One-Stop Billing Solution for Transport Businesses

Create customised GST invoices, manage quotations, and sales orders from one platform. Generate e-invoices and e-way bills, share them instantly via WhatsApp or email, and track business performance with advanced reports. Manage it all anytime with the mobile app.

Classification of Transportation Under GST

Goods Transport Services

- Road Transport: Trucking and cargo services.

- Rail Transport: Freight trains for large-scale goods movement.

- Air Transport: Domestic and international air cargo.

- Waterways: Inland and coastal shipping.

Passenger Transport Services

- Public transportation includes buses, taxis, and autorickshaws.

- Rail and air travel.

- Tourism and charter services.

Courier Services

- Delivery of parcels and packages, including express and logistics services.

GST Rates for the Transport Industry

- Road Transport (Goods): 5% without input tax credit (ITC), 12% with ITC.

- Passenger Transport:

- Non-AC Buses: 0%.

- AC Buses and Rail: 5%.

- Air Travel (Economy): 5%, Business Class: 12%.

- Rail Freight: 5%.

- Courier Services: 18%.

- Inland Waterways: 5%.

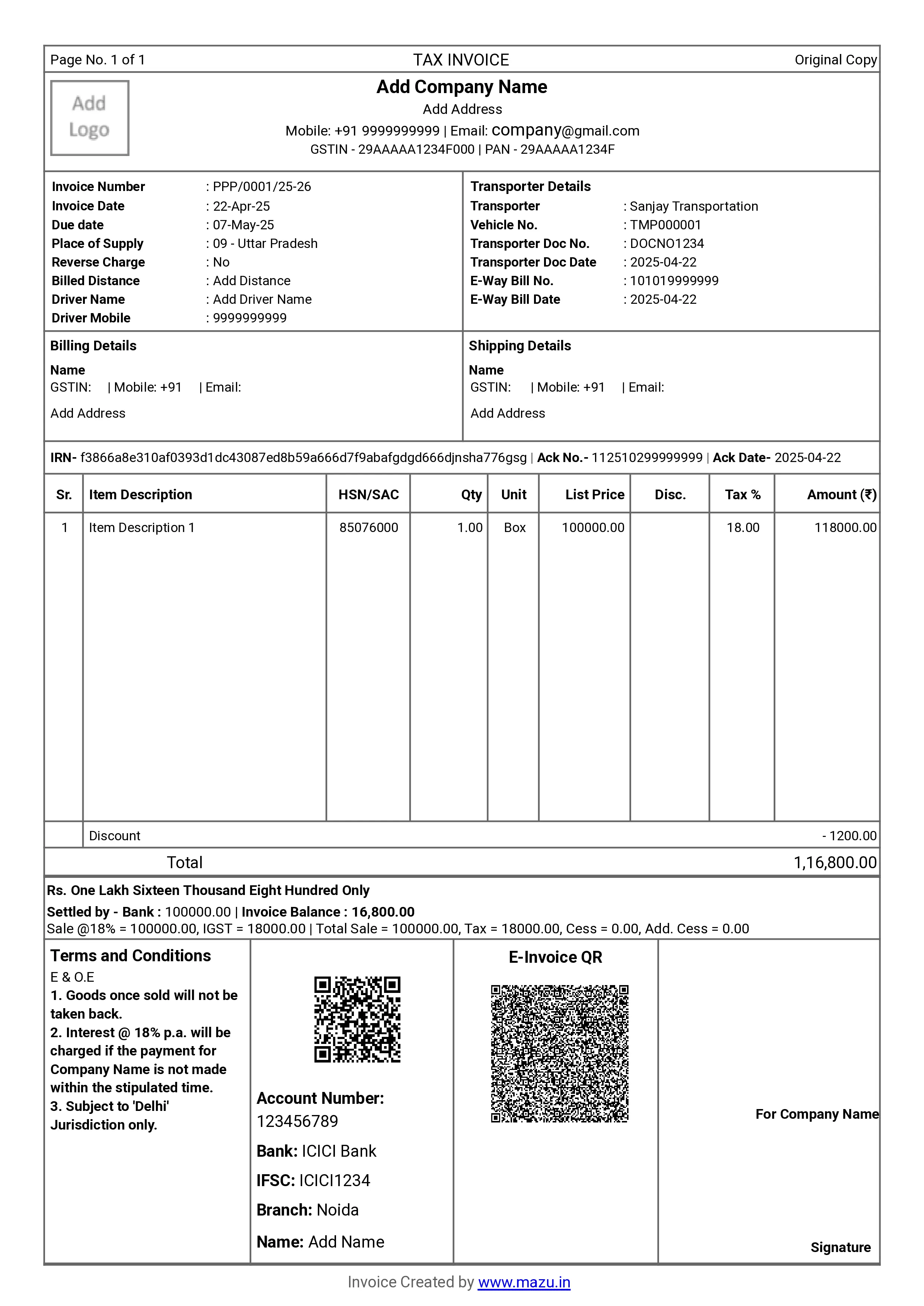

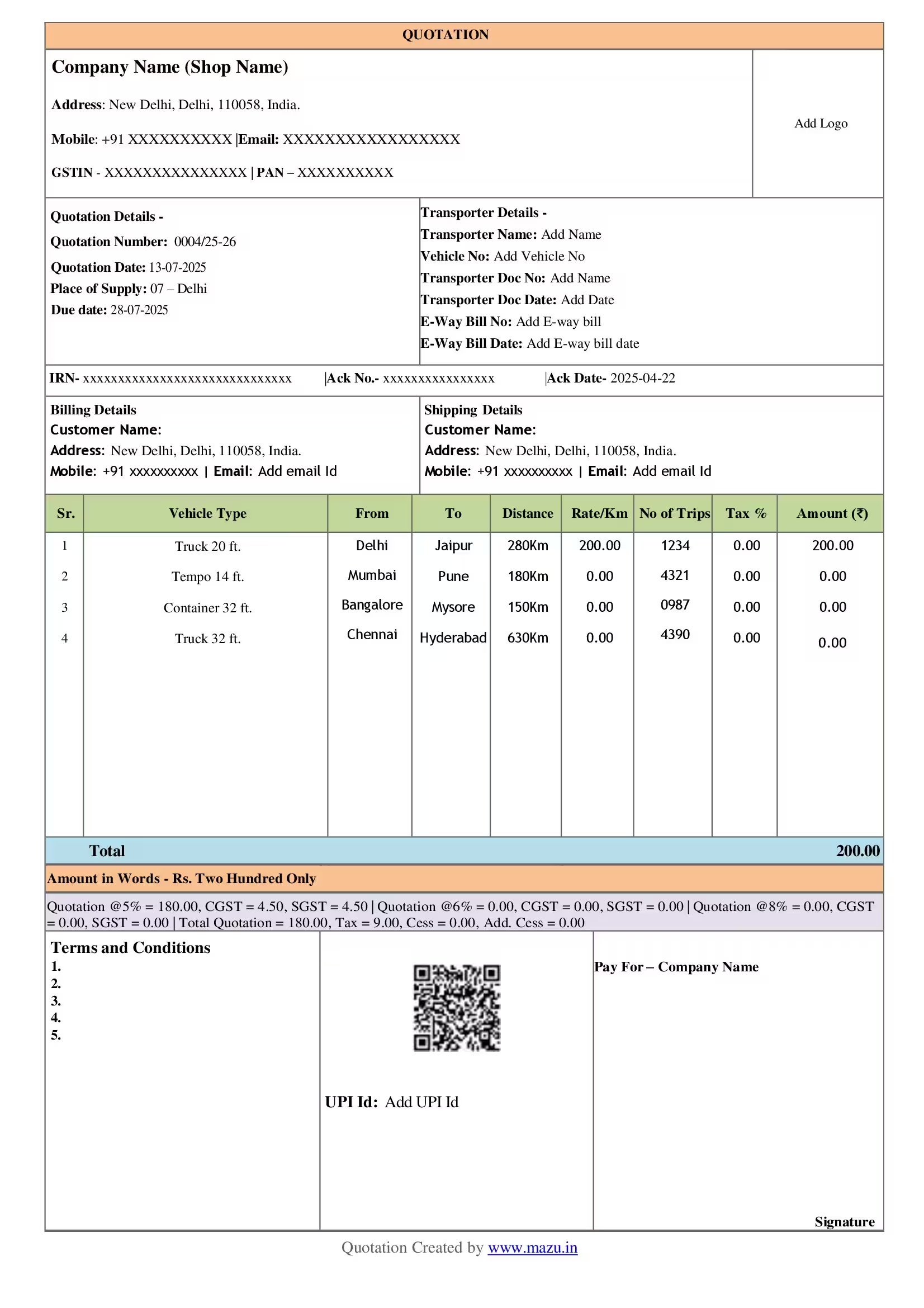

Invoicing Requirements for Transport Businesses Under GST

- Invoice Details: The invoice includes the supplier's and recipient's name, address, GSTIN, description of services, HSN/SAC code, and taxable value.

- E-Way Bill: Mandatory for goods movement exceeding Rs.50,000.

- Reverse Charge Mechanism (RCM): For unregistered goods transport agencies (GTAs), the recipient pays the GST.

- Time of Supply: GST is payable when the invoice is issued or when payment is received, whichever is earlier.

GST Registration for Transport Businesses in India

- Mandatory for businesses exceeding the turnover threshold of Rs.20 lakh (Rs.10 lakh in special category states).

- GTAs must register under GST, even if turnover is below the threshold.

- Registration ensures businesses can claim ITC and comply with tax regulations.

How to Stay GST Compliant as a Transport Business?

Timely Registration

Make sure the GST registration is based on turnover and service type.

Accurate Invoicing

Use proper HSN/SAC codes and mention GST details clearly.

E-Way Bill Compliance

Generate and carry e-way bills for eligible goods.

Reverse Charge Mechanism

Understand when RCM applies and account for it correctly.

Maintain Records

Maintain detailed records of invoices, payments, and ITC claims.

File Returns on Time

File GSTR-1, GSTR-3B, and other applicable returns promptly.

HSN/SAC Code for Transport Businesses

| Service | HSN/SAC Code | GST Rate |

|---|---|---|

| Road Transport (Goods) | 996511 | 5% / 12% |

| Rail Transport (Goods) | 996512 | 5% |

| Inland Waterways | 996513 | 5% |

| Air Freight | 996514 | 18% |

| Passenger Transport by Road | 996411 | 0% / 5% |

| Passenger Transport by Air | 996413 | 5% / 12% |

| Courier Services | 996812 | 18% |

Note: This table includes common services and corresponding HSN and SAC codes with GST rates. The GST rate may vary based on specific products or updates in GST law.

How mazu Can Streamline Invoicing for the Transportation Industry?

Effortless Invoicing

- Quickly create GST and non-GST invoices with pre-filled details.

- Instantly generate Party/Item details within the invoice.

- Share invoices directly via email or WhatsApp.

Smart Tax Management

- Auto-calculate taxes with suggestions based on HSN codes.

- Handle multi-GST rate billing with ease.

- Choose tax-inclusive or tax-exclusive options for flexible pricing.

Seamless Payment Tracking

- Accept payments through Cash, Bank, or UPI.

- Track payment statuses: Paid, Due, or Overdue.

- Access dynamic QR codes for faster payments.

Strengthen Brand Presence

- Add your logo, signature, and personalized header/footer.

- Customize invoice templates with colors, fonts, and optional fields.

- Print duplicate or triplicate copies as needed for professional use.

discover

Some frequently asked questions

Yes, mazu allows you to create and manage invoices for multiple clients under a single account.

mazu automatically calculates taxes based on HSN codes and provides tax rate suggestions for accurate GST compliance.

Yes, mazu helps you track payment statuses, including Paid, Due, and Overdue, ensuring smooth payment management.

Yes, mazu allows you to add optional fields (up to five) to your invoices, so you can include details like route information, vehicle numbers, or driver details.

Yes, with mazu you can add item-wise or bill-wise discounts to cater to managing multiple transportation agreements, offering flexibility in pricing.

Yes, you can share invoices instantly via email or WhatsApp to communicate with your clients promptly.

mazu allows you to add your logo, customize header/footer text, and adjust font styles, providing a professional and branded invoice for your transportation services.

Yes, mazu’s mobile app for invoicing ensures you can access and manage your invoices, payments, and client details anytime, anywhere.