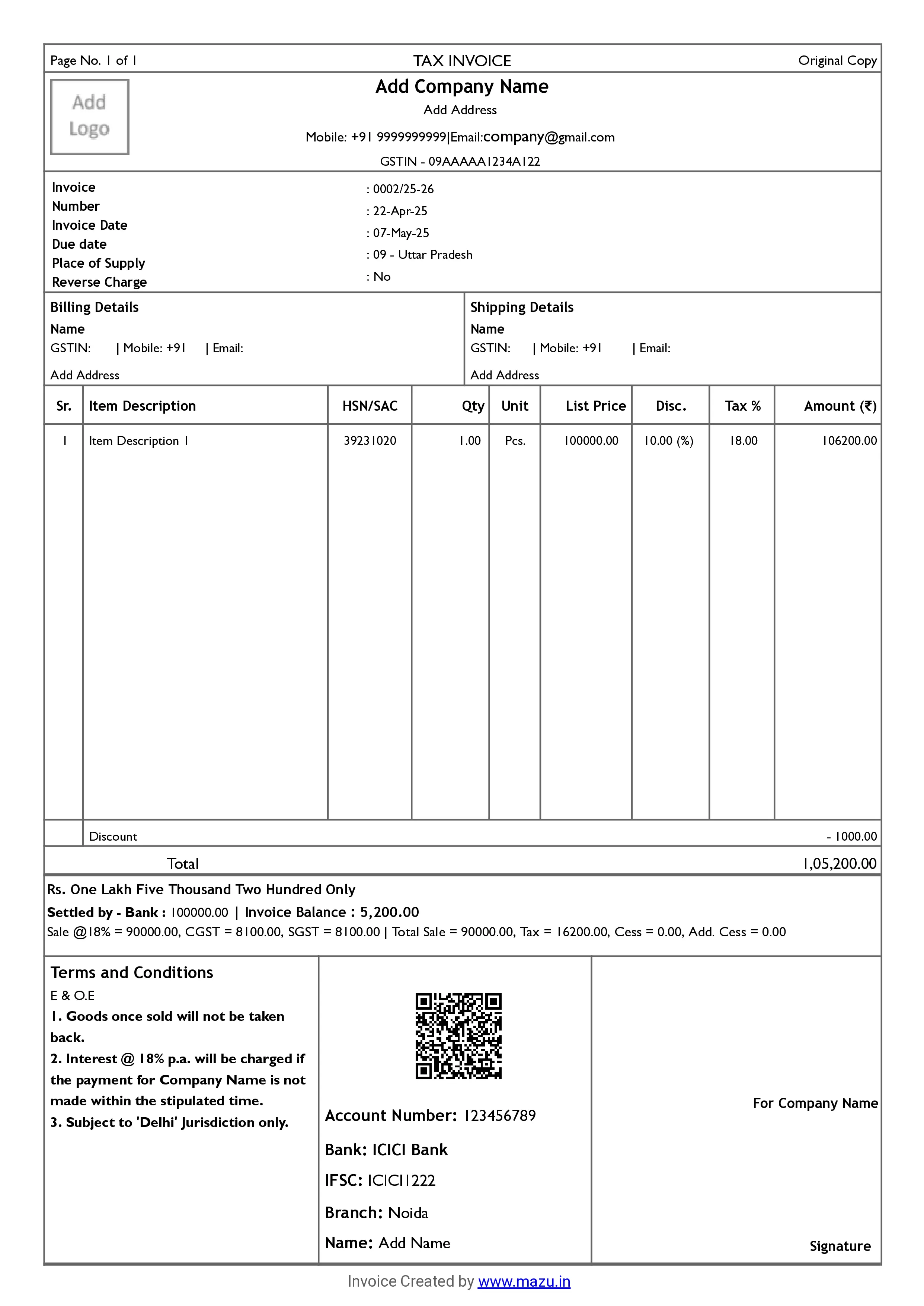

GST Invoice:- Businesses registered under GST issue a GST invoice when selling goods or services. It includes the buyer's and seller's GSTIN, invoice number, date, item details, HSN/SAC code, tax rates (CGST/SGST/IGST), and the total payable amount. This format is mandatory for B2B transactions in India.

Proforma Invoice:- A proforma invoice is a preliminary document shared before the actual sale. It outlines product or service details, pricing, and terms but is not a legal invoice. It's commonly used to help customers make informed decisions or to initiate payment or import procedures.

Tax Invoice:- This is used when a taxable sale is made. It contains tax components and is issued to claim the input tax credit. A tax invoice typically includes all mandatory fields, such as supplier and buyer details, invoice number, itemised list, and applicable taxes.

Retail Invoice:- A retail invoice is generated for direct-to-consumer sales (B2C). It may or may not show GST separately and usually includes basic details like product name, quantity, price, and total amount. It's primarily used in shops, supermarkets, and service counters.

Cash Invoice:- A cash invoice is issued immediately after the payment is made in cash during the transaction. It's a quick, simplified document used by local retailers and small vendors, often for walk-in customers.

Payment Receipt Invoice:- This document confirms that payment has been received. It includes the amount paid, the mode of payment, the transaction date, and the invoice number to which it corresponds. It's helpful for both businesses and customers as proof of payment.

Export Invoice:- Export invoices are used when selling goods or services internationally. This format includes details like buyer and seller country, currency, port of shipment, product description, quantity, price, terms like FOB or CIF, and other customs-related information.

- Login or Sign Up: Go to app.mazu.in and log in using your email or mobile number. If you're a new user, sign up to get started.

- Go to Sales: Click on the "Invoices" section from the left-hand menu.

- Create a New Invoice: Tap the + button at the screen's bottom-right corner.

- Add Party: Select a party from the dropdown list or create a new one.

- Add Items: You can choose items from your list or manually enter their details, including quantity, rate, and applicable tax.

- Add Bill Sundry: Include any additional charges, discounts, or taxes as required.

- Settlements: Enter the payment amount received for this invoice.

- Preview & Send: Check the invoice preview, then share it via Email, WhatsApp, or print it. You can also download it as a PDF

A well-structured invoice format ensures:

- Clear communication of charge

- Faster payments

- Better brand impression

- Easy tax filing and compliance

- Reduced errors in billing

Key elements include while creating GST Invoice Format:

Name and Address of the Supplier – Identifies the business or individual issuing the invoice.

GSTIN of the Supplier – The supplier's registered GST number is used for tax reporting and compliance.

Unique Invoice Number – A sequential and unique number assigned to each invoice for easy tracking.

Date of Issue – The date on which the invoice is generated and shared with the buyer.

Name and Address of the Recipient – Specifies the details of the customer or buyer receiving the goods or services.

GSTIN of the Recipient (if registered) – The buyer's GST number is needed to claim input tax credit.

Delivery Address – The location of the goods or services, if different from the billing address.

HSN Code – Harmonized System of Nomenclature code that classifies the goods or services for tax purposes.

Description of Goods or Services – Mentioning what is being sold, including product or service names.

Quantity or Unit – Indicates the number or measurement of goods or services provided.

Total Value – The full price of the goods or services before applying any taxes.

Taxable Value – The amount on which GST will be calculated after deductions or discounts.

Rate of Tax (CGST, SGST, IGST, Cess) — The applicable GST rates depend on the nature of supply and location.

Amount of Tax – The exact tax amount charged under each GST component.

Place of Supply — This is important for determining whether IGST or CGST/SGST applies to inter-state or intra-state transactions.

Reverse Charge Applicability – Indicates whether the buyer, instead of the seller, is liable to pay the tax.

Signature of the Supplier – A physical or digital signature that authenticates the invoice and confirms its legitimacy.

Start with your business details at the top, add the customer’s information, and include the invoice number and date. List items with prices and taxes. Add the total payable amount and payment terms. Use tools like mazu to simplify the process.

Use a compact invoice format with essential fields like item name, quantity, rate, total, GST, and contact info. You can use free Word, Excel, or PDF templates available on mazu to create detailed yet minimal invoices in seconds.

A proforma invoice and a regular invoice may look similar, but they serve very different purposes in business transactions.

- Purpose and Timing

A proforma invoice is like a quote or estimate. It’s issued before a sale is confirmed to give the buyer an idea of the prices, items, and terms.

A regular invoice, on the other hand, is issued after the goods or services have been delivered. It's a formal payment request.

- Legal Validity

A proforma invoice is not legally binding. It doesn’t mean the buyer has to pay—it’s just for reference.

A regular invoice is legally binding. It acts as proof of the sale and is used for accounting and tax purposes.

- Use in Accounting

A proforma invoice is not recorded in the business’s official accounts because no payment is expected yet.

A regular invoice is recorded as part of the business’s income and the buyer’s payable accounts.

- Details Included

A proforma invoice usually includes estimated quantities, prices, and terms. It may not have an invoice number.

A regular invoice includes exact details—invoice number, payment terms, tax, and total payable amount.

Here, you can view a detailed summary of all the invoices you have created, including amounts received, outstanding dues, and partially paid transactions from vendors and customers.