Classification of the Fitness Industry under GST

Commercial Gyms

These include large gym chains and standalone fitness centres that cater to general fitness and health.

Specialized Fitness Studios

Focus on specific activities like yoga, pilates, Zumba, or CrossFit.

Personal Training Studios

Smaller setups offering one-on-one or small group training sessions.

Corporate Gyms

Operated within corporate offices for employees.

All these categories are subject to GST regulations, depending on the services offered and their turnover.

GST Rates for the Fitness Industry

- 18% GST: Applicable on services provided by commercial gyms and fitness centres.

- Exemptions: Yoga centres or fitness services offering purely health-related training might be exempt from GST if they fall under the category of "charitable activities."

What details do a gym owner need to create an invoice?

- GST-Compliant Invoices: Gym owners must issue GST-compliant invoices that include:

- Name and address of the gym/studio

- GSTIN (Goods and Services Tax Identification Number)

- Invoice number and date

- Description of services provided

- Value of service and applicable GST

- Total amount payable

- Invoice Frequency: Depending on the membership type (monthly, quarterly, or annual), ensure timely invoice issuance.

GST Registration for Gym Owners in India

Gym owners must register for GST if their annual turnover exceeds the threshold of ₹40 lakhs (or ₹10 lakhs in special category states). Registration is mandatory to:

- Legally collect GST from members

- Claim Input Tax Credit (ITC) on expenses like equipment purchases, maintenance, and rent

How to Stay GST Compliant as a Gym Owner

Accurate Bookkeeping

Maintain a detailed record of all transactions, memberships, and services provided.

Timely Filing of GST Returns

File monthly, quarterly, or annual GST returns based on your turnover and GST registration type.

Monitor Exemptions

Stay updated about GST exemptions and ensure your services qualify.

Leverage Technology

Use accounting software or tools to automate GST calculations, invoicing, and returns.

HSN/SAC Code for Fitness Businesses

| HSN/SAC Code | Code Type | Category | GST Rate |

|---|---|---|---|

| HSN | 9506 | Fitness Equipment | 18% |

| HSN | 2106 | Supplements | 18% |

| HSN | 6109 | Clothing (Sportswear) | 5% or 12% (based on price) |

| HSN | 6114 | Synthetic fiber-based sportswear | 18% |

| SAC | 999723 | Gym Memberships | 18% |

| SAC | 999293 | Personal Training | 18% |

| SAC | 999723 | Yoga Training | Exempt |

| SAC | 998319 | Online Fitness Classes | 18% |

| SAC | 999293 | Sports Coaching | 18% |

Note: This table includes common services and corresponding HSN and SAC codes with GST rates. The GST rate may vary based on specific products or updates in GST law.

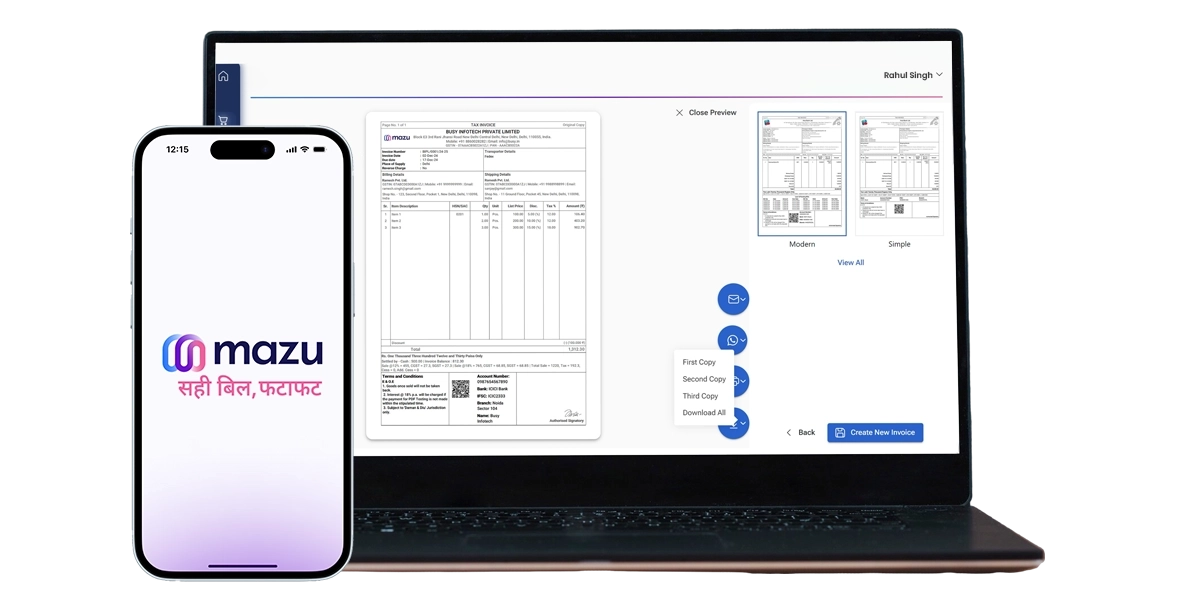

How mazu Can Streamline Invoicing for the Fitness Industry

Effortless Invoice Creation

- Instantly create invoices with pre-filled Party/Item details.

- Auto-fill GSTIN information to save time.

- Generate GST and non-GST invoices with just a few clicks.

Simplified Payment Management

- Accept payments via Cash, Bank, or UPI.

- Track payment statuses: Paid, Due, or Overdue.

- Offer dynamic QR codes for faster payment processing.

Elevate Brand Presence

- Customize invoices with headers, footers, colors, and fonts.

- Add your logo and signature for a professional touch.

- Include up to five optional fields to suit your business needs.

Flexible Billing Options

- Apply item-wise or bill-wise discounts.

- Choose tax-inclusive or tax-exclusive billing.

- Manage multiple GST rates seamlessly.

discover

Some frequently asked questions

mazu focuses on invoicing but can handle billing for memberships or sessions.

Yes, mazu generates dynamic QR codes for easy payments.

Yes, payment tracking ensures you stay updated on Paid, Due, or Overdue statuses.

Yes, you can add your logo, headers, and adjust font styles/colors.

Yes, you can bill items with various GST rates.

Yes, party-wise pricing lets you set customized rates for different members.

Yes, invoices can be shared directly via email or WhatsApp.

Yes, mazu’s mobile app ensures seamless access from anywhere.