One-Stop Billing Solution for Furniture

Create GST-compliant invoices with product dimensions, materials, and warranty details, send quotations, and manage payments from one platform. Generate e-invoices and e-way bills instantly and share bills via WhatsApp or email. Access it all anytime with the mobile app.

Types of Furniture and Their GST Rates

Under GST, furniture is categorized based on its material and usage, with varying tax rates. Below are the primary types of furniture and their GST rates:

Wooden Furniture

This category includes items made primarily of wood, such as beds, tables, chairs, and wardrobes and GST rate is 12%.

Metal Furniture

This category include items like steel cupboards, chairs, and office desks and GST rate is 18%.

Plastic Furniture

Commonly used in homes and outdoor settings, including plastic chairs and tables and GST rate is 18%.

Customized or Modular Furniture

This includes fitted furniture designed for specific spaces, such as modular kitchens and GST rate is 18%.

Invoices Required for Furniture Businesses

Invoicing is a critical part of running a GST-compliant furniture business. The invoice formats depends on the nature of the transaction:

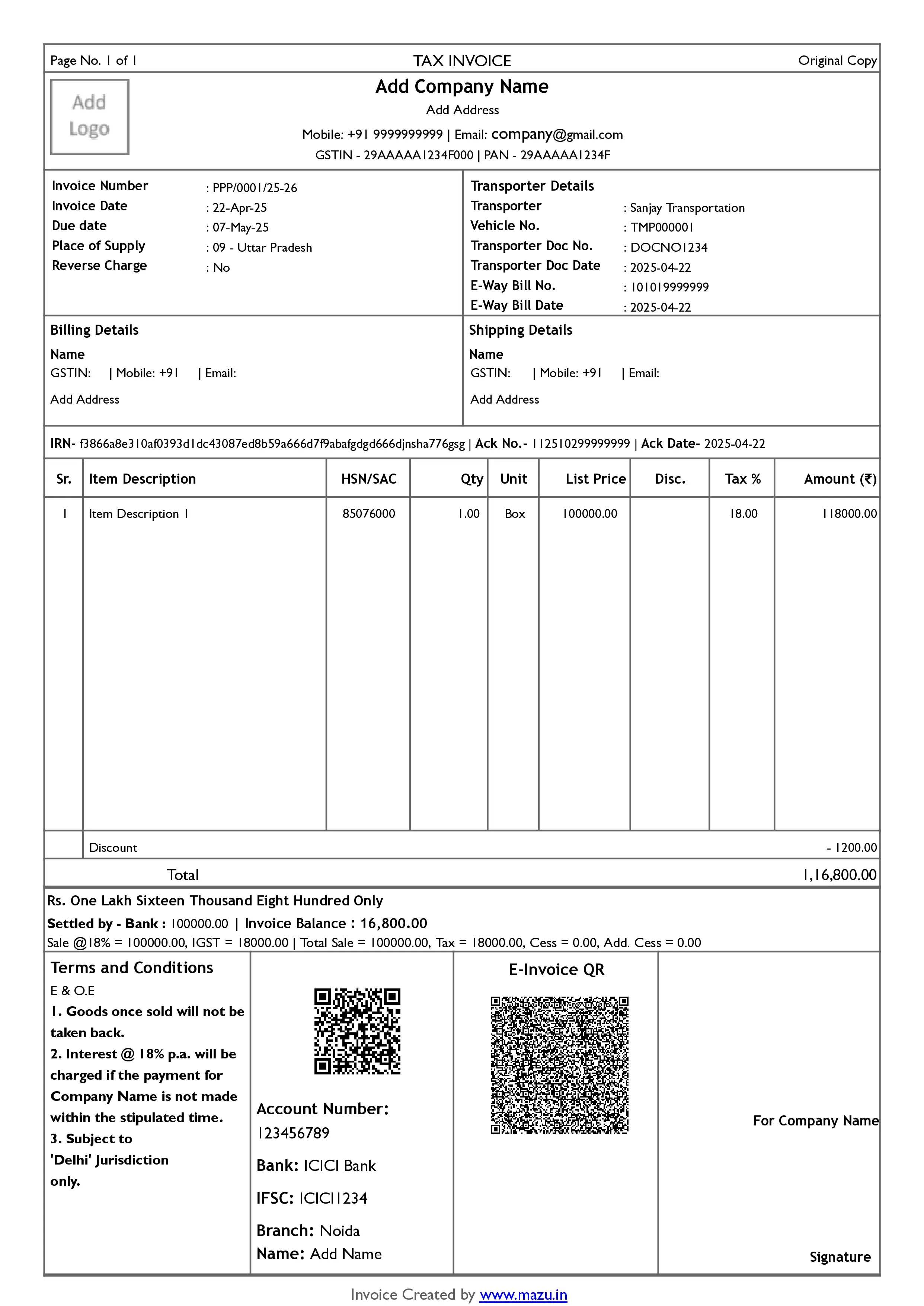

Tax Invoice

Issued when selling to registered businesses. It must include the GST amount and details like GSTIN, HSN code, and buyer’s details.

Bill of Supply

Used when the furniture is sold under GST-exempt categories or the business is registered under the Composition Scheme.

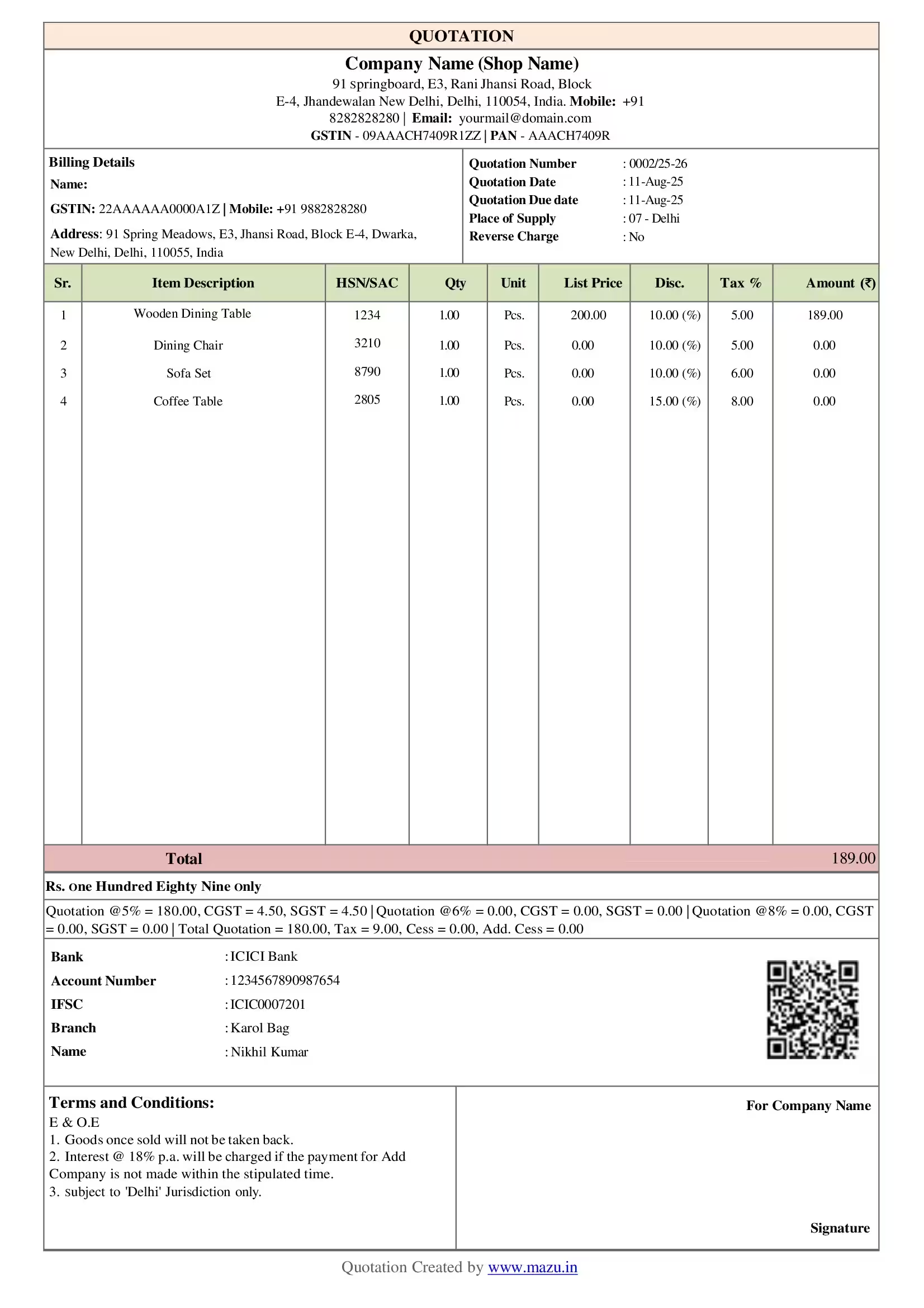

Proforma Invoice

A preliminary bill issued to customers before finalizing the sale, often used for quotations.

Delivery Challan

Required for transporting furniture to customers, especially for bulk or modular furniture deliveries.

Invoicing Requirements Under GST

For invoices to be GST-compliant, make sure they include the following details:

- Seller Details Name, address, and GSTIN of your furniture business.

- Buyer Details Name, address, and GSTIN (if registered).

- Invoice Number A unique, consecutive serial number.

- Date of Issue The date the invoice is generated.

- Description of Goods Include the type of furniture, quantity, and HSN code.

- Tax Details Breakdown of CGST, SGST, and IGST.

- Value of Goods Total amount before and after taxes.

GST Registration Requirements for Furniture Businesses

If you own a furniture business, GST registration is mandatory if:

- Your turnover exceeds ₹40 lakh (or ₹10 lakh in special category states).

- You supply furniture to other states (interstate supply).

- You are part of an e-commerce platform for selling furniture.

How to Stay Compliant with GST Regulations

Here’s how furniture businesses can stay GST-compliant:

- Accurate Record-Keeping Maintain clear records of all transactions, invoices, and GST returns.

- Timely GST Returns File GST returns (GSTR-1, GSTR-3B, etc.) on time to avoid penalties.

- Correct Use of HSN Codes Furniture items fall under HSN codes thus, ensure using correct codes ensures proper tax calculation.

- Monitor Input Tax Credit (ITC) Track ITC on raw materials like wood, metal, or plastic used in manufacturing furniture.

- Update Your Billing System Use GST-ready billing software to simplify invoicing and ensure compliance.

- Regular Training Educate your staff on GST rules and updates to avoid mistakes in transactions and filings.

HSN/SAC Code For Furniture Businesses in India

| Category | HSN/SAC Code | Description | GST Rate |

|---|---|---|---|

| Wooden Furniture | 9403 | Wooden furniture for household, office, or restaurant use. | 12% |

| Metal Furniture | 9403 | Metal furniture for household, office, or restaurant use. | 18% |

| Plastic Furniture | 9403 | Plastic furniture such as chairs, tables, or cabinets. | 18% |

| Mattress and Bedding Accessories | 9404 | Mattresses, bedding items like quilts, pillows, and cushions | 18% |

| Seats with Wooden Frames | 9401 | Seats with wooden frames, upholstered or not | 12% |

| Seats with Metal Frames | 9401 | Seats with metal frames, upholstered or not. | 18% |

| Furniture Parts | 9403 | Parts of furniture made of wood, metal, or plastic | 18% |

| SAC Code for Interior Design | 998391 | Services related to interior decoration and furniture design | 18% |

Note: This table includes common furniture products and their corresponding HSN/SAC codes with GST rates. The GST rate may vary based on specific products or updates in GST law.

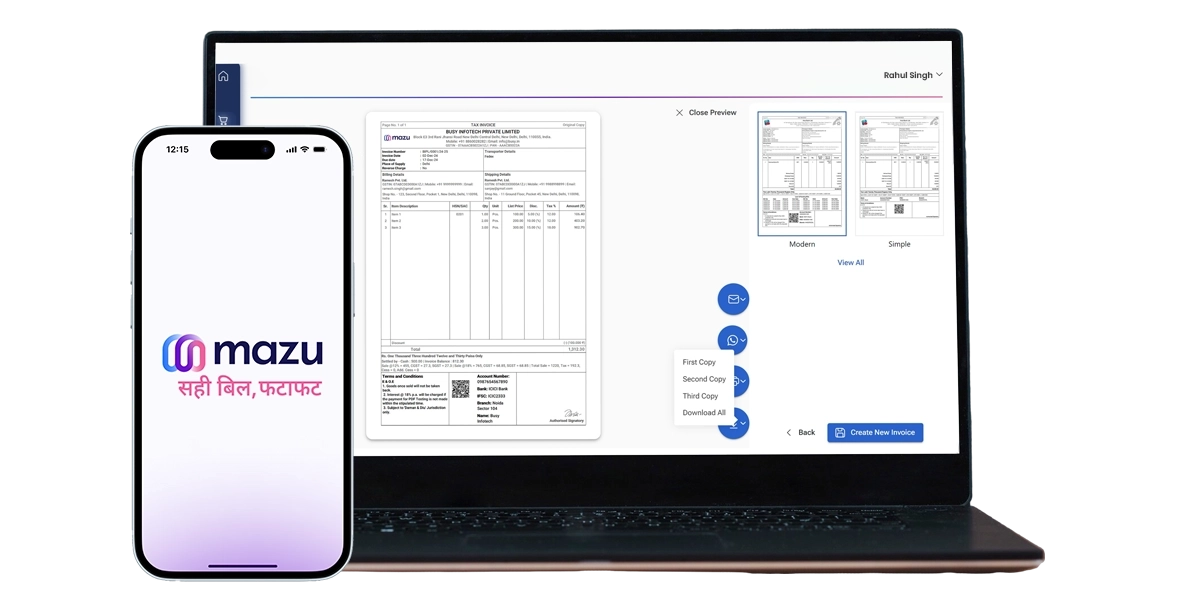

How mazu Can Simplify Invoicing for Furniture Businesses

Simplified Invoicing

- Instantly create Party/Item details within an invoice.

- Automatically fill GSTIN information and other fields for quick billing.

- Generate professional GST and non-GST invoices effortlessly.

Flexible Payment Options

- Accept payments through Cash, Bank, or UPI.

- Track payment statuses like Paid, Due, or Overdue.

- Ensure timely settlements with easy payment management.

Brand Consistency

- Add your business logo, signature, and custom fields.

- Customize invoice header, footer, colors, and fonts.

- Add additional fields to invoice templates.

Smart Features for Ease of Use

- Share invoices instantly via WhatsApp or email.

- Set item pricing based on individual parties.

- Get tax rate suggestions automatically based on HSN codes.

discover

Some frequently asked questions

To create a furniture invoice with mazu, simply enter the customer’s details, list the furniture items with descriptions (e.g., type, material, quantity), set the price, and apply taxes. mazu will generate a professional invoice.

Yes, mazu offers pre-designed invoice templates that you can use to quickly generate professional invoices for your furniture business. These templates can also be customized to suit your needs.

Yes, mazu allows you to generate GST invoices for your furniture business, with automatic GST calculation based on the product and applicable tax rates.

A furniture invoice should include:

- Customer’s name and contact details

- Furniture item descriptions (e.g., type, material, quantity)

- Prices for each item

- Total amount (including applicable taxes)

- GST details (if applicable)

- Payment method

Invoices generated with mazu are available in PDF format, making them easy to share, print, or store digitally.

Yes, mazu allows you to customize the furniture invoice templates by changing the layout, adding your logo, adjusting colors, and including additional fields.

Yes, you can save your invoices within mazu, making it easy to access them later for future reference or reuse.

Using a standardized furniture bill format helps in:

- It presents a polished, clear invoice to your customers.

- Ensures tax calculations and GST details are correct.

- Helps you easily track payments and manage records.