Understanding Advertising & Marketing Services Under GST

Whether you’re running ad campaigns, writing copy, planning digital strategies, or executing offline promotions, your services fall under the GST regime.

You’re required to issue GST-compliant invoices for all client transactions, whether one-time projects or monthly retainers. If you handle both advertising and marketing, you may need to itemise your services based on type, platform, or campaign.

Types of Services Covered

- Print, radio, and digital ads

- Influencer campaigns and media buying

- SEO/SEM services

- Social media marketing

- Email marketing and content strategy

- Branding and design consulting

- Campaign analytics and reporting

GST Rates for Advertising and Marketing

The standard GST rate for most advertising and marketing services is 18%. Here’s how it applies:

| Service Type | SAC Code | GST Rate |

|---|---|---|

| Advertising services (digital, print, media buying) | 998361 | 18% |

| Marketing consulting and promotional services | 998362 | 18% |

If you're billing for ad space, influencer fees, and agency commissions in a single invoice, it's good practice to break them down and apply the right SAC codes.

Invoicing Requirements for Agencies and Freelancers

To stay GST-compliant, your invoice should include:

- Your name or company name and GSTIN

- Client’s name and billing address

- Invoice number and issue date

- Service description (e.g., “SEO campaign for June 2025”)

- Relevant SAC code (998361 or 998362)

- GST breakup (CGST/SGST or IGST)

- Total invoice amount

- Payment terms

GST Registration for Advertising and Marketing Services

You must register under GST if:

- Your annual turnover exceeds ₹20 lakhs (₹10 lakhs for special category states)

- You offer services across states

- You work with corporate clients or agencies that require tax invoices

- You plan to claim input tax credit on tools, ad spend, or outsourced work

GST registration helps establish credibility and makes you eligible for larger projects and retainers.

How to Stay GST-Compliant as a Marketing Agency

- Use proper marketing invoice templates or invoice software

- Include SAC codes, invoice number, and GST breakup

- Maintain digital records of all invoices and payments

- File your monthly or quarterly GST returns (GSTR-1 and GSTR-3B)

- Reconcile ad spends with input tax credits

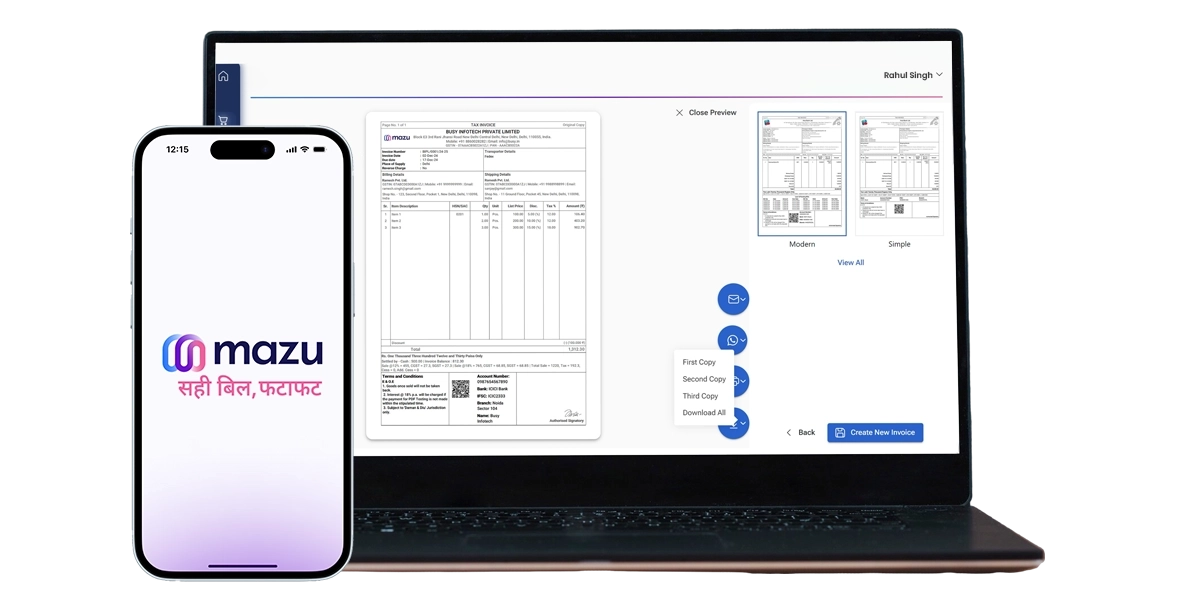

How mazu Can Streamline Invoicing for Marketing Agencies?

1. Fully Customisable Invoices

Create polished, agency-style invoices that reflect your branding. Add your logo, adjust layouts, and include campaign details, deliverables, or hourly rates to keep billing clear and professional.

2. Quick Invoice Sharing

Send invoices directly to clients via WhatsApp or email in just a few seconds. Ensure faster approvals and smooth payment flow—no chasing required.

3. Advanced Reporting

Track earnings by campaign, client, or service type. Easily monitor unpaid invoices, project-wise billing, and monthly revenue trends with clear, easy-to-read reports.

4. Sales Quotation Management

Quickly draft and manage quotations for ad campaigns, retainers, or marketing packages. Add custom fields or attachments, and convert approved quotations into invoices or work orders in one click.

5. Effortless Payment Management

Manage all incoming payments from one place. Track payment status, modes (like UPI, bank transfer, etc.), and ensure consistent cash flow across all client accounts.

6. Create Invoices on the Go

Whether you're on a shoot or in a client meeting, generate invoices, quotations, or service orders anytime, anywhere using the mazu mobile app.

discover

Some frequently asked questions

A marketing and advertising invoice template is a ready-to-use format for billing clients for services like ad campaigns, content creation, social media management, or media buying. It includes service details, hours or project fees, and applicable taxes.

Freelancers, digital marketing agencies, ad consultants, and creative professionals can use these templates to send clear, professional invoices to clients.

Yes, these templates can include multiple services in a single invoice. You can add line items for different campaigns, platforms, or deliverables, making billing transparent and organized.

The standard GST rate is 18%, applicable to both digital and traditional advertising as well as marketing consultancy services.

Use SAC Code 998361 for advertising services and 998362 for marketing consultancy or promotion services.

Yes, if your income crosses the GST threshold or you work with interstate clients or agencies.

You can download a marketing invoice template, use an advertising bill format in Excel, or generate invoices using mazu in just a few clicks.

Yes. mazu is an all-in-one tool for freelancers and agencies offering design, advertising, and marketing services. It handles GST, invoice generation,e-way bill generation and payment tracking with ease.