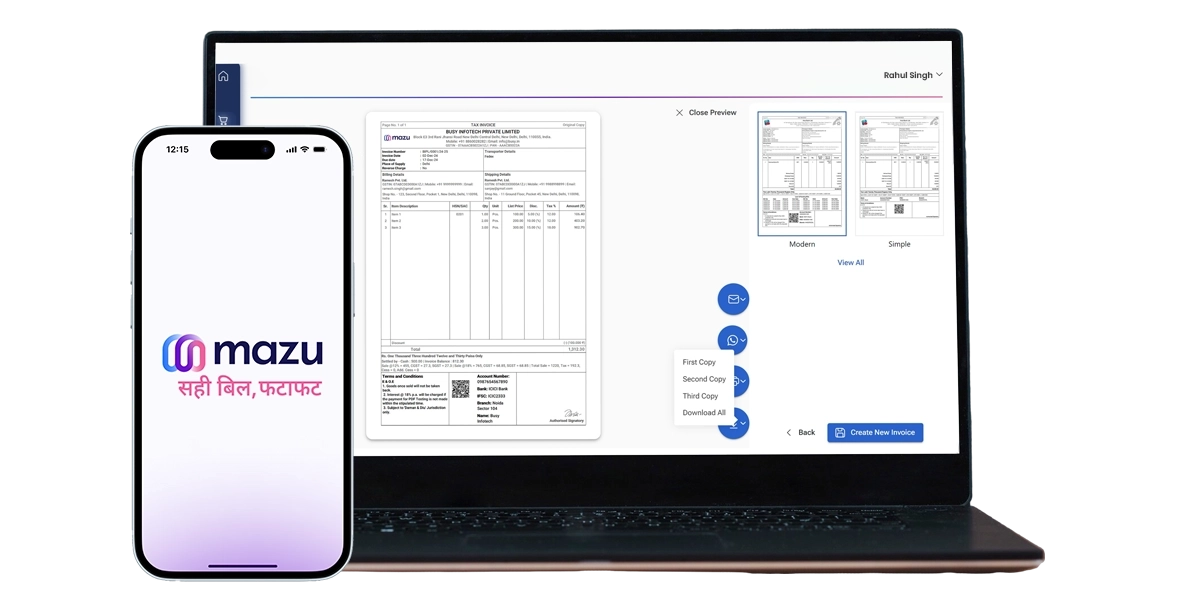

One-Stop Billing Solution for Retail

Create custom GST-compliant invoices with item-wise pricing, discounts, and taxes, prepare quotations, manage sales orders, and process payments from one platform. Generate e-invoices and e-way bills and share bills via WhatsApp or email. Access it all anytime with the mobile app.

Types of Retail Businesses Under GST

Retail businesses come in different shapes and sizes and have specific rules under GST. Some of the common types of retail businesses are:

B2C (Business to Consumer)

Retailers who sell directly to consumers. Examples include grocery stores, clothing shops, and online retail companies.

B2B (Business to Business)

Retailers who sell products to other businesses, such as wholesalers or resellers, must maintain detailed records and issue invoices accordingly.

E-Commerce Retailers

Businesses that sell products online through platforms like Amazon or Flipkart must comply with GST regulations, including collecting GST on behalf of suppliers and paying it to the government.

GST Rates for Retail Industry

GST rates for retail businesses depend on the type of product or service being sold. Here's a breakdown of GST rates:

5% GST

Products like fresh fruits, vegetables, and some footwear fall under the 5% GST category.

12% GST

Many daily-use products, such as packed foods, dairy, and cosmetics, are taxed 12%.

18% GST

Apparel, footwear, electronics, and other non-essential items generally fall under this tax bracket.

28% GST

Luxury items such as high-end vehicles, perfumes, and certain branded goods are subject to the highest GST rate.

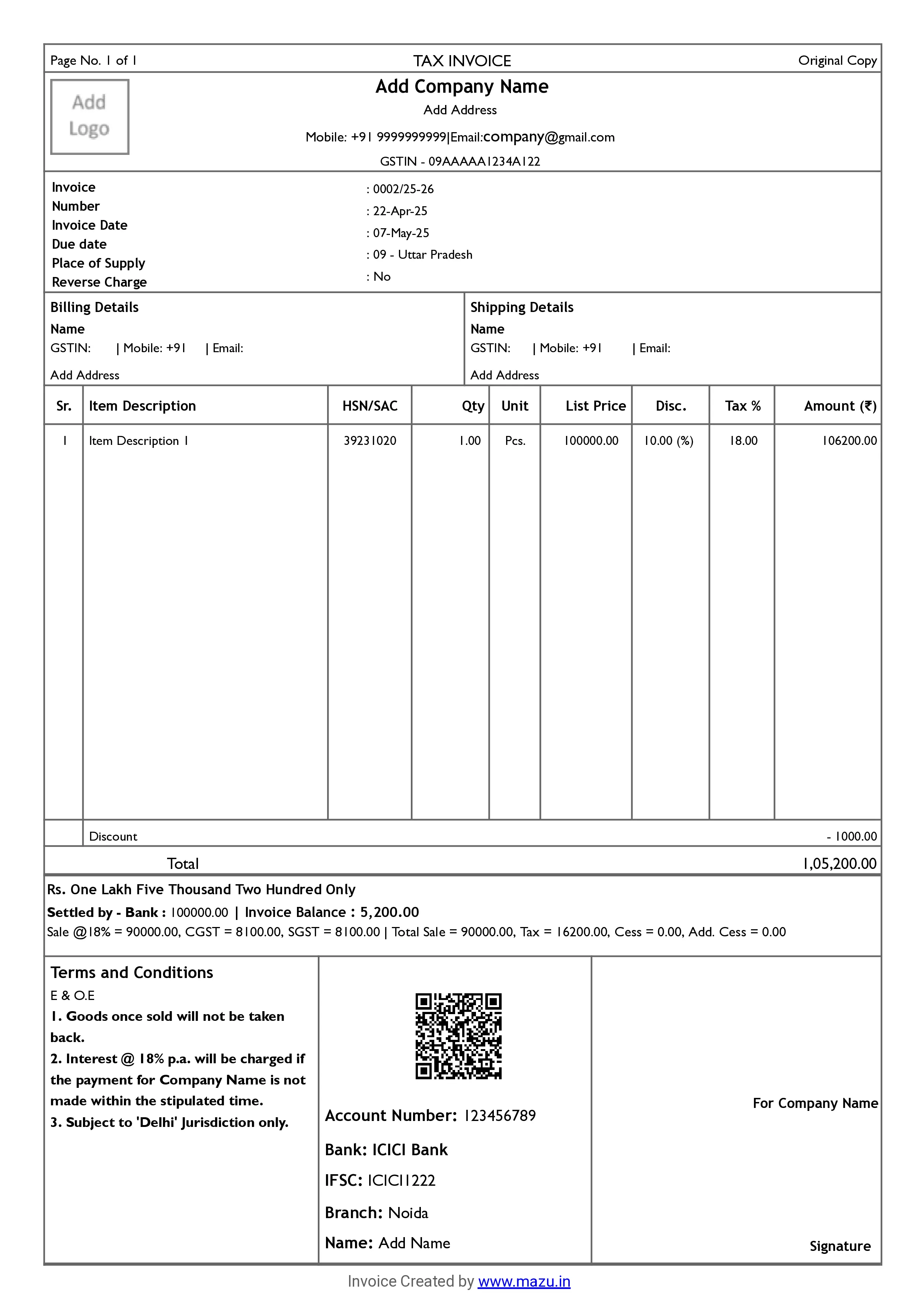

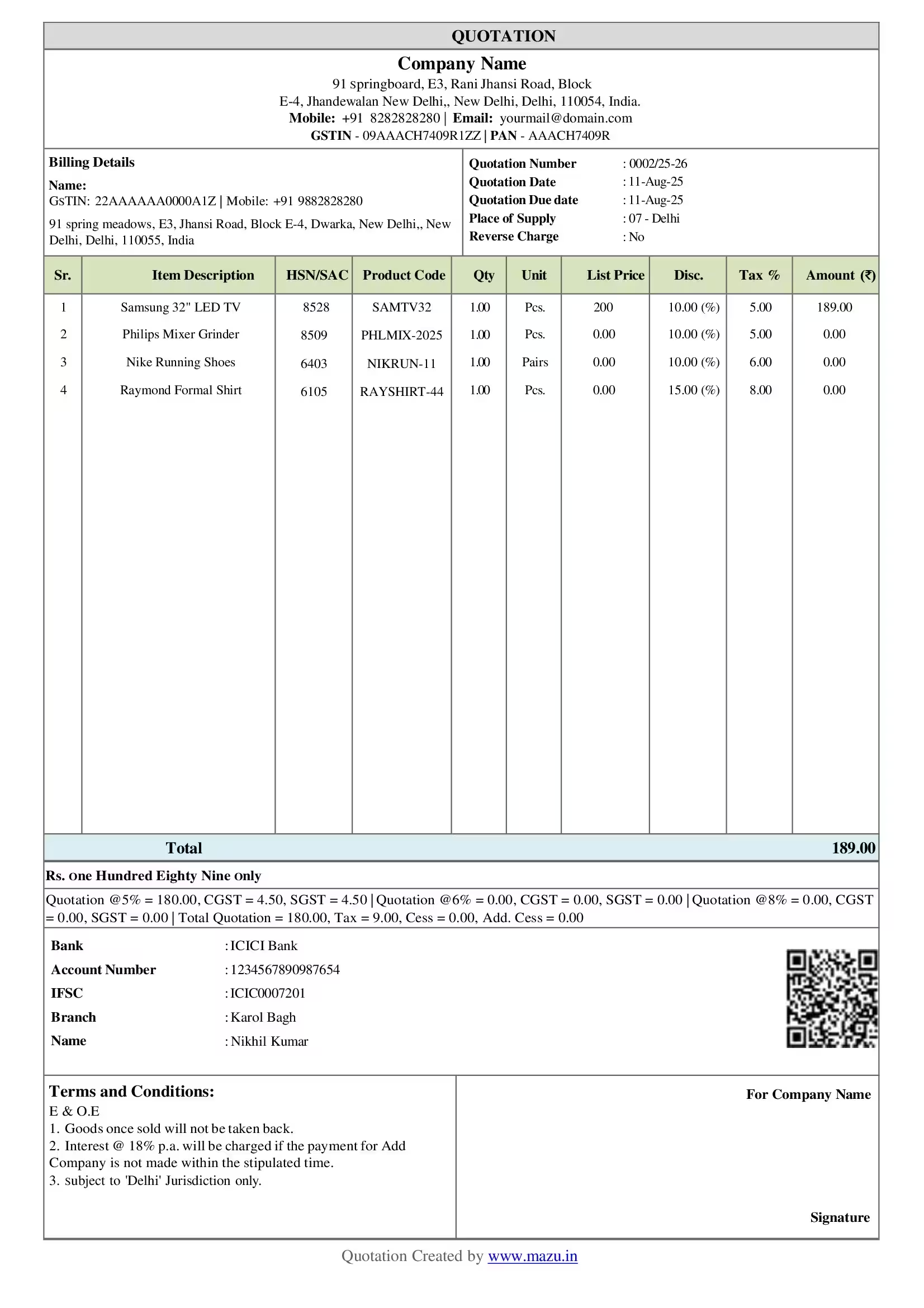

Invoicing Requirements for the Retail Industry

Here are some types of invoice formats you might need:

- Retail Invoice (B2C Invoice): You need a retail invoice for sales to end consumers. This invoice typically includes:

- Business name and address

- GSTIN of your business

- Date of transaction

- Details of the goods or services sold

- GST amount charged

- Tax Invoice (B2B Invoice): A tax invoice is required if you sell to another business. It includes:

- GSTIN of both buyer and seller

- HSN/SAC codes for the goods or services sold

- GST rates applied (CGST, SGST, IGST)

- Bill of Supply: This is issued when the supply is exempt from GST, or the seller is under the Composition Scheme.

How to Stay Compliant with GST as a Retail Business

Here are some tips to ensure compliance with GST rules

- Keep Detailed Records: Maintaining accurate records of all your transactions, including sales and purchases, will help you file your returns correctly and avoid errors during audits.

- Issue Proper Invoices: As mentioned earlier, issue the correct invoice formats—retail, tax, or bill of supply to ensure the correct GST rates are applied.

- File GST Returns on Time: Retailers must file GST returns regularly. Typically, GST returns must be filed monthly or quarterly, depending on your turnover.

- Pay GST on Time: Timely payment of GST is critical to avoid penalties. GST is paid monthly (or quarterly for smaller businesses) and must be paid before filing the returns.

- Availing Input Tax Credit (ITC): If registered under GST, you can claim ITC on any tax paid on purchases for your business. Thus, make sure you follow the eligibility rules and that your supplier has filed the necessary returns.

HSN/SAC Code For the Retail Industry

| Code Type | Code | Description |

|---|---|---|

| HSN | 4015 | Apparel and clothing accessories made of rubber or plastic |

| 4201 to 4206 | leather or composition leather articles (e.g., bags, belts, wallets) | |

| 6101 to 6117 | Knitted or crocheted clothing and accessories | |

| 6201 to 6217 | Non-knitted clothing and accessories | |

| 6401 to 6405 | Footwear | |

| 8517 | Telephone sets, including smartphones | |

| 9403 | Furniture and its parts | |

| SAC | 9961 | Accommodation services (if applicable in retail, e.g., in malls) |

| 9962 | Restaurant and catering services (common in retail spaces) | |

| 9972 | Renting or leasing services involving goods | |

| 9985 | Supply of tangible goods services | |

| 9997 | Other miscellaneous services |

Note: This table includes common retail products and their corresponding HSN/SAC codes with GST rates. The GST rate may vary based on specific products or updates in GST law.

How mazu Can Simplify Invoicing for Retail Businesses

Simplified Invoice Sharing

- Invoice sharing via email or WhatsApp

- Supports multiple payment methods (Cash, bank transfers, and UPI)

- Dynamic QR codes for faster payment processing

Efficient GST Management

- Auto-fill GSTIN details

- HSN/SAC Code Suggestions

- Automatic Tax Calculation

Elevate Brand Experience

- Adjust Color/font size/Font style

- Add Optional fields up to 5

- Logo and signature image can be added

Streamlined Utility Features

- Generate duplicate/triplicate bill copies

- Set minimum sales price warnings

- Collaborate with team members

discover

Some frequently asked questions

To make a retail invoice with mazu, enter customer details, add the purchased items, set the prices, apply taxes (if needed), and generate the invoice with a few clicks.

Retailers, shop owners, and businesses selling goods directly to consumers can use the retail invoice generator on mazu.

A retail invoice can include customer name, item descriptions, quantities, prices, taxes, total amount, and payment method.

A retail invoice template should have:

- Business name, contact details, and logo

- Customer details

- Itemized list of products with prices

- Total amount and tax information

- Payment terms

Including return and exchange policies on a retail invoice is a good practice as it helps clarify terms for customers and ensures transparency.

Yes, mazu allows you to generate invoices with or without GST, depending on your business requirements and the nature of the transaction.

mazu lets you set a warning for when the sale price is below a certain threshold, helping you manage pricing more effectively.

Yes, mazu allows role-based access to have control over access and permissions.

mazu's simple and user-friendly interface helps you generate invoices in less than 10 seconds.

Yes, mazu is perfect for small retail businesses, providing an easy-to-use solution for invoicing, GST compliance, and customer management.