One-Stop Billing Solution for Stationery

Generate custom, GST-compliant invoices with item-wise pricing, discounts, and send order quotations, and process payments from one platform. Generate e-invoices and e-way bills instantly, and share via WhatsApp or email. Access it all anytime with the mobile app.

Types of Stationery and Their GST Classification

Stationery items fall into different categories under GST, each with specific tax rates. Here is the breakdown:

Educational Stationery

This includes items like notebooks, pencils, pens, and erasers are typically taxed at 12% under GST.

Office Stationery

This includes products such as staplers, files, folders, and markers that fall under an 18% GST slab.

Art and Craft Supplies

This includes items like paints, brushes, and sketchbooks that often attract an 18% GST rate.

Luxury Stationery

This includes premium products, including decorative or branded stationery, which, depending on their classification, may fall under higher tax brackets.

GST Rates for Stationery Products

GST rates for stationery items vary based on their use and material. Here are some common rates:

5% GST

This applies to some specific paper-based stationery like exercise books and handmade paper products.

12% GST

It is applied to most educational stationery, such as pencils and sharpeners.

18% GST

It covers items like adhesives, markers, and office supplies.

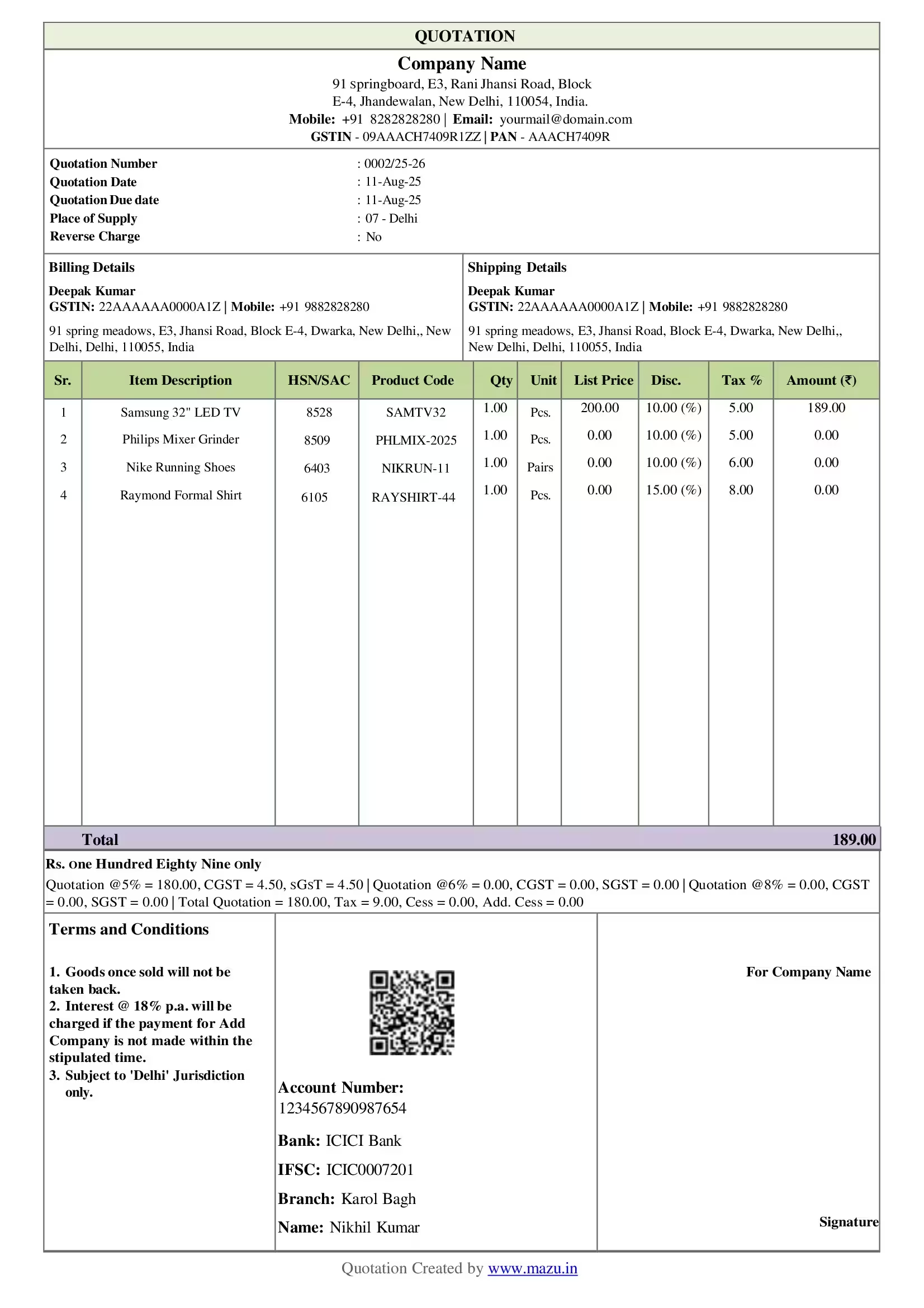

Invoices Required for Stationery Businesses

Invoices are a critical part of running a GST-compliant stationery business. Here are the types of invoices you may need:

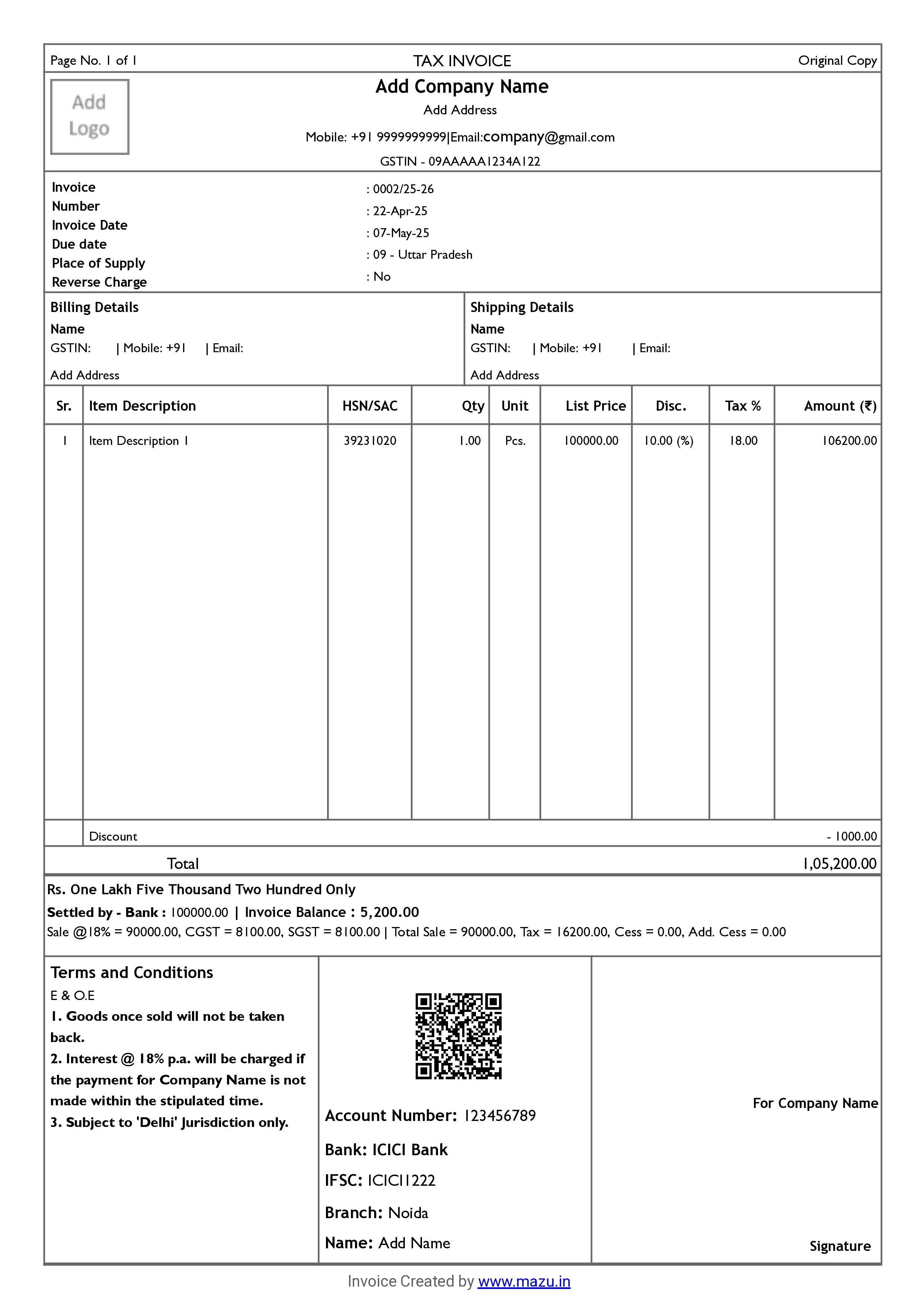

Tax Invoice

Used when selling taxable goods. It must include GSTIN, product description, HSN codes, quantity, tax rates, and total amount.

Bill of Supply

Required for exempt goods or supplies under the composition scheme.

Delivery Challan

Used when transporting goods without immediate sale, such as sending stock to a warehouse or samples to customers.

Debit and Credit Notes

Issued for returns, cancellations, or pricing adjustments.

Invoicing Requirements for Stationery Businesses Under GST

A GST-compliant invoice must include:

- Name, address, and GSTIN of the supplier.

- Invoice number and date.

- Description of goods with HSN code.

- Quantity and unit price.

- Applicable GST rates and amounts.

- Buyer’s details, including GSTIN if applicable.

- Place of supply and terms of sale.

GST Registration for Stationery Business Owners

GST registration is mandatory for stationery businesses exceeding the specified turnover threshold:

Turnover Threshold

- ₹40 lakh for most states (₹10 lakh for special category states).

- ₹1.5 crore for businesses opting for the composition scheme.

Documents Required

- PAN card and Aadhaar card.

- Business registration certificate.

- Address proof and bank account details.

- Digital signature or e-signature.

Online Registration

- Online Registration

- Visit the GST portal.

- Fill out the application and upload the required documents.

- Receive your GSTIN upon approval.

How to Stay GST-Compliant

Compliance doesn’t have to be complicated. Here are steps to keep your business GST-ready:

- Maintain Accurate Records: Keep detailed sales, purchases, and inventory records.

- File GST Returns on Time: Regular filing of GSTR-1, GSTR-3B, and annual returns is mandatory.

- Use Accounting Software: Automate invoicing, tax calculations, and return filing with GST-compliant tools.

- Stay Updated: Regularly check for GST updates to adjust pricing and processes as needed.

- Training for Staff: Educate your team about GST procedures and compliance to avoid errors.

HSN/SAC Codes For Stationery Businesses

| Product/Service | HSN/SAC Code | GST Rate |

|---|---|---|

| Pen, Pencil, and Other Writing Instruments | 9608 | 18% |

| Exercise Books and Notebooks | 4820 | 12% |

| Paper and Paperboard | 4802 | 12% |

| File Folders and File Covers | 4820 | 18% |

| Staplers and Staples | 8203 | 18% |

| Adhesive Tape, including Scotch Tape | 3919 | 18% |

| Envelopes and Letter Pads | 4817 | 12% |

| Rulers and Other Stationery Items | 9017 | 18% |

| Printing Ink | 3215 | 18% |

| Office Equipment (Stapler, Punching Machine) | 8472 | 18% |

| Scissors, Shredders, and Trimmers | 8203 | 18% |

Note: This table includes common Stationery items and their corresponding HSN/SAC codes with GST rates. The GST rate may vary based on specific products or updates in GST law.

How mazu Can Simplify Invoicing for Stationery Businesses?

Easy Billing and Invoice Management

- Quickly create GST and non-GST invoices.

- Personalize templates with logos, headers, and footers.

- Easily share invoices via email or WhatsApp.

Flexible Tax and Payment Management

- Automatically calculate taxes based on HSN codes.

- Accept payments via cash, bank, and UPI.

- Track payment statuses (paid, due, or overdue).

Multi-Business Support

- Manage billing on the go with the mobile app

- Handle multiple businesses under a single account.

- Quickly create and manage party/item details.

Brand Consistency and User Access

- Adjust fonts and colours, and add custom fields to personalize invoices.

- Invite employees and assign role-based access.

- Print duplicate or triplicate copies of invoices.

discover

Some frequently asked questions

A Stationery invoice generator is a tool for stationery stores to create detailed customer invoices. The invoice includes information about the order, such as the purchased items, their prices, and taxes.

With mazu, you can easily create a Stationery invoice by entering the customer's details, adding items, applying taxes (if needed), and generating the invoice with just a few clicks. You can also customize the invoice layout to suit your brand.

A Stationery invoice should include the following details:

- Customer name and contact information

- Date and time of the order

- An itemized list of stationery items

- Total amount (including taxes)

- Payment method (Cash, Bank, or UPI)

- GST details (if applicable)

Yes, mazu allows you to create non-GST invoices for your stationery store by simply choosing the appropriate option during the invoice creation process.

Yes, mazu supports the generation of GST invoices. It automatically calculates GST based on the items and provides tax rate suggestions based on HSN codes.

Invoicing ensures compliance with GST, keeps records organized, and builds trust through transparent billing.

Yes, mazu auto-fills GSTIN details, ensuring valid and GST-compliant invoices.

Yes, mazu allows users to generate duplicate or triplicate invoices as needed, and you can also rename them to avoid confusion.

Yes, it lets you set a minimum sales price and alerts you if prices fall below the set limit.