One-Stop Billing Solution for Automobile

Create professional, GST-compliant invoices with VIN, part numbers, and warranty details, send quotations for spares or accessories, and view business reports such as sales receivables and ledgers. Generate e-invoices and e-way bills instantly, and share via WhatsApp or email. Access it all anytime with the mobile app.

Types of Automobiles under GST

The GST system classifies automobiles into different categories:

Passenger Vehicles

These include cars, SUVs, and other vehicles designed for personal transport.

Commercial Vehicles

These include trucks, buses, and any other vehicle used for transporting goods or people commercially.

Two-wheelers and Three-wheelers

This category includes motorcycles, scooters, and auto-rickshaws.

Electric Vehicles

These are vehicles powered by electricity instead of fuel, such as electric cars and bikes.

Parts and Accessories

This includes spare parts, tyres, and other vehicle components.

GST Rates for the Automobile Industry

GST rates vary depending on the type of Automobiles. Here's a breakdown:

Passenger Vehicles

GST for passenger vehicles typically ranges from 18% to 28%, depending on the vehicle's price and specifications.

Commercial Vehicles

These vehicles usually attract 28% GST.

Two-wheelers

GST on two-wheelers is generally 28%, but electric two-wheelers enjoy a much lower rate of 5%.

Electric Vehicles (EVs)

Electric vehicles are taxed at a lower rate of 5%, making them a more affordable option for manufacturers and customers.

Parts and Accessories

Spare parts and accessories generally attract 28% GST, with some items eligible for lower rates.

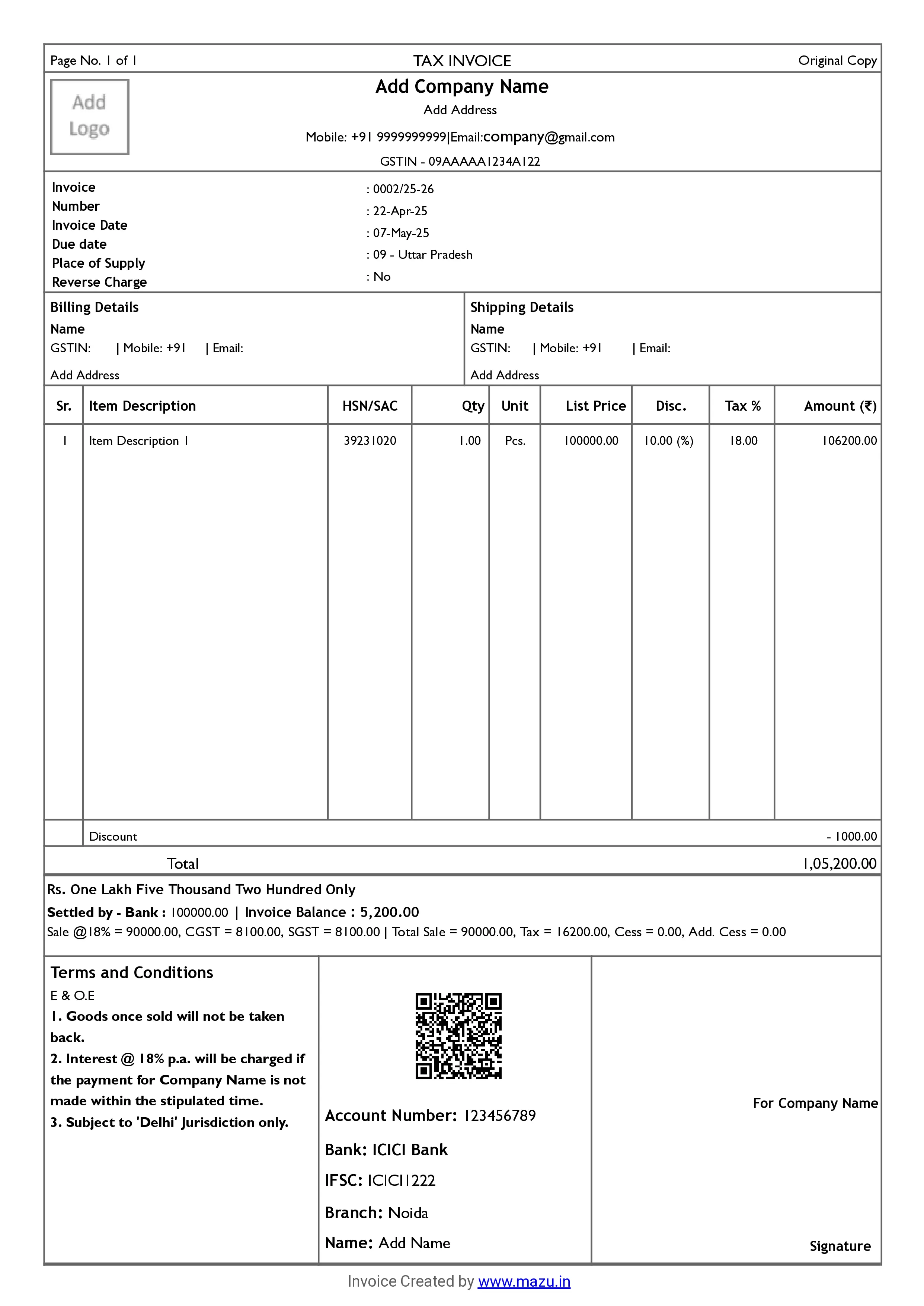

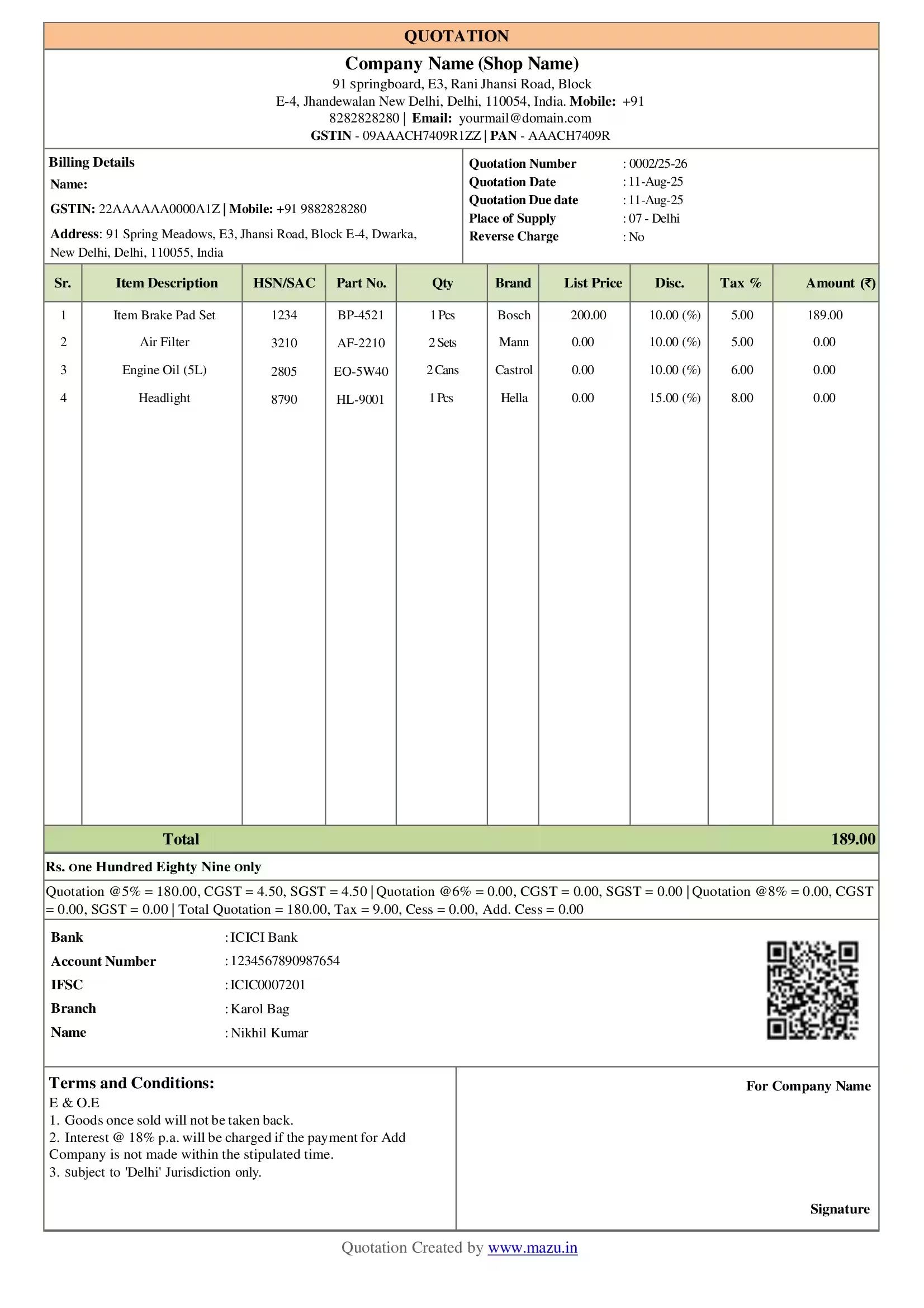

Invoicing Requirements for Automobile Companies under GST

Here are the key requirements for automobile businesses:

- GST-Invoice Format: The invoice must include specific details like the seller's GSTIN, buyer's GSTIN, description of goods, value, and the applicable GST rate. It should also include whether the sale is interstate or intrastate.

- HSN/SAC Code: Codes must be included in invoices for different automobile products, helping classify goods for GST purposes.

- GST Number on Invoice: Your GST number must be printed on all invoices.

- Invoice for Sale of Vehicles: When selling vehicles, you must issue a tax invoice including the vehicle's registration number, engine/chassis number, and model year. For goods sold, a delivery challan may be required.

- Invoice for Spare Parts: When selling spare parts or accessories, ensure each part is invoiced separately with its description and applicable GST rate.

GST Registration for Automobile Business Owners

Here's what you need to know:

- Threshold Limit: Businesses with a turnover of over ₹40 lakhs (₹20 lakhs for some special category states) must register for GST.

- GSTIN Application: To register, you must apply for a GST Identification Number through the official GST portal. This process includes submitting documents like your business PAN, proof of business address, and bank account details.

- Need for Registration Once registered, you must file periodic GST returns, collect GST on your sales, and be eligible to claim input tax credit for GST paid on business purchases.

How to stay GST Compliant as an Automobile Business

To stay compliant with GST, here are a few things you must follow:

- Timely Filing of Returns: Ensure you file your GST returns (GSTR-1, GSTR-3B, etc.) on time, as returns summarise your sales, purchases, and GST liabilities.

- Maintain Accurate Records: Record all invoices, payments, and receipts to accurately file returns and claim input tax credits.

- Regularly Review GST Rates: GST rates can change, so it's important to stay updated on any changes affecting your business, especially if you deal with different types of automobiles or accessories.

- Claim Input Tax Credit: You can reduce your GST liability by claiming input tax credit for tax paid on business-related purchases.

HSN/SAC Codes For Automobile Businesses

HSN Codes for Automobiles and Related Goods

| HSN Code | Description | GST Rate |

|---|---|---|

| 8701 | Tractors (other than road tractors) | 12% |

| 8702 | Motor vehicles for transporting ten or more persons | 28% |

| 8703 | Passenger cars, including racing cars | 28% |

| 8704 | Motor vehicles for goods transport | 28% |

| 8705 | Special-purpose vehicles (e.g., crane lorries, fire-fighting vehicles) | 28% |

| 8706 | Chassis fitted with engines for motor vehicles | 28% |

| 8711 | Motorcycles (including mopeds) | 28% |

| 4011 | New pneumatic tires for motor vehicles | 28% |

| 8407/8408 | Engines for motor vehicles | 18%-28% |

HSN Codes for Automobile Spare Parts

| HSN Code | Description | GST Rate |

|---|---|---|

| 8708 | Parts and accessories of motor vehicles | 28% |

| 8714 | Parts and accessories for motorcycles | 28% |

| 4012 | Retreaded or used pneumatic tires | 18% |

| 7009 | Glass for motor vehicles | 28% |

| 8483 | Transmission shafts and cranks | 18% |

| 8511 | Electrical ignition/starting equipment | 28% |

SAC Codes for Automobile Services

| SAC Code | Description | GST Rate |

|---|---|---|

| 998821 | Maintenance and repair services of motor vehicles | 18% |

| 998822 | Maintenance and repair services of motorcycles | 18% |

| 996601 | Renting of motor vehicles with an operator | 18% |

| 996602 | Renting of motor vehicles without an operator | 18% |

| 998873 | Sale of motor vehicle parts and accessories | 18%-28% |

How mazu Can Streamline Invoicing for the Automobile Industry?

Quick and Easy Invoicing

- Auto-fill GSTIN details for fast invoicing.

- Add logos, signatures, and additional fields.

- Share via email or WhatsApp with one click.

Tax Compliance Made Simple

- Automatic tax calculation for accuracy.

- Get the right tax rates based on HSN codes.

- Easily create GST & Non-GST invoices.

Flexible Payment Management

- Accept payments via cash, bank, or UPI.

- Monitor paid, due, or overdue payments.

- Manage party-wise settlements.

Convenient and Customizable

- Manage your business on the go with the app.

- Handle multiple business profiles under one account.

- Customize invoice templates with logos and design preferences.

discover

Some frequently asked questions

Yes, mazu allows you to generate duplicate or triplicate copies of invoices, which helps maintain records.

Yes, mazu lets you set alerts to ensure no item is sold below a specified minimum price.

An automobile invoice generator allows businesses to create detailed customer invoices. The invoice includes information about the products, such as the purchased items, their prices, and taxes.

With mazu, you can effortlessly create an automobile invoice by entering the customer's details, adding items, applying taxes (if needed), and generating the invoice with just a few clicks.

Yes, mazu offers role-based access to control what employees can do within the system.

Yes, mazu allows you to add up to five optional fields to include additional information on your invoices.

Yes, mazu’s quick invoice creation feature helps you generate bills within seconds, fastening the entire billing process.

To check all invoices in mazu, follow the below steps:

- Log in to your mazu account.

- Select the desired business account.

- Navigate to the mazu dashboard.

mazu's simple and user-friendly interface helps you generate invoices in less than 10 seconds.

Yes, mazu is perfect for small retail businesses, providing an easy-to-use solution for invoicing, GST compliance, and customer management.