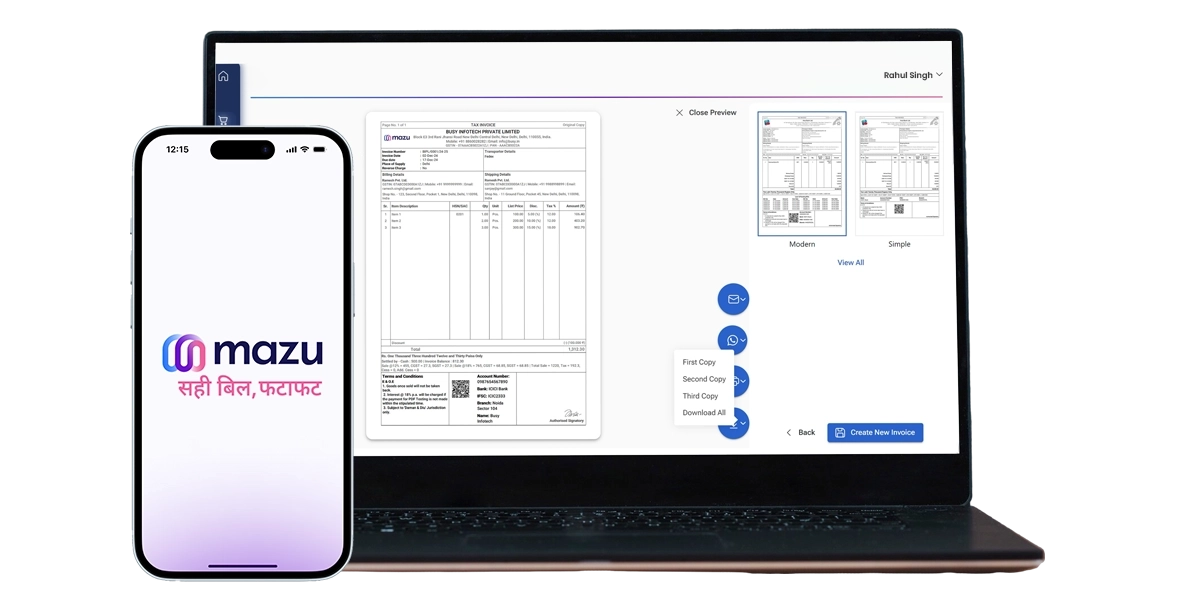

One-Stop Billing Solution for Content Writing Services

Create professional invoices with project names, word counts, and rates, manage client quotations, and track payments in a single dashboard. Share instantly via WhatsApp or email, and track business performance with advanced reports from our mobile app.

Understanding Content Writing Services under GST

Content writing services are considered taxable under GST. If you create articles, blogs, website copy, ad copies, or social media content for clients, your services fall under GST if you meet the eligibility criteria.

For clients within India, you must charge GST on your invoices based on location. If you're providing services to international clients and receive payments in foreign currency, your work may be classified as export and can qualify as zero-rated.

Types of Content Writing Services Covered Under GST

Common services subject to GST include:

- Blog and article writing

- Website content creation

- SEO content and product descriptions

- Copywriting for ads, landing pages, or emails

- Social media captions and post content

- Editing and proofreading

Whether you work on per-project billing or long-term retainers, GST must be applied correctly. Having a proper content writing invoice template helps maintain compliance with minimal effort.

GST Rates for Content Writing Services in India

Content writing services fall under SAC Code 998397 and are taxed at a standard rate of 18% (9% CGST + 9% SGST or 18% IGST, depending on the nature of supply).

If your service includes bundled offerings (like writing + publishing or design + content), make sure you itemize or clearly define the combined service in your invoice.

Invoicing Requirements for Content Writers

A GST-compliant freelance writing invoice template should include:

- Your name or business name and GSTIN

- Client’s name and address

- Invoice number and date

- Description of the content writing service provided

- SAC Code (998397)

- GST breakup (CGST/SGST or IGST)

- Total amount payable

- Signature (optional but preferred)

GST Registration for Freelance Writers

You must register under GST if:

- Your annual income from writing services exceeds ₹20 lakhs (₹10 lakhs in special category states)

- You provide services across states

- You want to claim input tax credit

- You work with overseas clients and want to issue zero-rated export invoices

How to Stay GST Compliant as a Freelance Content Writer

Follow these best practices to ensure smooth GST operations:

- File monthly or quarterly GST returns

- Use GST-compliant invoice templates with SAC codes

- Keep records of all client payments and invoices

- Reconcile input credits for software tools like grammar checkers or keyword planners

- Use software to generate reports and avoid manual errors

How mazu Can Streamline Invoicing for Content Writing Services?

1. Fully Customisable Invoices

Create clean, professional invoices that match your writing brand or freelance profile. Add your logo, adjust layouts, and include details like word count, content type, and delivery deadlines.

2. Quick Invoice Sharing

Easily send invoices to clients via WhatsApp or email in just a click. Speed up payment cycles and reduce follow-ups with instant delivery.

3. Advanced Reporting

Track your income by article, project, or client. Monitor pending payments and analyze your monthly earnings through simple, easy-to-understand reports.

4. Sales Quotation Management

Send quotes for writing assignments with transparent pricing and scope. Attach writing samples or briefs, and instantly convert approved quotations into invoices.

5. Effortless Payment Management

Stay on top of all incoming payments in one place. Check what’s paid or pending, and keep your cash flow steady with real-time updates.

6. Create Invoices On the Go

Generate e-invoices and quotations directly from your phone with the mazu mobile app, anytime, anywhere.

discover

Some frequently asked questions

Yes, content writing invoices often include deliverables like blogs, articles, or web content charged by word count or project, while copywriting invoices may cover ad copies, taglines, or sales content, usually billed at a premium or hourly rate. The format may vary slightly based on service type and pricing model.

Yes, freelancers can use mazu to create and download professional content writing invoices for free. It’s simple, GST-compliant, and doesn’t require any advanced setup.

Absolutely. Once your invoice is ready, you can share it with your clients instantly via WhatsApp, email, or download it as a PDF for direct sharing—all from within mazu.

Content writing services are subject to an 18% GST under the SAC Code 998397.

You can use a content writing invoice format or pre-designed sample invoices for freelance writing that include all necessary GST details.

Yes. mazu provides freelance writing invoice templates in Word, PDF, and Excel formats, suitable for all types of projects.

Your invoice for freelance work should include your details, the client's details, a service description, the GST rate, the SAC code, and the total amount. Use a structured invoice format for freelancers to maintain clarity and compliance.

Yes, you can save and reuse templates in mazu for ongoing clients. This is ideal if you’re billing for regular content uploads, blogs, or social media copywriting.

mazu lets you generate invoices from your phone or desktop, track payments, and even create content writing bill templates with custom branding.