Types of Jewellery Businesses Under GST

Jewellery businesses in India can be classified under GST in the below-mentioned categories:

- Retail Jewellery Shops

- Sell jewellery directly to customers, and GST is applied to the sale price.

- Manufacturers

- Create jewellery using raw materials like gold, silver, or diamonds, and GST applies to the manufacturing cost and value addition.

- Wholesalers/Distributors

- Supply jewellery to retailers or other businesses and GST is charged on bulk transactions.

- Job Work Units

- Offer services like polishing, designing, or repairing jewellery; GST applies to the service charges.

GST Rates for Jewellery Businesses

The GST rates for jewellery depend on the type of product or service:

Gold Jewellery

3% GST

Silver Jewellery (without studding)

3% GST

Diamond Jewellery

3% GST

Making Charges

5% GST if billed separately.

Loose Diamonds

0.25% GST

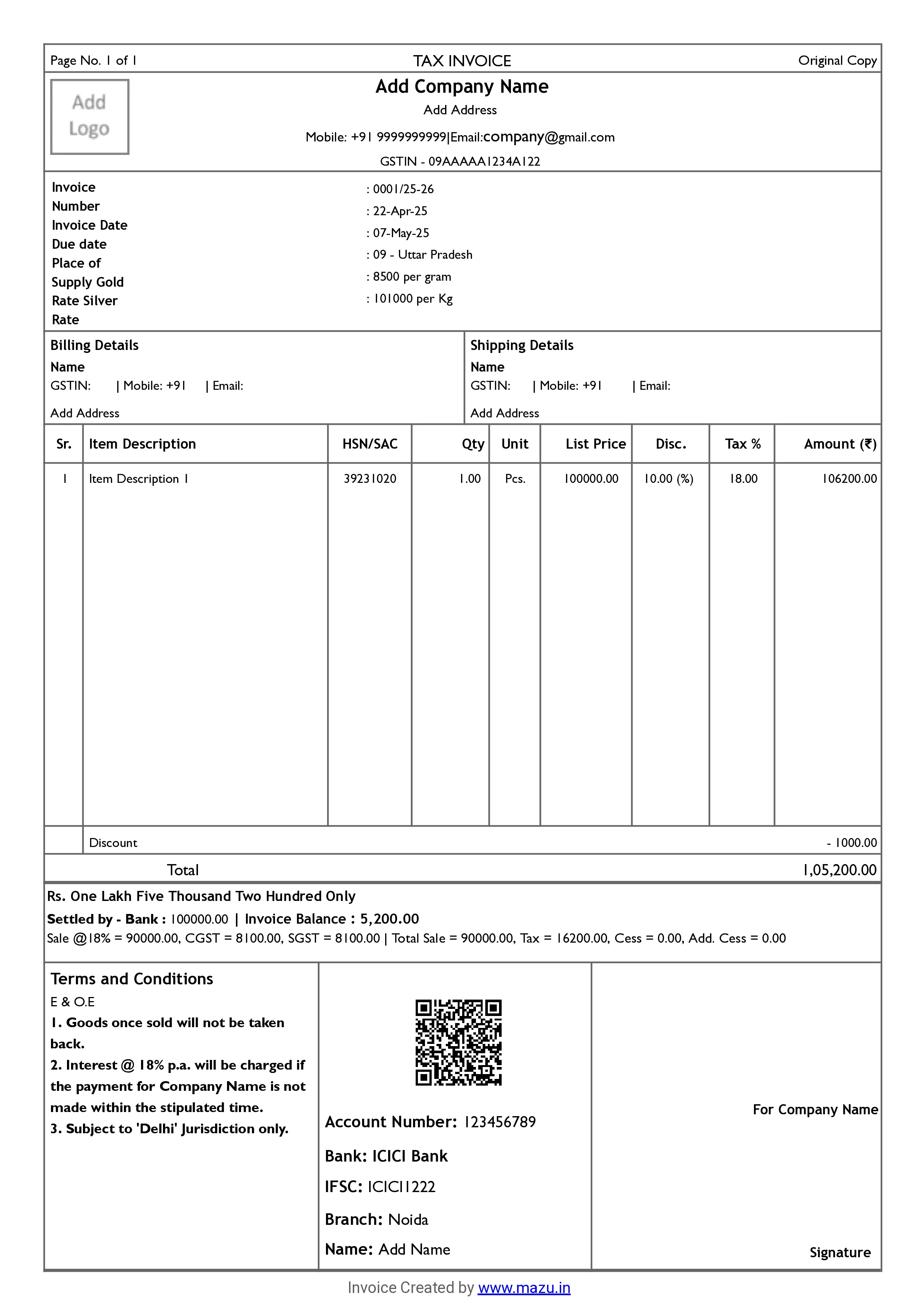

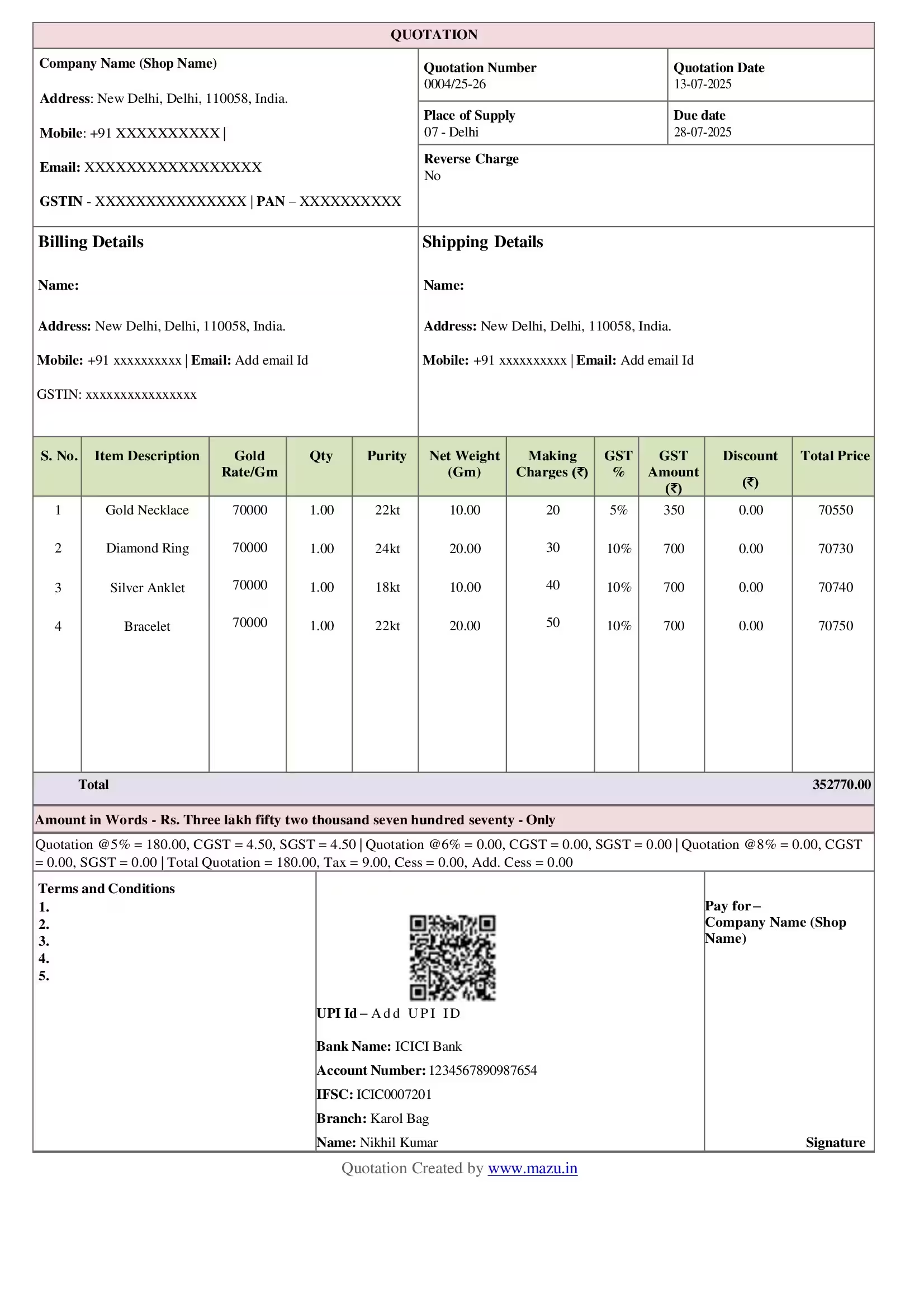

Types of Invoices Required by Jewellers

Jewellers need specific invoice formats to comply with GST rules:

- Tax Invoice: Used for all taxable sales of jewellery and includes details like GST amount, buyer details, and HSN code

- Bill of Supply: Required for exempted or non-taxable goods (e.g., pure gold coins), no GST is charged on such items.

- Advance Receipt Voucher: Accepting advance payments before delivering goods or services.

- Job Work Challan: When sending goods for job work like polishing or designing.

Invoicing Requirements for Jewellers Under GST

Every invoice must contain the below-mentioned information to ensure compliance:

- Supplier name, address, and GSTIN.

- Buyer’s name, address, and GSTIN (if applicable).

- Date of issue and unique invoice number.

- Description of the jewellery (e.g., type, weight, and purity).

- HSN code for jewellery

- GST rate and amount

- Total value of the invoice, including GST.

Requirements for GST Registration for Jewellers

Jewellers must register for GST if their annual turnover exceeds ₹20 lakh (₹10 lakh for businesses in special category states).

Key documents required for registration:

- PAN Card of the business owner.

- Proof of business address (rental agreement, utility bill, etc.).

- Aadhar card of the proprietor/partners.

- Bank account details (passbook or bank statement).

- Digital signature for online submission.

How to Stay Compliant with GST Regulations as a Jeweller

GST compliance doesn’t have to be complex. Here are a few steps you should follow:

- Maintain Accurate Records

- Keep detailed records of purchases, sales, and expenses. Regularly reconcile your accounts to ensure accuracy.

- File GST Returns on Time

- File monthly or quarterly GST returns (GSTR-1, GSTR-3B, and GSTR-9). Late filing attracts penalties and interest.

- Apply Reverse Charge Mechanism (RCM) Where Required

- If you purchase goods/services from unregistered suppliers, pay GST under RCM.

- Separate GST on Making Charges

- Make sure GST on making charges is billed separately for better clarity.

- Regularly Update HSN Codes

- Use the correct HSN code to avoid penalties during audits.

- Stay Updated with GST Changes

- Regularly check GST notifications for updates in tax rates or policies.

HSN/SAC Codes For Jeweller Businesses In India

| Category | HSN/Sac Code | Description | GST Rate |

|---|---|---|---|

| Gold (Unworked) | 7108 | Gold (including gold plated with platinum) unwrought or in semi-manufactured forms, or in powder form | 3% |

| Gold Jewelry | 7113 | Articles of jewelry and parts thereof, of precious metal or of metal clad with precious metal | 3% |

| Silver (Unworked) | 7106 | Silver (including silver plated with gold or platinum) unwrought or in semi-manufactured forms, or in powder form | 3% |

| Silver Jewelry | |||

| 7113 | Articles of jewelry and parts thereof, of precious metal or of metal clad with precious metal | 3% | |

| Platinum | 7110 | Platinum, unwrought or in semi-manufactured forms, or in powder form | 3% |

| Precious Stones | 7103 | Precious stones (excluding diamonds) and semi-precious stones | 0.25% |

| Diamonds | 7102 | Diamonds, whether or not worked, but not mounted or set | 0.25% |

| Imitation Jewelry | 7117 | Imitation jewelry | 12% |

| Pearls (Natural or Cultured) | 7101 | Natural or cultured pearls, not strung, mounted, or set | 0.25% |

| Labor Charges for Jewelry | SAC 9988 | Manufacturing services on physical inputs (goods) owned by others (e.g., labor charges for making jewelry) | 5% |

| Jewelry Repair Services | SAC 9987 | Maintenance, repair, and installation services (e.g., repair services for jewelry) | 18% |

Note: This table includes common jewellery products and their corresponding HSN/SAC codes with GST rates. The GST rate may vary based on specific products or updates in GST law.

How mazu Can Streamline Invoicing for the Jewellery Industry

Effortless Invoice Creation and Sharing

- Create GST and non-GST invoices

- Share Invoices via email or WhatsApp

- Auto-fill GSTIN details

Customisable and Professional Invoices

- Customise invoices with headers & footers

- Adjust colors, fonts, and logo

- Add optional fields

Flexible Billing Options

- Multiple GST rates, item-wise or bill-wise discounts

- Tax-inclusive or exclusive pricing

- Dynamic QR codes for faster payment processing

Efficient Tax and Payment Management

- Automatic tax calculation

- HSN code-based suggestions

- Check payment status like Paid, Due, or Overdue

discover

Some frequently asked questions

With mazu, you can easily create a jewellery invoice by adding customer details, item descriptions (like metal, weight, and design), prices, and applying GST if required. The software will generate an invoice that can be shared with the customer or printed.

Yes, mazu is designed with security in mind. It uses encryption to protect customer data, ensuring your billing information and personal details are safe and secure.

Online billing software for jewellery shops offers several benefits:

- It streamlines the invoicing process, reducing manual errors.

- Automatically calculates taxes and ensures GST compliance.

- It helps track sales and payments in real-time.

To finalize a jewellery invoice template in mazu, add all necessary details (customer information, item descriptions, pricing, taxes), review for accuracy, and then save or share the invoice. You can also customize the template to maintain brand consistency.

A jewellery invoice template should include the following:

- Shop’s name, address, and contact details

- Customer name and contact details

- An itemized list of jewellery items (type, weight, price)

- The total amount, including taxes

- GST information (if applicable)

- Payment method and date

Yes, mazu lets you generate duplicate or triplicate copies of invoices, which is useful for maintaining records.

Yes, mazu allows you to set alerts to ensure no item is sold below a specified minimum price.

Yes, mazu offers role-based access, so you can control what employees can do within the system.

Yes, mazu lets you add up to five optional fields to include additional information on your invoices.

Absolutely! mazu’s quick invoice creation feature helps you generate bills in seconds, improving efficiency in daily operations.