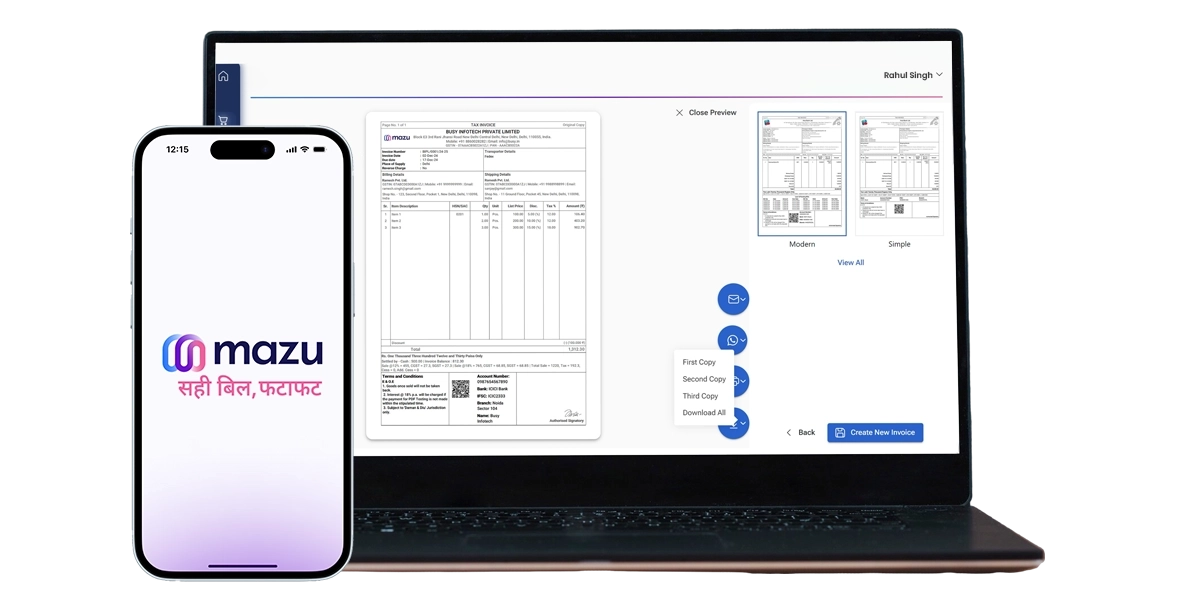

One-Stop Billing Solution for Electrical Store

Create GST-compliant invoices with product specifications, warranty, and brand details, send quotations, and view detailed reports from one platform. Generate e-invoices and e-way bills instantly, and share bills via WhatsApp or email. Access it all anytime with the mobile app.

What are the Types of Electricals under GST?

Here are some common types of electrical items and their classifications under GST:

Electrical Appliances

Fans, air conditioners, heaters, and refrigerators.

Lighting Solutions

LED lights, bulbs, and tube lights.

Wiring and Cables

Electrical wires, cables, and conduits.

Switchgear

Switches, sockets, circuit breakers, and distribution boards.

Other Components

Motors, inverters, and transformers.

GST Rates for the Electrical Industry

GST rates for electrical products typically range from 5% to 28%. Here are some common rates:

5% GST

Certain renewable energy devices and components.

12% GST

LED lights, bulbs, and electrical transformers.

18% GST

Fans, wiring cables, and most household electrical appliances.

28% GST

Luxury electrical items such as air conditioners and refrigerators.

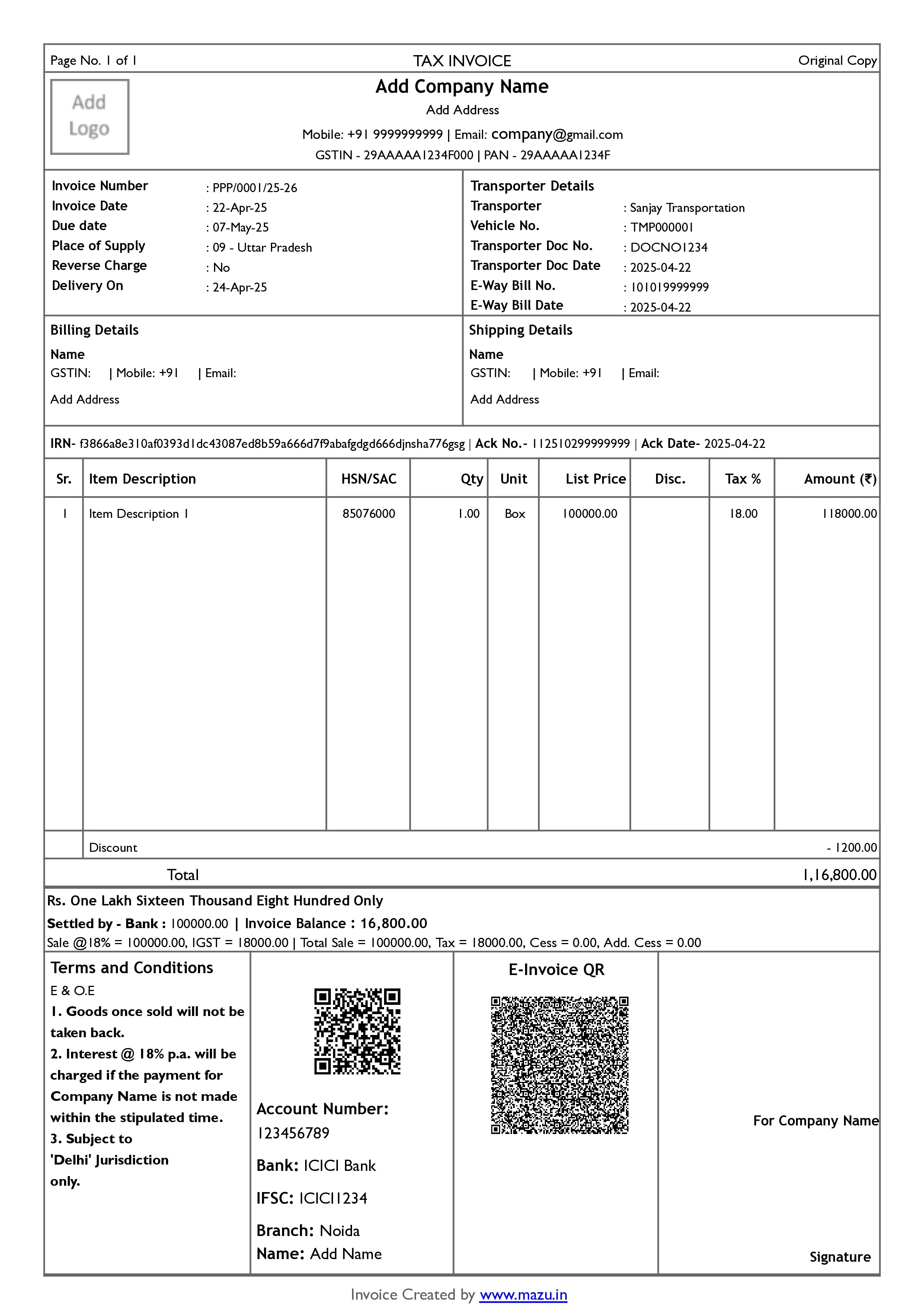

What details does an electrical store need to create an invoice?

Here are the key requirements for electrical stores to create a compliant invoice:

- GSTIN Display: Your store’s GST Identification Number (GSTIN) must be clearly displayed on all invoices.

- Invoice Details: Include the buyer’s GSTIN (if registered), product description, HSN code, quantity, rate, and total amount.

- Tax Breakdown: Clearly segregate CGST, SGST, or IGST on the invoice.

- E-Invoicing (If Applicable): Businesses with an annual turnover above the prescribed limit must comply with e-invoicing regulations.

GST Registration for Electrical Store Owners in India

GST registration is mandatory if your store’s turnover exceeds the threshold limit of Rs.20 lakh (Rs.10 lakh for special category states). Here’s how to register:

- Gather Documents: PAN card, Aadhaar card, proof of business address, bank details, and digital signature.

- Apply Online: Visit the GST portal (www.gst.gov.in) and complete the registration process.

- Verify Details: Ensure all information is accurate to avoid delays.

- Receive GSTIN: Once approved, you’ll receive a unique GSTIN for all transactions.

How to Stay GST Compliant as an Electrical Business

Compliance with GST regulations is essential to avoid penalties and maintain smooth operations. Follow these tips to stay compliant:

- Timely Filing of Returns: Make sure you file GST returns (GSTR-1, GSTR-3B, etc.) on time to avoid late fees and interest.

- Maintain Accurate Records: Keep a record of all sales, purchases, and tax payments for audit purposes.

- Understand Input Tax Credit (ITC): Claim ITC on eligible purchases to reduce your GST liability.

- Monitor HSN Codes: Use the correct Harmonized System of Nomenclature (HSN) codes for products.

- Stay Updated: Regularly check GST notifications and updates to stay informed about any changes.

HSN/SAC Code For Electrical Products & Services

| Code Type | HSN/SAC Code | Description | GST Rate |

|---|---|---|---|

| HSN | 8536 | Electrical apparatus for switching or protecting circuits (e.g., switches, relays, fuses) | 18% |

| HSN | 8535 | Electrical apparatus for voltage exceeding 1,000 volts | 18% |

| HSN | 8544 | Insulated wires, cables, and other electric conductors | 18% |

| HSN | 8504 | Transformers, static converters (e.g., rectifiers) | 18% |

| HSN | 8501 | Electric motors and generators (excluding generating sets) | 18% |

| HSN | 8502 | Electric generating sets and rotary converters | 18% |

| HSN | 8507 | Electric accumulators, including lead-acid batteries | 18% |

| HSN | 8539 | Electric filament or discharge lamps, LED lamps | 12% |

| HSN | 8541 | Semiconductor devices (e.g., diodes, transistors, solar cells) | 18% |

| HSN | 9405 | Luminaires and lighting fittings, including LED lights | 12% |

| SAC | 998714 | Maintenance and repair services of electrical equipment | 18% |

| SAC | 998712 | Installation services of electrical equipment | 18% |

| SAC | 998319 | Electrical engineering services | 18% |

Note: This table includes common services and corresponding HSN and SAC codes with GST rates. The GST rate may vary based on specific products or updates in GST law.

How mazu Can Streamline Invoicing for the Electrical Industry?

Simplified Invoice Creation

- Instantly create GST and non-GST invoices with menial input.

- Auto-fill Party/Item details and GSTIN information to save time.

- Share invoices directly via email or WhatsApp for seamless communication.

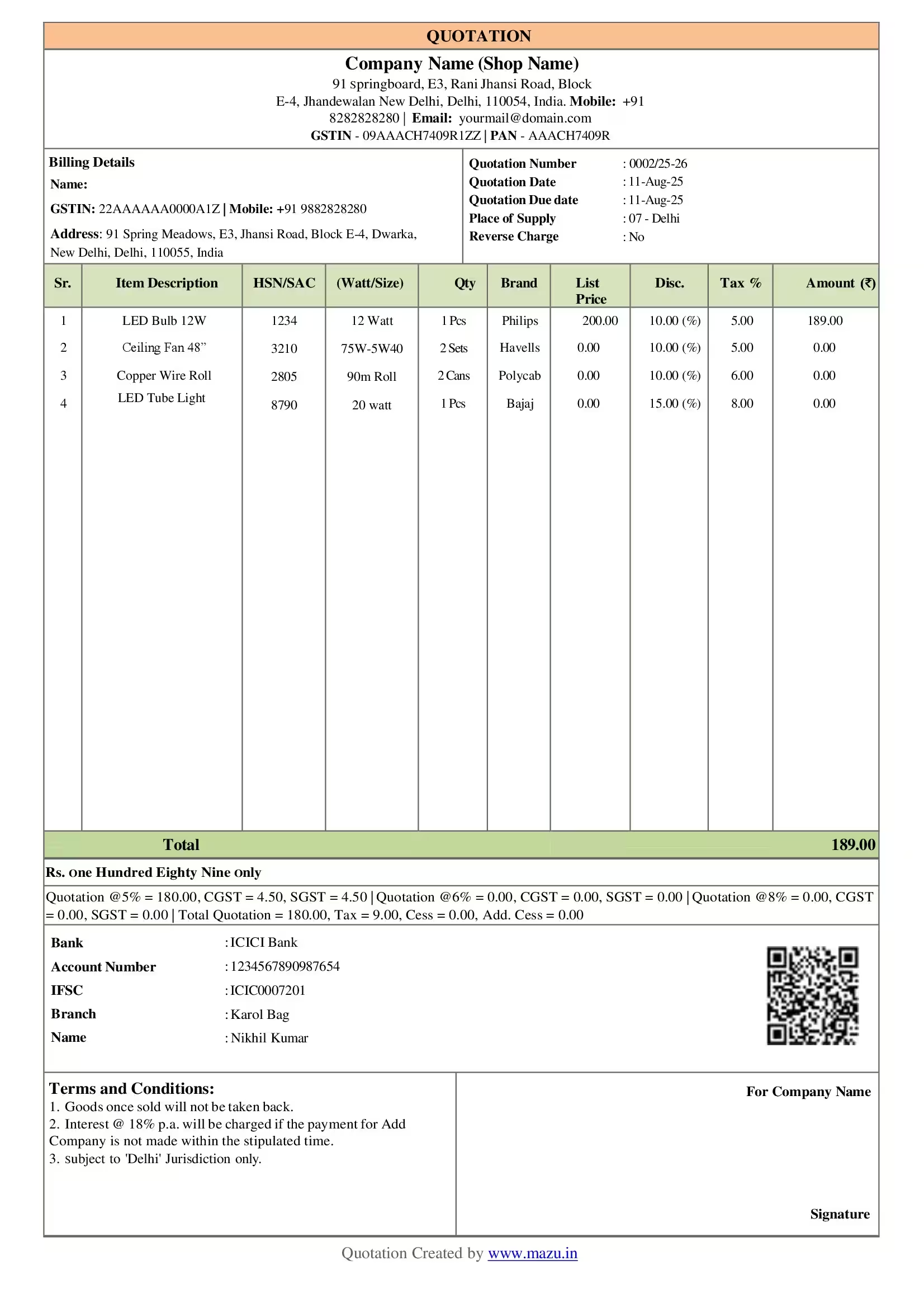

Flexible Billing Options

- Handle multi-GST rate billing and add item-wise or bill-wise discounts.

- Choose between tax-inclusive or tax-exclusive billing.

- Generate invoices with a dynamic QR code for instant payments.

Streamlined Tax Compliance

- Automatically calculate taxes and get tax rate suggestions based on HSN codes.

- Ensure accurate tax compliance with real-time calculations.

- Easily track payment statuses to stay updated on dues or overdue.

Personalized Branding

- Customize invoice templates with your logo, signature, and colours.

- Adjust fonts, headers, and footers to match your brand identity.

- Add up to 5 optional fields for more personalized invoices.

discover

Some frequently asked questions

Yes, mazu supports multi-GST rate billing for various electrical items.

mazu offers payment tracking to mark invoices as Paid, Due, or Overdue.

Yes, you can apply both item-wise and bill-wise discounts as needed.

Absolutely, mazu allows adding logos, headers, and footers for branding.

Yes, invoices can be shared instantly via email or WhatsApp.

Yes, mazu automatically calculates tax and suggests rates based on HSN codes.

Yes, mazu lets you manage multiple business profiles with a single account.