Classification of Bakery Stores under GST

Bakery stores fall under different categories based on their operations:

Standalone Bakeries

These are independent outlets selling bakery products made on-site.

Chains and Franchises

Large brands operate multiple stores with a standardized menu and pricing.

Home-Based Bakeries

Smaller setups running from homes, primarily catering to niche markets or custom orders.

Café-Style Bakeries

Offering a dine-in experience along with their baked goods.

GST Rates for Bakery Stores

The GST rates for bakery products vary depending on their nature:

- Bread: Fresh bread is exempt from GST.

- Cakes, Pastries, and Cookies: These are generally taxed at 18%.

- Packaged and Branded Goods: Pre-packaged items attract 12% or 18% GST, depending on the product type.

- Dine-In Services: A 5% GST applies to the total bill if the bakery also offers dining facilities.

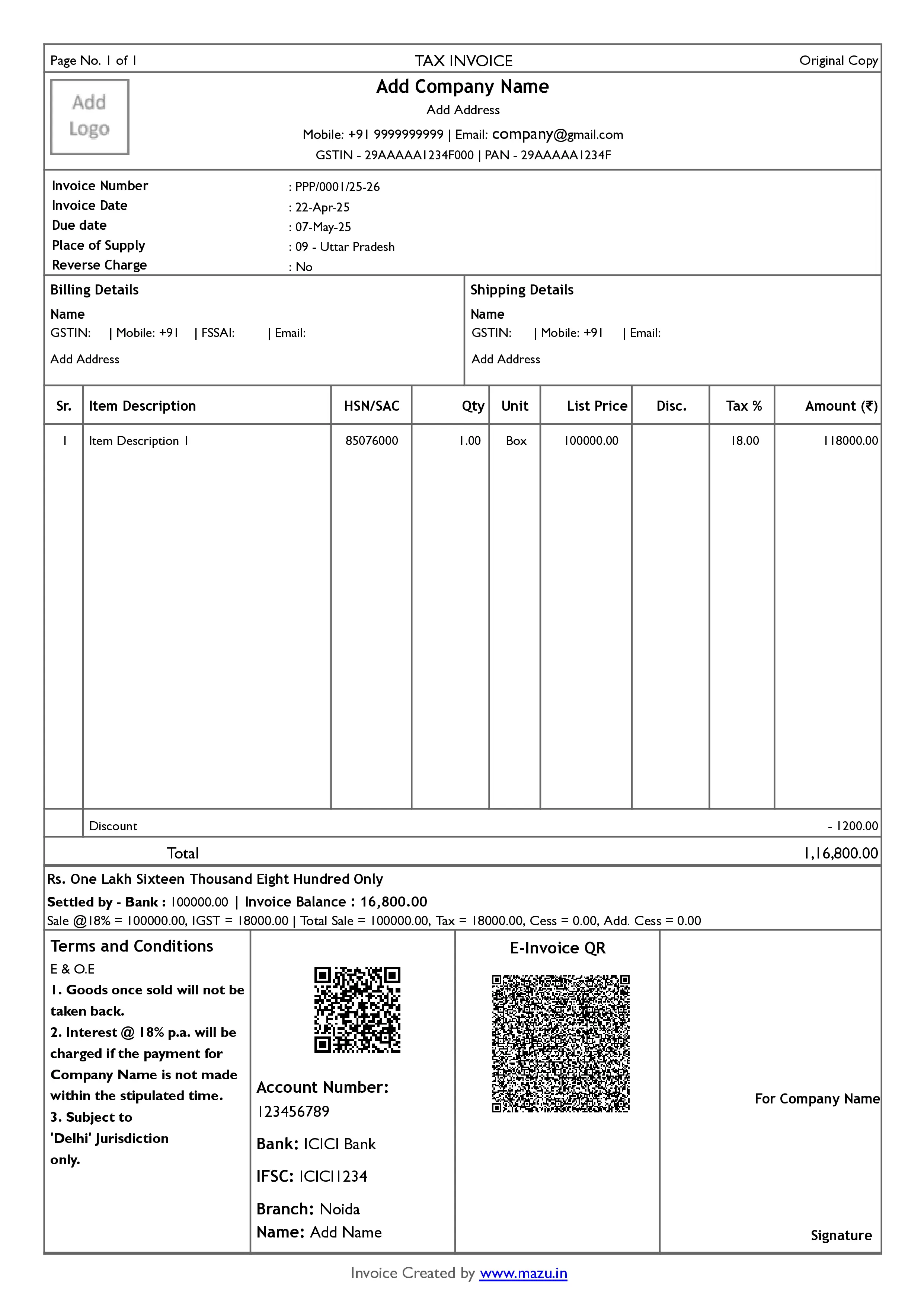

What details does a bakery owner need to create an invoice?

To stay GST compliant, bakery stores must have a proper invoice format for every sale. Here’s what a GST-compliant invoice must include:

- Store Details: Name, address, and GSTIN of the bakery.

- Customer Details: Name and GSTIN (if applicable).

- Invoice Number and Date.

- Description of Goods Sold: Clearly mention the product name and quantity.

- Taxable Value: Item-wise breakdown of prices before tax.

- GST Rate and Amount: Applicable GST rate (e.g., 5%, 18%) and the corresponding amount.

- Total Invoice Value: Sum of all charges, including GST.

GST Registration for Bakery Stores in India

Bakery owners must register under GST if:

Turnover Exceeds the Threshold

Annual turnover exceeds ₹40 lakh (₹20 lakh in special category states).

Supplying Outside State

Engaged in inter-state supply of goods.

E-Commerce Sales

Selling through online platforms like Zomato or Swiggy.

Documents needed for GST registration include:

- PAN Card

- Aadhaar Card

- Address Proof of Business Premises

- Bank Account Details

Once registered, bakery stores receive a unique GSTIN (Goods and Services Tax Identification Number).

How to Stay GST Compliant as a Bakery Store Owner

Staying GST-compliant doesn’t have to be overwhelming. Here are some tips to consider:

Accurate Record-Keeping

Maintain detailed purchases, sales, and stock movement records.

Regular Tax Filings

File GSTR-1, GSTR-3B, and other applicable returns on time.

Monitor Input Tax Credit (ITC)

Claim ITC for GST on business expenses like raw materials and packaging.

Use GST-Compatible Software

Consider using a reliable billing and accounting solution to automate calculations and generate accurate invoices.

HSN Codes For Bakery Businesses In India

| Category | HSN Code | GST Rate |

|---|---|---|

| Bread (excluding sweetened) | 1905 90 20 | 0% |

| Cakes and pastries | 1905 90 90 | 18% |

| Biscuits | 1905 31 00 | 18% |

| Rusks, toasted bread, etc. | 1905 40 00 | 18% |

| Pizza bases | 1905 90 10 | 18% |

| Cookies | 1905 | 18% |

| Savory bakery items | 1905 | 12% |

| Wafers | 1905 32 00 | 18% |

Note: This table includes common services and corresponding HSN and SAC codes with GST rates. The GST rate may vary based on specific products or updates in GST law.

How mazu Can Streamline Invoicing for the Bakery Stores?

Easy Invoice Management

- Create GST and non-GST invoices quickly.

- Share invoices instantly via email or WhatsApp.

- Customize invoice templates, headers, and footers for your unique branding.

Seamless Payment Tracking

- Accept payments through multiple modes: Bank, Cash, and UPI.

- Track payment statuses to ensure nothing gets missed (Paid/Due/Overdue).

- Automatically calculate and include taxes for compliance.

Flexible Billing Options

- Support for multi-GST rate billing and tax-inclusive/exclusive pricing.

- Offer item-wise or bill-wise discounts to customers.

- Generate dynamic QR codes for hassle-free payments.

Personalized Business Branding

- Add your logo and digital signature to invoices.

- Customize font styles, colors, and optional fields for a professional look.

- Manage multiple business profiles with a single account for efficiency.

discover

Some frequently asked questions

Yes, mazu supports both GST and non-GST invoice creation.

Yes, mazu currently supports A4-size invoice printing.

Yes, item-wise and bill-wise discounts are easily manageable.

You can set different prices for parties based on customer profiles in mazu invoice generator.

Yes, mazu allows you to choose between tax-inclusive or exclusive billing.

Yes, every invoice can include a dynamic QR code for quick payments.

mazu’s mobile app ensures you can manage billing anytime, anywhere.

Yes, mazu allows the creation of duplicate or triplicate copies as needed.