Types of Garment Businesses Under GST

Garment businesses can be categorized on the basis of their operations:

Retailers

Sell garments directly to customers. Examples include local clothing shops and branded retail outlets.

Wholesalers

They supply garments in bulk to retailers or other businesses.

Manufacturers

Produce garments using raw materials like fabric, thread, and accessories.

Exporters

These businesses cater to international markets by exporting garments made in India.

E-commerce Sellers

Sell garments online through platforms like Amazon, Flipkart, or their websites.

GST Rates for the Garments Industry

GST rates for garments vary based on their sale value:

- 5% GST: It applies to garments or apparel costing up to ₹1,000 per piece.

- 12% GST: It applies to garments or apparel priced above ₹1,000 per piece.

Moreover, raw materials such as fabric, yarn, and accessories also have specific GST rates:

- Fabrics: 5%

- Yarn: 12%

- Accessories (e.g., buttons, zippers): 18%

Note: These GST rates can vary, so kindly check the official website before applying the GST rate to invoices.

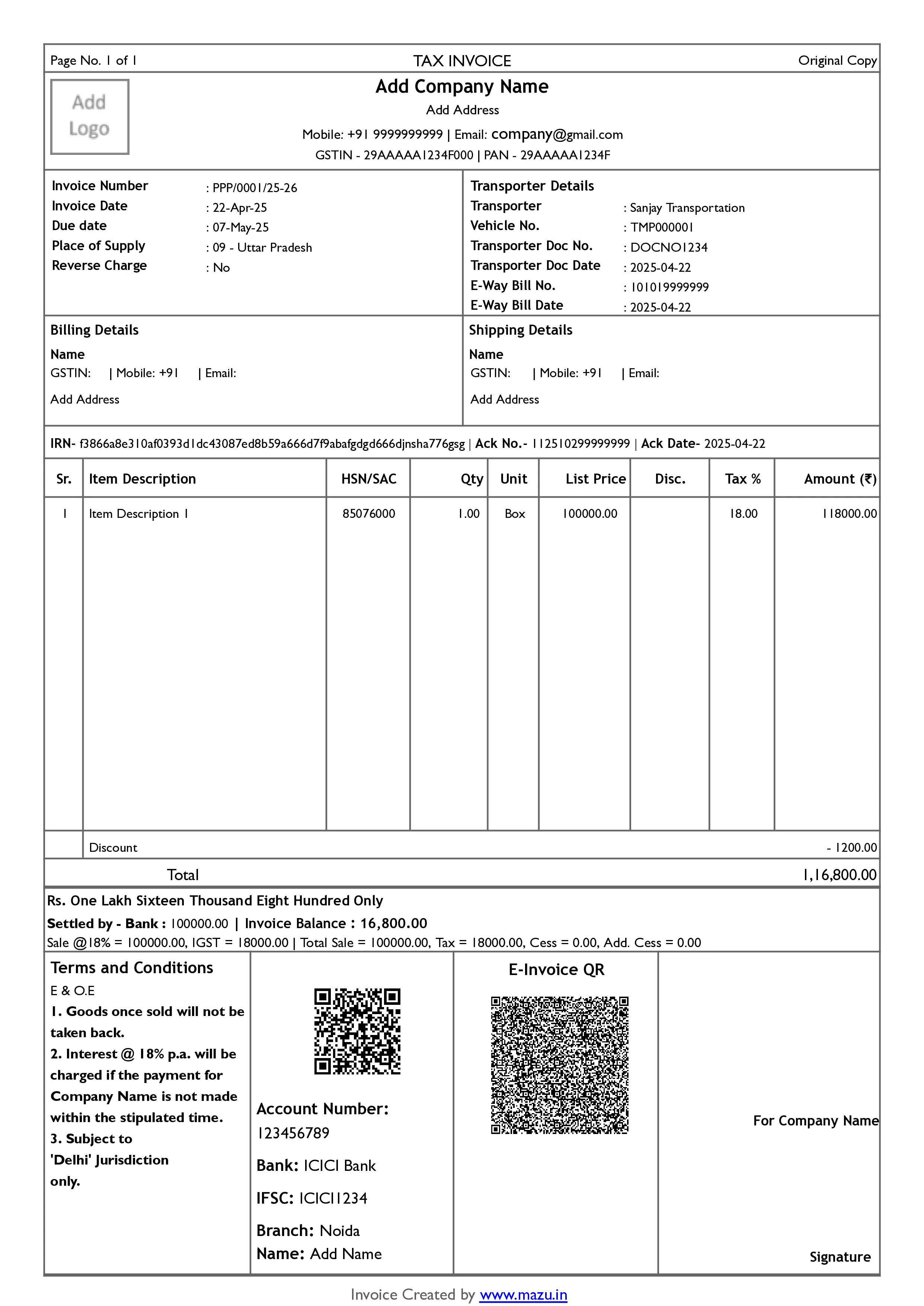

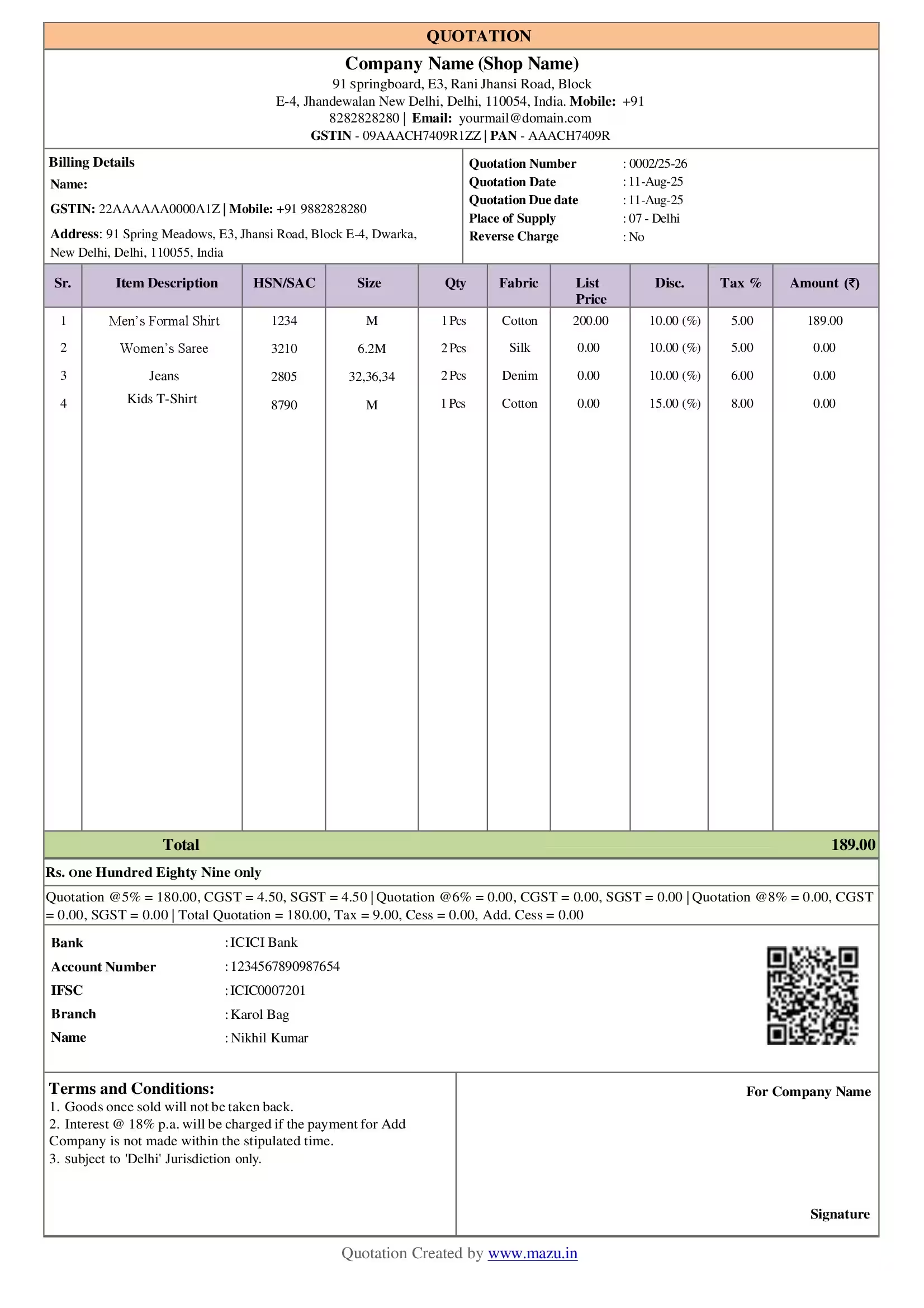

What details does a garment business owner need to create an invoice?

Creating professional invoices is essential for compliance. Here are a few requirements:

- Basic Information

- Name, address, and GSTIN of your business and buyer (if applicable).

- Invoice Details

- Invoice number and date.

- Description of the garments sold (e.g., type, quantity, size).

- HSN code for garments.

- Sale value and applicable GST rate.

- Total amount, including GST.

- E-Way Bill (if applicable)

- For transporting goods worth more than ₹50,000, an e-way bill must be generated.

GST Registration for Garment Businesses in India

If you own a garment business, you must register for GST under the following conditions:

- Turnover Threshold: Businesses with an annual turnover exceeding ₹40 lakhs (₹10 lakhs for special category states) must register for GST.

- E-Commerce Sellers: Mandatory GST registration, irrespective of turnover.

- Voluntary Registration: Small businesses with lower turnover can do voluntary registration to avail of input tax credit and expand market reach.

How to Stay GST Compliant as a Garment Business

Staying compliant with GST is crucial for smoothly running your business and avoiding legal complications. Here are a few tips to remember:

- Maintain Accurate Records: Maintain Accurate Records: Make sure you maintain detailed records of sales, purchases, and inventory. Thus, consider using accounting software to simplify bookkeeping.

- File Returns on Time: Regularly file GST returns (GSTR-1, GSTR-3B, etc.) to avoid penalties.

- Understand Reverse Charge Mechanism (RCM): If you purchase goods from unregistered suppliers, you may need to pay GST under RCM.

- Use Professional Tools: Leverage billing and invoicing solutions tailored for garment businesses to automate processes and reduce errors.

HSN Code For Garment Businesses in India

| Category | HSN Code | GST Rate |

|---|---|---|

| Woven Fabrics | 5208-5212 | 5% (if value ≤ ₹1000), 12% (if value > ₹1000) |

| Knitted or Crocheted Fabrics | 6001-6006 | 5% or 12% based on value |

| Apparel (Made of Cotton) | 6101-6204 | 5% (if value ≤ ₹1000), 12% (if value > ₹1000) |

| Apparel (Made of Other Materials) | 6105-6211 | 5% (if value ≤ ₹1000), 12% (if value > ₹1000) |

| Accessories (Belts, Gloves, etc.) | 6212-6217 | 5% or 12% based on value |

| Scarves, Shawls, and Other Items | 6214 | 5% or 12% based on value |

| Second-hand Clothing | 6309 | 5% |

Note: This table includes common services and corresponding HSN and SAC codes with GST rates. The GST rate may vary based on specific products or updates in GST law.

How mazu Can Streamline Invoicing for the Garment Industry?

Effortless Invoice Management

- Create GST and non-GST invoices with just a few clicks.

- Share invoices instantly via email or WhatsApp.

- Customize invoice templates for a personalized look.

Seamless Tax Compliance

- Automatic tax calculations for error-free billing.

- HSN-based tax rate suggestions for accuracy.

- GSTIN-based auto-fill for faster processing.

Flexible Payment Tracking

- Accept payments via multiple modes: UPI, bank, or cash.

- Track payment statuses (Paid, Due, Overdue) at a glance.

- Generate party-wise settlements for easy reconciliation.

Personalized Business Branding

- Add your logo, signature, and custom fields to invoices.

- Customize header/footer, font style, and colors to match your brand.

- Offer duplicate/triplicate invoice copies for added flexibility.

discover

Some frequently asked questions

Yes, mazu supports quick invoice creation for any collection or sale.

Yes, you can add item-wise or bill-wise discounts for bulk orders.

Yes, mazu supports payments via Bank, Cash, and UPI.

You can add your logo, signature, and change fonts and colors for branding.

Yes, it calculates taxes based on HSN codes and applies them to invoices.

Yes, mazu enables managing multiple business profiles from a single account.

Yes, mazu’s mobile app makes creating and sharing invoices easy.

Yes, mazu allows the creation of duplicate or triplicate copies as needed.