Who Are Freelancers?

Freelancers are individuals who provide specialized services to businesses or individuals. They work on a project or contract basis rather than being full-time employees.

Some examples of freelancers are:

Writers

Content creators, copywriters, or technical writers.

Designers

Graphic, web, or UI/UX designers.

Developers

Website, app, or software developers.

Marketers

SEO experts, social media managers, or digital managers.

Consultants

Finance, HR, or business strategy advisors.

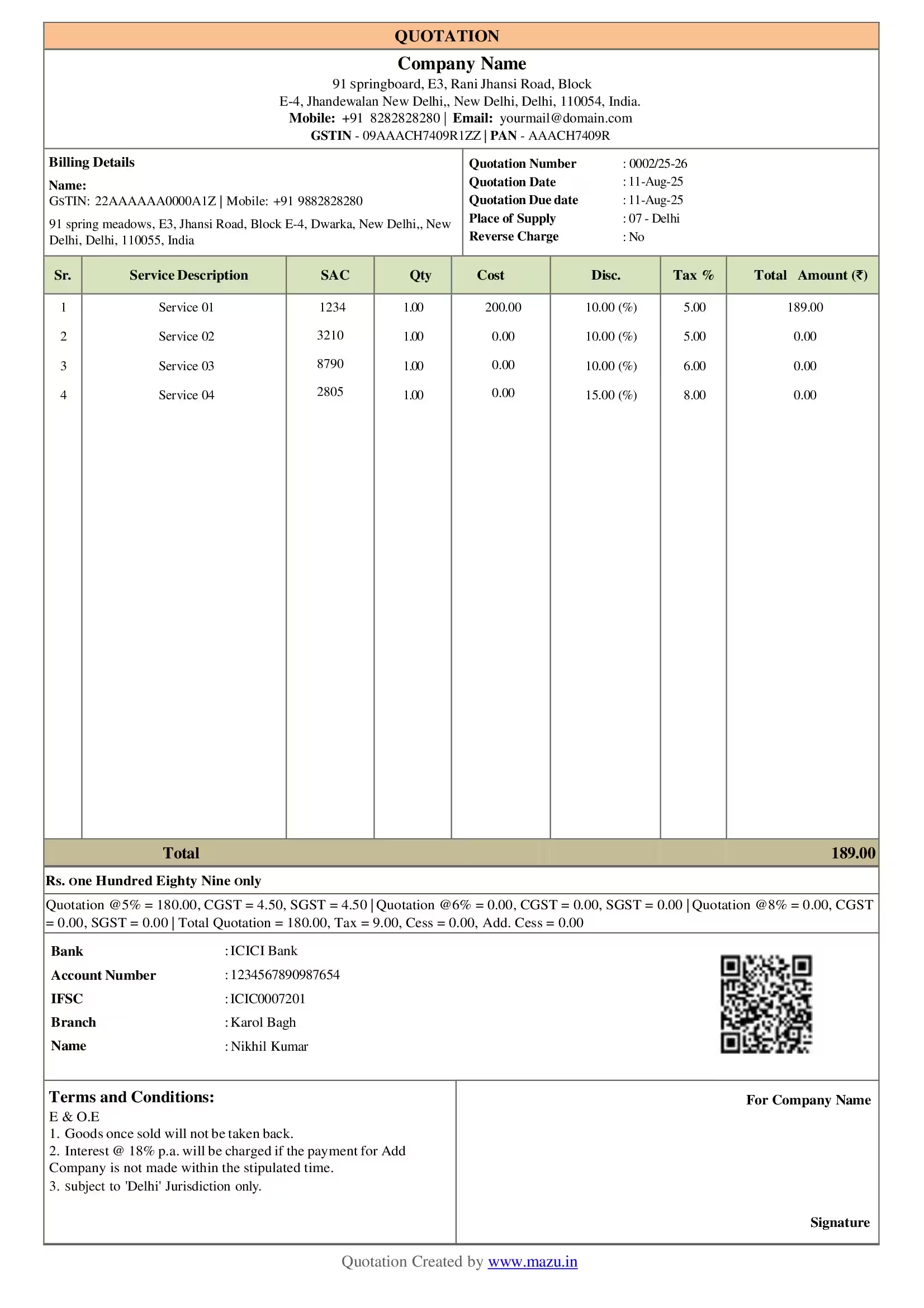

What types of invoices does a freelancer need to generate?

Freelancers can use different types of invoice formats:

Standard invoice

The most common type of invoice, used to request payment at the end of a project

Pro-forma invoice

This is also known as a prepayment invoice; this is an estimate or quotation for work that hasn't been completed yet

Timesheet invoice

This is used when invoicing for hours worked rather than products or projects

Past due invoice

This is used to remind a client who is late in paying and to add late fees to the total due

Recurring invoice

These invoices are sent regularly, such as monthly or quarterly, to reflect an ongoing agreement for work

Interim invoice

It is used ongoing projects to represent partial billings issued periodically until project completion

Final invoice

This invoice is used to mark the end of a project or service and to detail the total amount owed

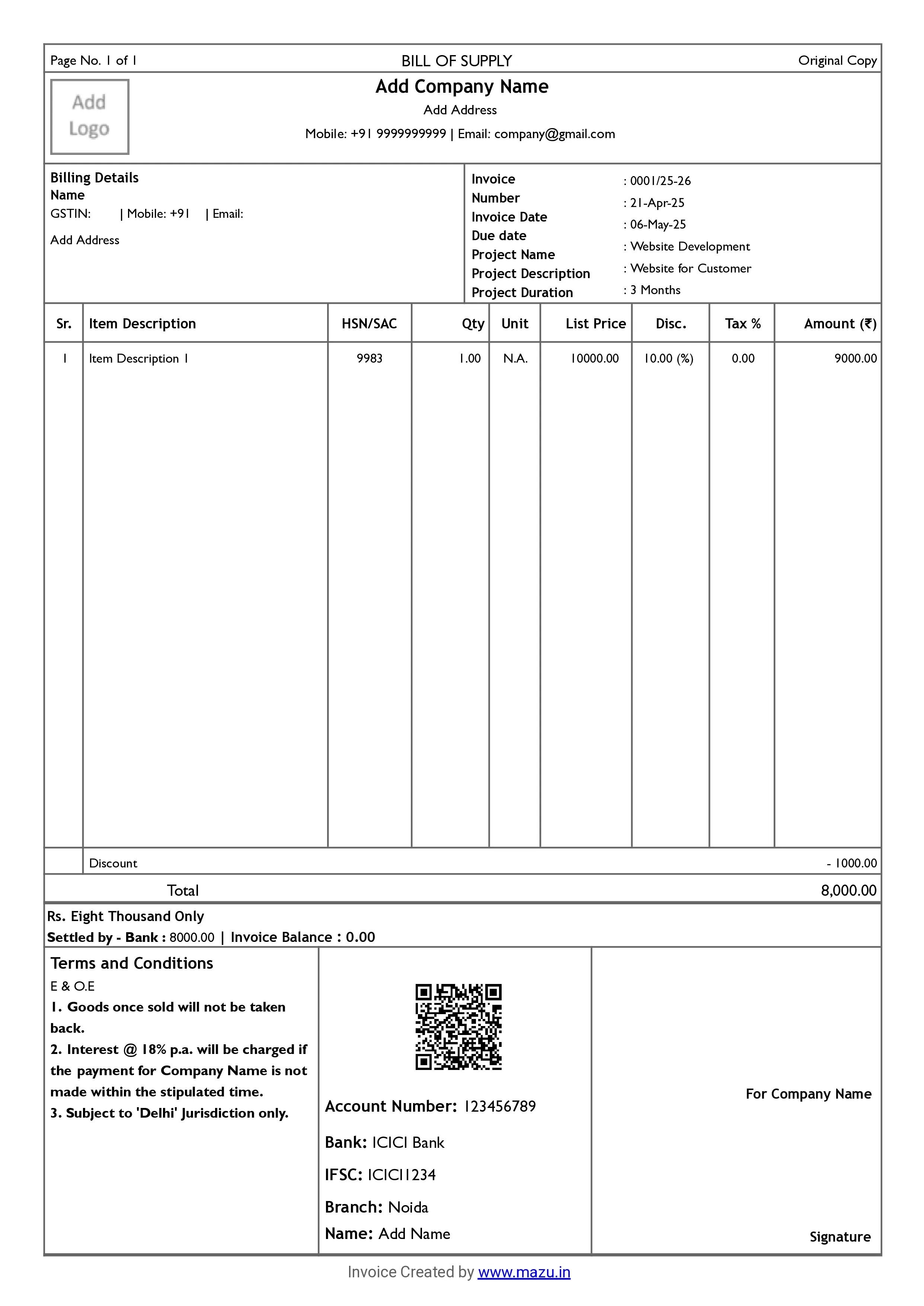

What details does a freelancer need to create an invoice?

When creating an invoice, freelancers should include the following details:

- An appropriate title, such as "Invoice" or "Tax Invoice"

- The freelancer's and their company's name and logo

- The freelancer's contact details

- The client's name and information, such as their address, contact number, email, and GSTIN

- The invoice date

- An invoice number

- A description of the services provided to the client and their charges

- Tax rates, if applicable

- The total amount due

- Payment details and terms

Applicability to Freelancers

GST applies to freelancers if their annual turnover exceeds Rs.20 lakhs (Rs.10 lakhs for North-Eastern states).

How to Stay Compliant with GST regulations as a freelancer?

Issue GST Invoices

Use GST-compliant invoices, including your GSTIN, client's details, and applicable GST rates.

Use Billing Software

Consider using GST-compliant billing software to streamline invoicing, tax calculations, and filing returns.

Use SAC Code

Use the correct SAC to classify your services and apply the right GST rate.

File GST Returns on Time

File your returns regularly (monthly or quarterly) to avoid penalties and stay compliant.

Maintain Accurate Records

Keep detailed records of all transactions, including services and tax payments.

SAC Codes For Freelancers

| Services | SAC Codes | GST Rate |

|---|---|---|

| Writers | 998911 | 18% |

| Designers | 998314 | 18% |

| Developers | 998314 | 18% |

| Marketers | 998311 | 18% |

| Other IT Services | 998319 | 12%, 5%, 18% |

Note: This table includes common services and corresponding SAC codes with GST rates. The GST rate may vary based on specific products or updates in GST law.

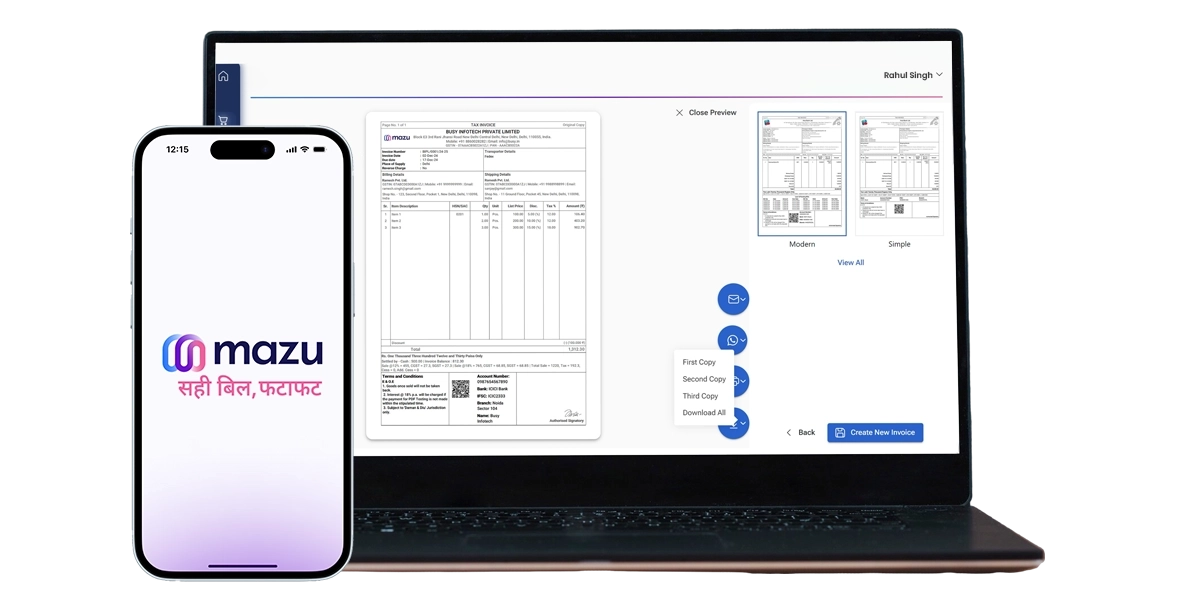

How mazu Can Streamline Invoicing For Freelancers?

Effortless Billing

- Quickly create non-GST and GST invoices free with minimal fields.

- Instantly auto-fill GSTIN details to populate party information.

- Easily share invoices via email or WhatsApp.

Tax Compliance Made Easy

- Automatic tax calculations ensure accurate invoicing.

- Get GST rate suggestions based on HSN codes.

- Support for multi-GST rate billing and tax-inclusive/exclusive options.

Flexible Payment Management

- Accept payments via Bank, Cash, and UPI.

- Track payment statuses: Paid, Due, or Overdue.

- Manage party-wise settlements for easy payment tracking.

Elevate Brand Experience

- Personalize invoices with custom headers, footers, fonts, and colors.

- Include up to 5 optional custom fields.

- Add your logo and signature for a professional touch.

discover

Some frequently asked questions

Yes, you can edit your invoice in mazu and add fields as your requirements.

You can add upto 5 optional fields.

mazu is a free billing Software. You can generate unlimited invoices for free.

Yes, you can share invoices with your clients via WhatsApp or email and create multiple copies.

To check the payment status in mazu, follow these steps:

- Log in to your mazu account.

- Select the desired business account.

- Navigate to the mazu dashboard.

Here, you can view a detailed summary of payments, including amounts received, outstanding dues, and partially paid transactions from both vendors and customers.

Yes, freelancers need to pay GST.

Yes, you can download duplicates/triplicates of your invoice.

To check all invoices in mazu, follow these steps:

- Log in to your mazu account.

- Select the desired business account.

- Navigate to the mazu dashboard

Here, you can view a detailed summary of all the invoices you have created, including amounts received, outstanding dues, and partially paid transactions from vendors and customers.