Classification of Textile Businesses Under GST

Textile businesses fall into different categories under GST depending on their operations:

Manufacturers

Businesses involved in creating yarns, fabrics, or garments from raw materials.

Traders

Dealers who purchase textiles in bulk and sell them wholesale or retail.

Exporters

Companies focused on exporting textiles to international markets, often benefiting from specific GST provisions like zero-rated supplies.

Job Workers

Businesses offering services like embroidery, dyeing, and printing for textile manufacturers.

GST Rates for the Textile Industry

The GST rates for textiles depend on the type of product:

- Raw Cotton: Exempt from GST.

- Yarns: Subject to 5% GST.

- Fabrics: Generally taxed at 5%.

- Apparel: Apparel priced up to ₹1,000 is taxed at 5%; above ₹1,000, the rate increases to 12%.

- Man-Made Fibers: These attract an 18% GST rate.

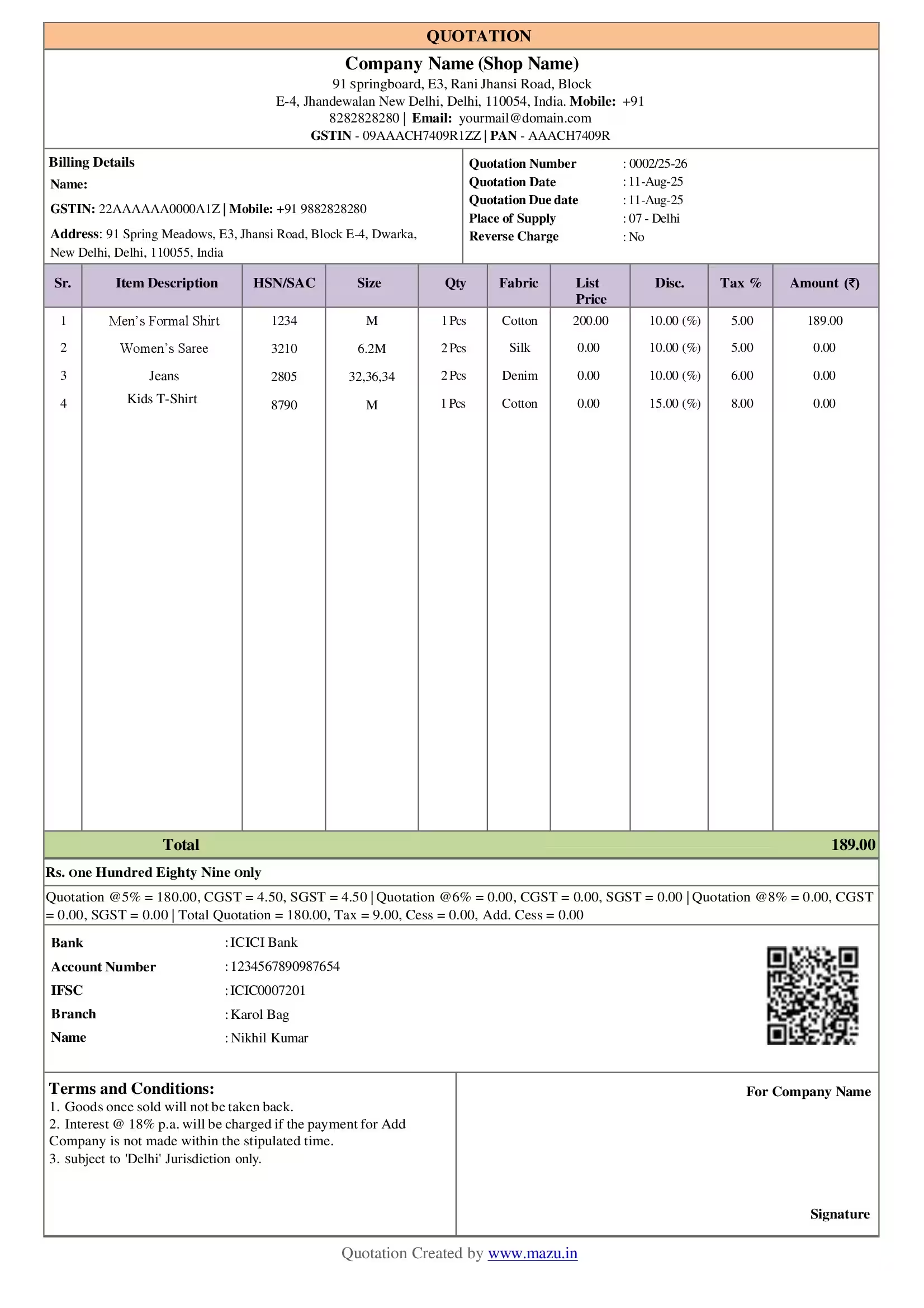

What details does a textile business need to create an invoice?

Invoicing is a critical aspect of GST compliance. Textile businesses must ensure their invoices include the following:

- GSTIN (Goods and Services Tax Identification Number)

- Details of the buyer and seller

- Item description, quantity, and price

- Applicable GST rates and amounts

- HSN (Harmonized System of Nomenclature) codes for products

GST Registration for Textile Businesses in India

Textile businesses must register under GST if their annual turnover exceeds the prescribed threshold for normal states, which is ₹40 lakh for goods-only businesses and for Special Category States ₹10 lakh.

Steps for GST registration include:

- Visiting the GST portal.

- Providing business and proprietor details.

- Uploading required documents like PAN, address proof, and bank details.

- Receiving the GSTIN upon approval.

How to Stay GST Compliant as a Textile Business

Here’s how textile businesses can stay compliant

- Maintain Accurate Records: Make sure you maintain detailed records of purchases, sales, and expenses to simplify tax filings.

- File Returns on Time: Regularly file GST returns (GSTR-1, GSTR-3B, etc.) to avoid interest and late fees.

- Use Technology: Consider accounting software that can manage invoicing, GST filing, and reconciliation.

- Claim Input Tax Credit: Ensure accurate ITC claims by verifying vendor GST compliance.

- Stay Updated: Regularly check for GST updates and amendments affecting the textile industry.

HSN/SAC Codes For Textile Businesses In India

| HSN Code | Description | GST Rate |

|---|---|---|

| 5007 | Woven fabrics of silk or silk waste | 5% |

| 5102 | Fine or coarse animal hair | 12% |

| 5208 | Woven fabrics of cotton, containing ≥85% by weight | 5% |

| 5307 | Woven fabrics of jute or other textile bast fibers | 5% |

| 5407 | Woven fabrics of synthetic filament yarn | 5% |

| 5509 | Yarn of synthetic staple fibers | 12% |

| 5513 | Woven fabrics of synthetic staple fibers | 12% |

| 5601 | Wadding, gauze, felt, and nonwovens | 5% |

| 5806 | Narrow woven fabrics | 12% |

| 6006 | Knitted or crocheted fabrics | 5% |

| 6203 | Men's or boys' suits and jackets | 12% |

| 6301 | Blankets and travel rugs | 12% |

| 6304 | Furnishing articles (e.g., curtains, bedspreads) | 5% |

| 6505 | Hats and other headgear | 18% |

Note: This table includes common services and corresponding HSN and SAC codes with GST rates. The GST rate may vary based on specific products or updates in GST law.

How mazu Can Streamline Invoicing for the Textile Industry?

Quick and Easy Invoicing

- Create GST and non-GST invoices with automatic GSTIN-based details.

- Share invoices instantly via email or WhatsApp.

- Pre-made invoice templates for a professional look.

Smart Payment Management

- Accept payments through multiple methods: Cash, Bank, and UPI.

- Track payment statuses: Paid, Due, or Overdue.

- Generate dynamic QR codes for faster transactions.

Strengthen Business Branding

- Add your logo, signature, and choose header/footer designs.

- Customize invoice colors, fonts, and styles to match your brand.

- Include optional fields (up to 5) for specific business needs.

Efficient Tax Compliance

- Automatically calculate taxes and suggest rates based on HSN codes.

- Handle multi-GST rate billing and tax-inclusive/exclusive options.

- Stay GST-compliant with accurate tax data integration.

discover

Some frequently asked questions

Yes, mazu allows billing with multiple GST rates for various textile products.

Yes, you can easily monitor payment statuses like Paid, Due, or Overdue.

Yes, mazu provides the option to set minimum price warnings.

Yes, mazu offers flexible tax-inclusive/exclusive options.

Yes, you can customize headers - footers and add your logo to invoices.

Yes, mazu allows invoice sharing via email or WhatsApp instantly.

Yes, you can easily import or export items and party details.