One-Stop Billing Solution for Restaurants

Create professional GST invoices with order details, and tax breakdowns, share instantly via WhatsApp or email and view detailed sales reports in one place. Manage dine-in, takeaway, and delivery orders seamlessly, stay on top of dues, and access it all anytime with the mobile app.

Understanding GST Categories for Hotels and Restaurants

GST is applied differently based on the type of services your business offers.

Standalone Restaurants

Include dine-in restaurants, both air-conditioned and non-air-conditioned.

Takeaway and Delivery Outlets

Food businesses offering delivery or self-pickup services.

Outdoor Catering

Catering services provided at events or locations outside your restaurant.

Hotel Restaurants

Restaurants operating within hotels. GST rates depend on room tariffs.

Luxury Dining

High-end restaurants are offering premium services and experiences.

GST Rates for Restaurant and Hotel Services

Applying the right GST rate is crucial for accurate billing.

Non-AC Restaurants

5% GST (No input tax credit)

AC Restaurants

5% GST (No input tax credit)

Hotel Restaurants

- Room tariff below ₹7,500/day: 5% GST (No input tax credit)

- Room tariff above ₹7,500/day: 18% GST (With input tax credit)

Takeaway and Delivery

5% GST (No input tax credit)

Outdoor Catering

18% GST (With input tax credit)

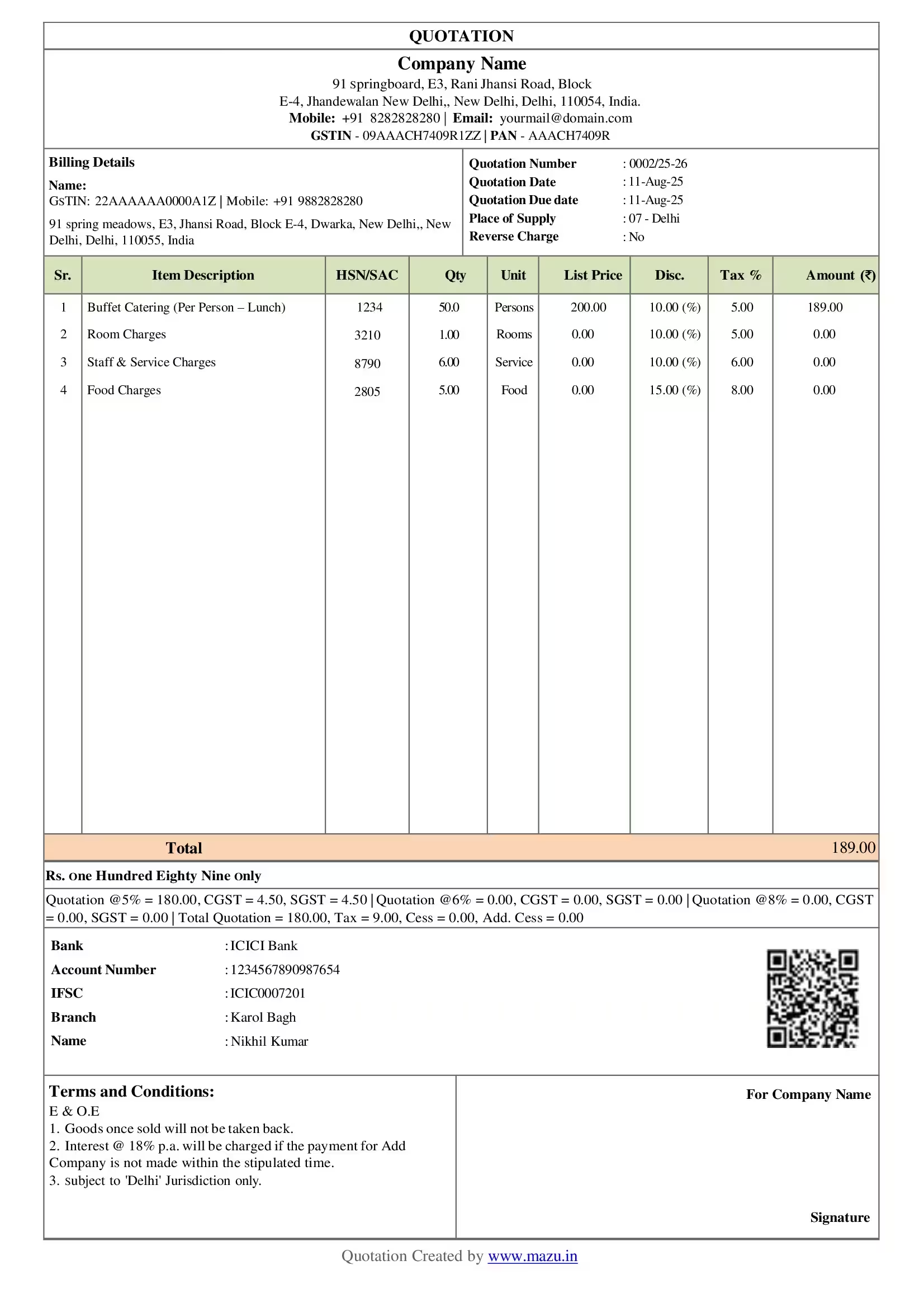

Billing Requirements for Hotels and Restaurants

GST compliance is crucial when creating bills for hotels and restaurants. Here's what you need to know:

Types of Invoices

Tax Invoice

This is for transactions where GST is charged.

Bill of Supply

For exempt or non-GST services.

What details does a restaurant need to create an invoice?

- Business name, address, and GSTIN.

- Unique invoice number and date.

- Customer details (if applicable).

- HSN/SAC codes for goods/services.

- GST rates and tax breakdown (CGST, SGST, or IGST).

- Total invoice amount.

GST Registration for Restaurants

GST registration is mandatory if your restaurant or hotel business earns more than ₹20 lakh annually (₹10 lakh in special category states).

How to Stay GST-Compliant

Compliance doesn’t have to be complex. Here are steps to keep your business GST-ready:

File GST Returns on Time

Submit monthly or quarterly returns like GSTR-1 and GSTR-3B to avoid penalties.

Maintain Accurate Records

Keep detailed records of all transactions, including sales, purchases, and tax payments.

Use GST-Compliant Billing Software

Simplify your invoicing and filing processes with tools designed to handle GST complexities.

Train Your Team

Ensure your staff understands GST rules to avoid errors in billing and compliance.

Display GST Details Clearly

Include your GSTIN on menus, invoices, and business signboards.

SAC Codes For Restaurants

Restaurants fall under SAC code 996331 for services Provided By Restaurants, Cafes, And Similar Eating Facilities, Including Takeaway Services, Room Services, and Food Delivery.

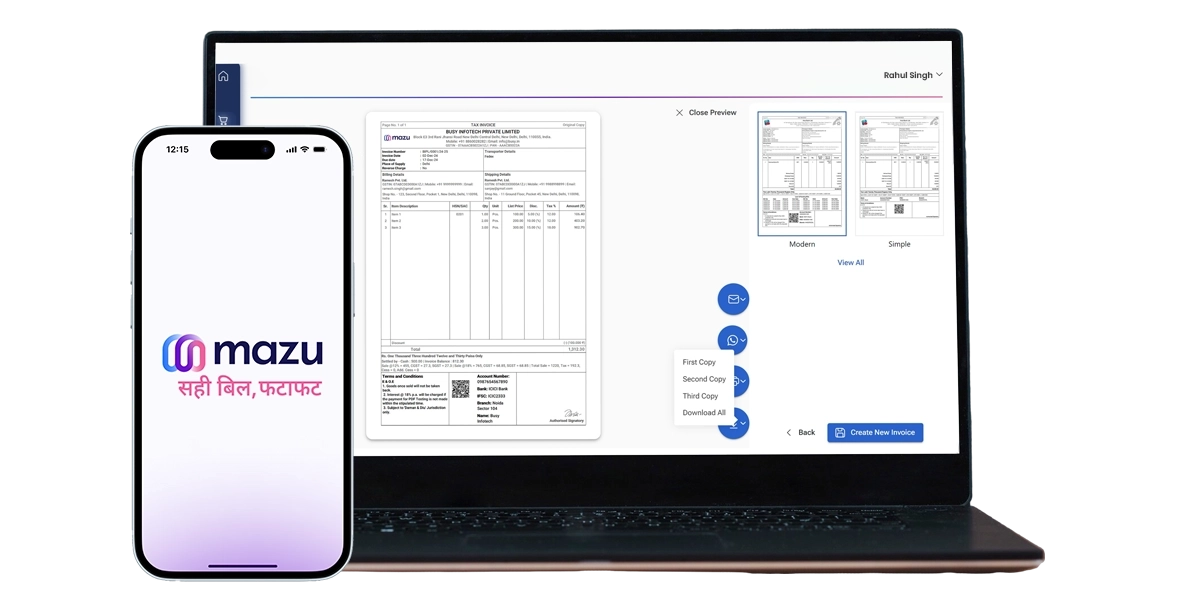

How mazu Can Streamline Restaurants and Hotels Invoicng?

- Convenient Billing & Sharing

- Quickly generate GST and non-GST invoices with minimal input.

- Easily share invoices via email or WhatsApp.

- Manage billing on the go with the mazu Mobile app.

- Flexible Payment Options

- Accept payments through Cash, Bank, or UPI.

- Track payment statuses as Paid, Due, or Overdue.

- Assign payment statuses for better control and tracking.

- Tax Compliance Made Simple

- Automatically calculate taxes based on GST rates.

- Receive tax rate suggestions for each product based on HSN codes.

- Autofill GSTIN details to save time and avoid errors.

- Personalized Branding & Customization

- Customize invoices with your brand’s header, footer, fonts, and logo.

- Add up to five optional fields for additional customization.

- Invite employees and control access & permissions.

discover

Some frequently asked questions

A restaurant invoice generator is a tool that allows restaurants to create detailed customer invoices. The invoice includes information about the order, such as the purchased items, their prices, and taxes.

With mazu, you can easily create a restaurant invoice by entering the customer's details, adding items from your menu, applying taxes (if needed), and generating the invoice in just a few clicks. You can also customize the invoice layout to suit your brand.

A restaurant invoice should include the following details:

- Customer name and contact information

- Date and time of the order

- An itemized list of food and drinks with prices

- Total amount (including taxes)

- Payment method (Cash, Bank, or UPI)

- GST details (if applicable)

Yes, mazu allows you to create non-GST invoices for your restaurant by simply choosing the appropriate option during the invoice creation process.

Yes, mazu supports the generation of GST invoices. It automatically calculates GST based on the items and provides tax rate suggestions based on HSN codes.

Invoicing ensures compliance with GST, keeps records organized, and builds trust through transparent billing.

Yes, mazu auto-fills GSTIN details, ensuring valid and GST-compliant invoices.

SAC codes classify services, e.g., restaurant services: 996331, for GST compliance and proper tax filing.

Yes, mazu allows businesses to generate duplicate or triplicate invoices as needed.

Yes, it lets you set a minimum sales price and alerts you if prices fall below the set limit.