Understanding Legal Services Under GST

Legal services provided by advocates, law firms, or LLPs are subject to GST, typically at 18%. However, services offered to individuals, small businesses, or under reverse charge mechanisms may be exempt or taxed differently. It's important to understand GST implications on consultancy, litigation, arbitration, and agreements to ensure proper invoicing and compliance. This helps both legal professionals and their clients stay aligned with GST regulations.

Types of Legal Services Under GST

Legal services under GST include a wide range of professional activities:

- Representation Services: in courts, tribunals, or government bodies

- Legal Consultancy: including advice, legal opinions, and strategy

- Arbitration and Mediation: for dispute resolution

- Documentation & Drafting: like agreements, wills, contracts, etc.

GST Rates Applicable to Legal Services

Legal services are generally taxed at 18% GST, especially when provided to businesses.

| Type of Legal Service | GST Applicability | GST Rate |

|---|---|---|

| Services to individual clients | May be exempt | 0% or NA |

| Services to business entities | Taxable | 18% |

| Services by senior advocates | Taxable | 18% |

| Services to judicial/government bodies | Conditional Exemption | 0% or NA |

GST Registration for Legal Services

Legal professionals must understand when GST registration is mandatory:

- If you serve business clients, you must register; no turnover threshold applies.

- Law firms, regardless of size, that offer B2B services should get registered to avoid compliance issues.

Invoicing Requirements for Legal Professionals

To ensure compliance and clarity, legal invoices should contain the following essential elements:

- Your GSTIN

- GSTIN of the client (if applicable)

- Invoice number and date

- Full details of services rendered

- SAC (Service Accounting Code)

- GST amount (CGST/SGST/IGST)

- Digital or physical signature

SAC Code for Legal Services under GST

Each type of legal service is assigned a unique SAC (Service Accounting Code) under GST. Below are the most relevant codes with GST rates

| SAC Code | Service Description | GST Rate |

|---|---|---|

| 998211 | Legal representation services | 18% |

| 998212 | Legal advisory and consultancy | 18% |

| 998213 | Arbitration and conciliation | 18% |

| 998214 | Legal documentation drafting | 18% |

Staying GST-Compliant as a Legal Service Provider

Here's a breakdown of steps every legal service provider should follow:

- Register for GST if working with businesses

- Use GST-compliant invoices

- File GSTRs regularly (monthly or quarterly)

- Track payments and match invoices

- Maintain digital records for audits

If you manage everything manually, there's always a risk of missing deadlines or data mismatches. That’s where using a robust legal billing software makes a real difference.

How mazu Streamlines Invoicing for Legal Services?

1. Fully Customisable Invoices

Design professional legal invoices using a customised invoice format that reflects your firm’s branding. Modify headers, footers, and fonts, and add your logo and digital signature to deliver polished, client-ready bills.

2. Quick Invoice Sharing

Send invoices instantly via WhatsApp or email. Ensure timely payments and maintain clear, prompt communication with clients.

3. Advanced Reporting

Track client-wise billing, service-wise income, and pending payments with detailed reports. Monitor receivables, ledgers, and overall firm performance for better financial control.

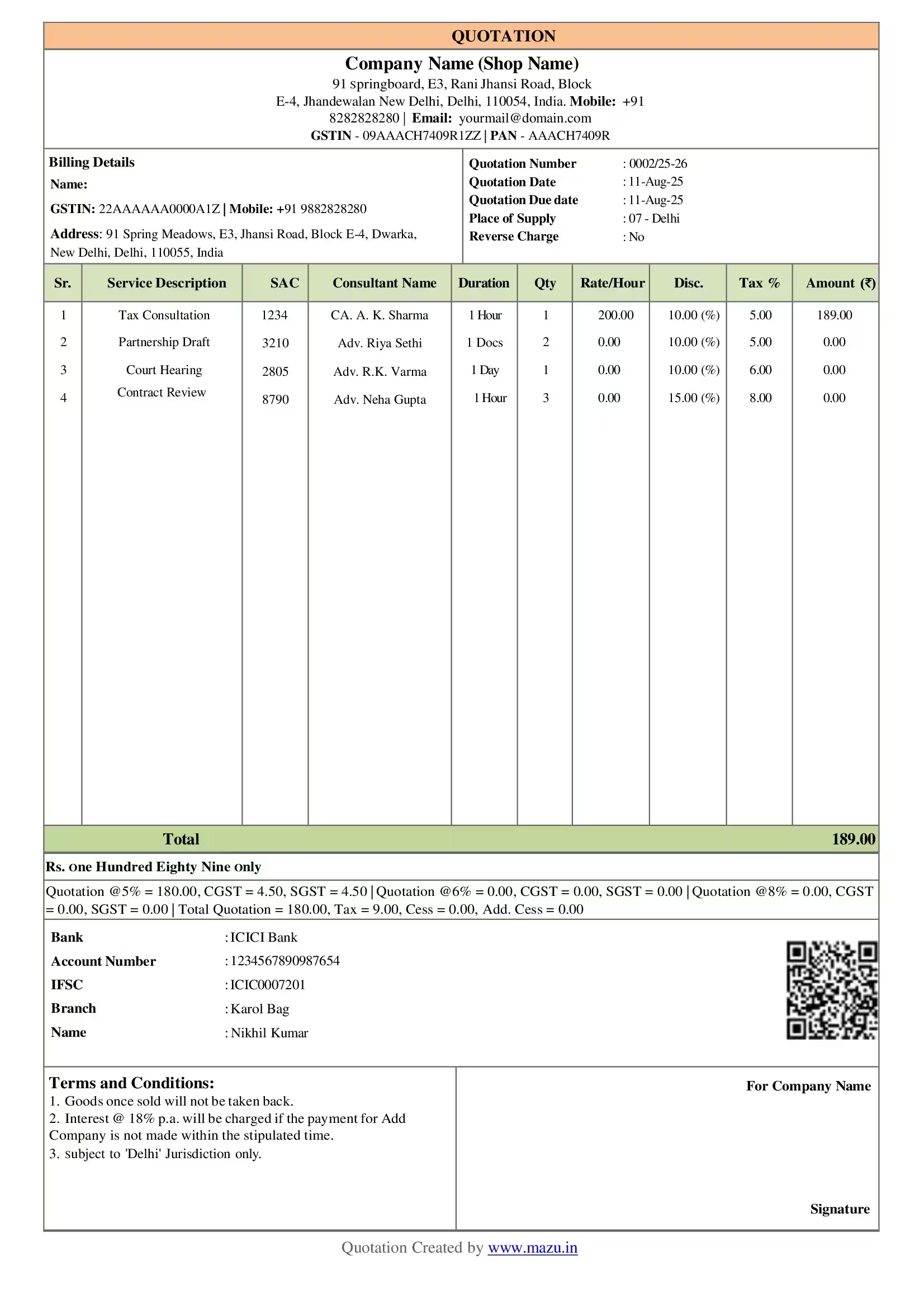

4. Sales Quotation Management

Easily create and manage legal fee quotations with custom fields and supporting attachments. Convert them to invoices in one click and track approval status effortlessly.

5. Effortless Payment Management

Keep track of all client payments in one place, whether by cheque, bank transfer, or UPI. Get real-time visibility on payment status to maintain a steady cash flow.

6. Create Invoices on the Go

With the mazu mobile app, legal professionals can generate invoices, quotations, or sales order anytime, from anywhere, perfect for court visits or client meetings.

discover

Some frequently asked questions

A legal invoice template is a pre-designed format used by lawyers and legal professionals to bill clients for services like consultations, casework, and retainers. With mazu, you can generate GST-compliant legal invoices quickly and professionally.

Freelance lawyers, legal firms, consultants, and advocates can use these templates to streamline billing and maintain proper records. mazu makes it easy to customize and share legal invoices with clients in just a few clicks.

To create an invoice using mazu, log in to your mazu account, select your business profile, and choose the invoice option. Then, add your legal service details, client name, billing method (hourly, fixed, etc.), and tax info.

A lawyer’s invoice should include the lawyer’s or law firm’s name, client details, description of legal services, hours worked or fixed charges, invoice date, invoice number, applicable taxes (like GST), total amount payable, payment terms, and due date.

Yes, you can download ready-to-use templates in Excel, Word, or PDF formats.

With mazu, you can fully customize legal bill templates, add your firm’s name, logo, color scheme, address, and terms.

Yes, mazu allows you to record all payment modes, including cash, bank transfer, or UPI. Just choose the correct payment method while marking the invoice as paid, and the system will keep your billing records accurate.

Yes. mazu lets you upload and place your law firm’s logo on every invoice..